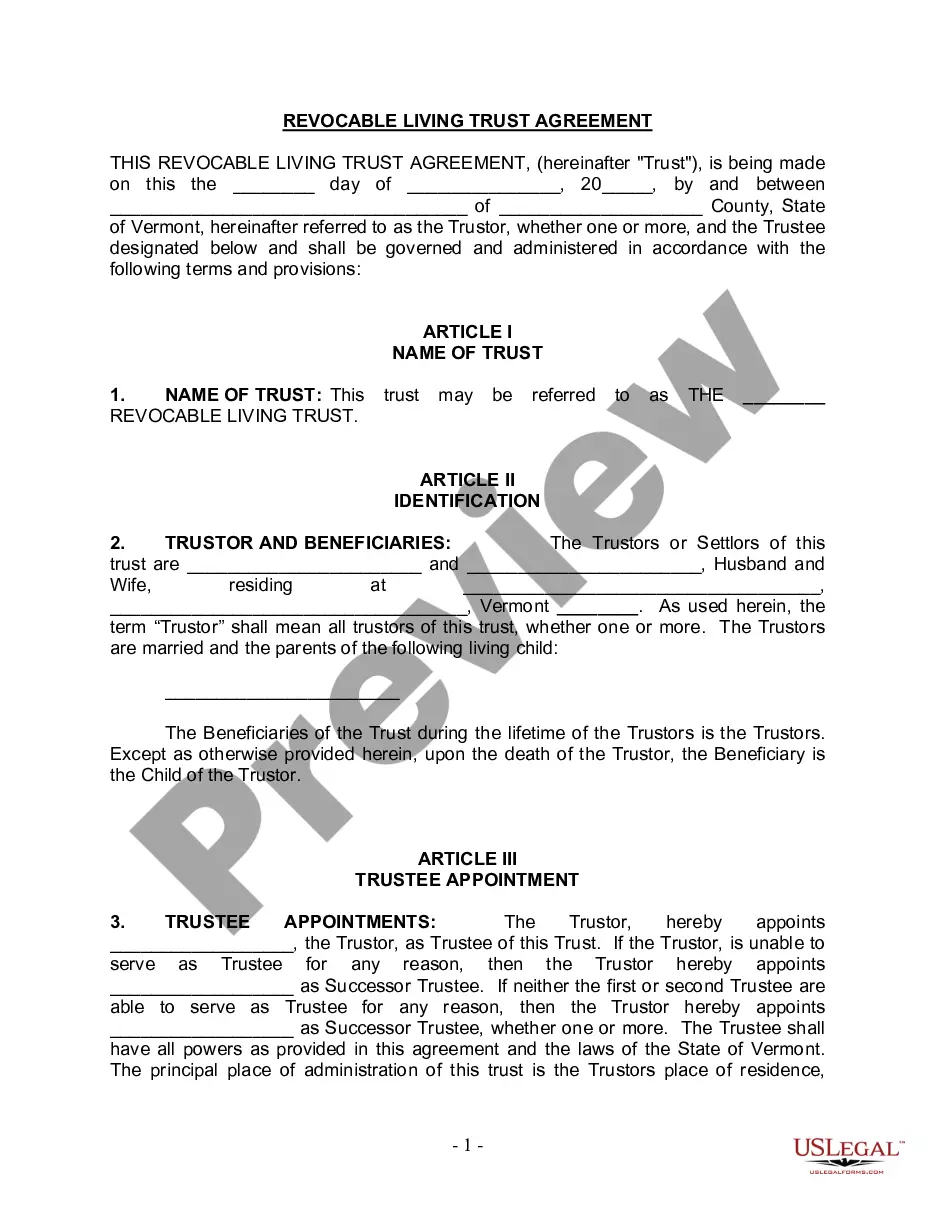

This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Vermont Living Trust for Husband and Wife with One Child

Description

How to fill out Vermont Living Trust For Husband And Wife With One Child?

Looking for a Vermont Living Trust for Husband and Wife with One Child on the internet can be stressful. All too often, you see papers which you think are ok to use, but find out later they’re not. US Legal Forms provides over 85,000 state-specific legal and tax forms drafted by professional attorneys in accordance with state requirements. Have any document you’re looking for in minutes, hassle free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll instantly be included to your My Forms section. In case you do not have an account, you have to register and choose a subscription plan first.

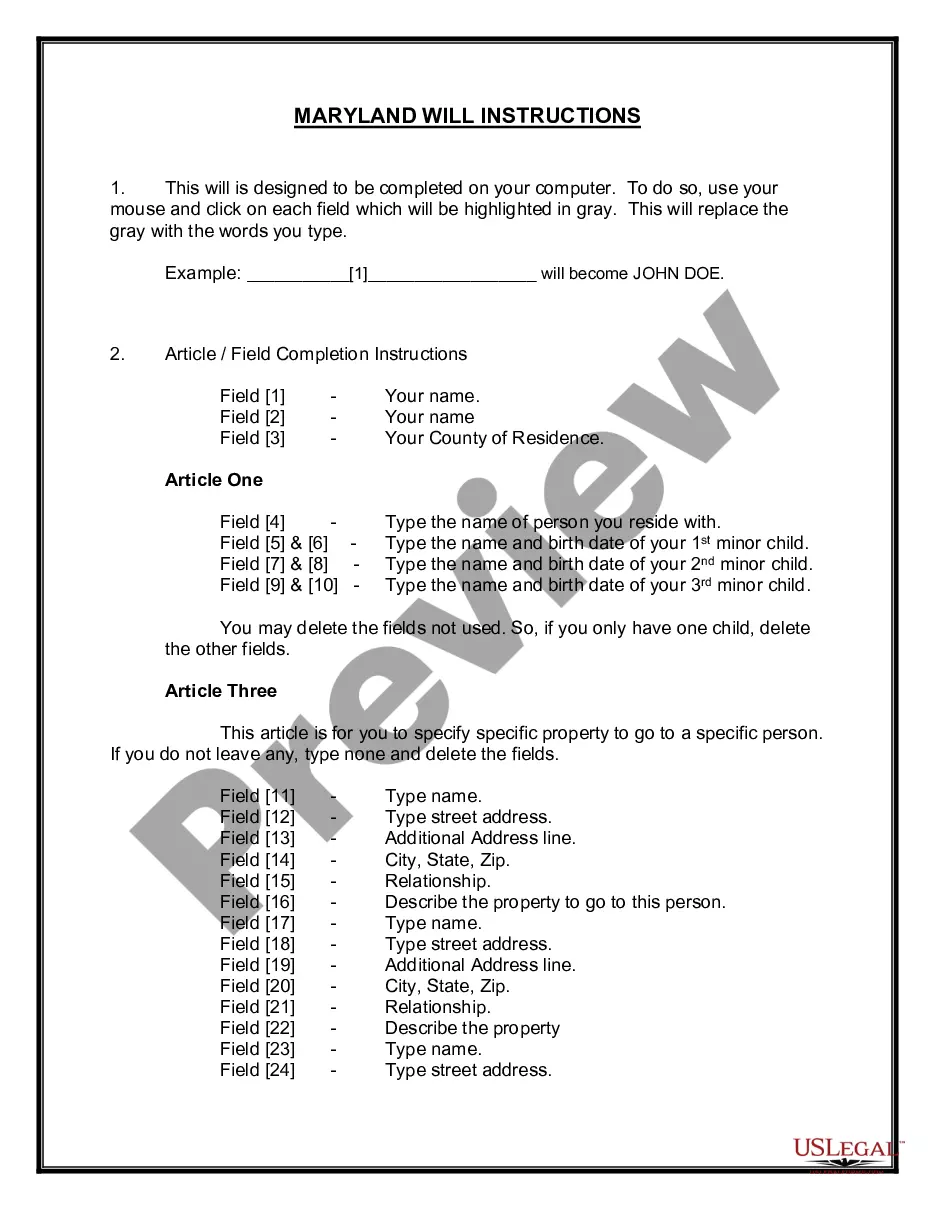

Follow the step-by-step guidelines below to download Vermont Living Trust for Husband and Wife with One Child from the website:

- Read the form description and hit Preview (if available) to check whether the form meets your expectations or not.

- In case the form is not what you need, find others using the Search field or the listed recommendations.

- If it is right, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the document in a preferable format.

- Right after getting it, it is possible to fill it out, sign and print it.

Obtain access to 85,000 legal templates straight from our US Legal Forms library. In addition to professionally drafted templates, users will also be supported with step-by-step guidelines on how to get, download, and fill out forms.

Form popularity

FAQ

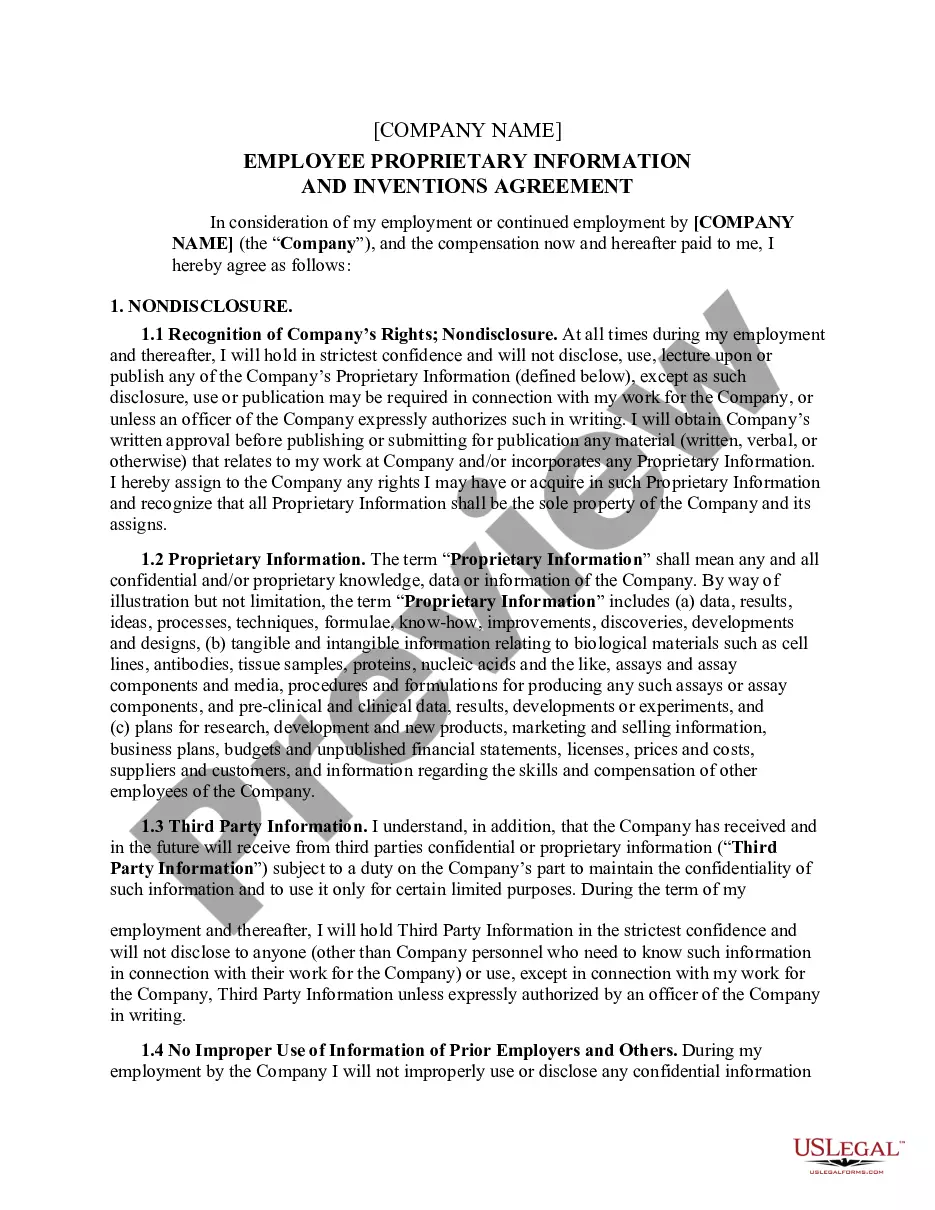

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

Under California law, a marriage automatically invalidates any pre-existing will or trust as to the new spouse's inheritance rights, unless the documents provide for a new spouse, or clearly indicate a new spouse will receive nothing.

Many people choose to set up different types of trusts to manage their funds for their families, including after they pass away. Generally, a family trust is any trust set up for the benefit of someone's relatives and a living trust is one set up while its creator is still alive.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

The trust in no way protects your assets, so that reasoning is simply false. You should put your vehicles into your trust in order to avoid probate. Only those assets held by the trust will avoid probate.

If the ultimate beneficiaries of the Living Trust are family members of the person who created the trust, the trust will often be referred to as a Family Trust. If those beneficiaries include friends, charities, or other non-family members, then the trust is typically called a Living Trust.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

With a shared trust, property left by one grantor to the survivor stays in the living trust when the first grantor dies; no transfer is necessary.You can transfer all of it to the trust, and each spouse can name beneficiaries (including each other) to receive his or her separate property.