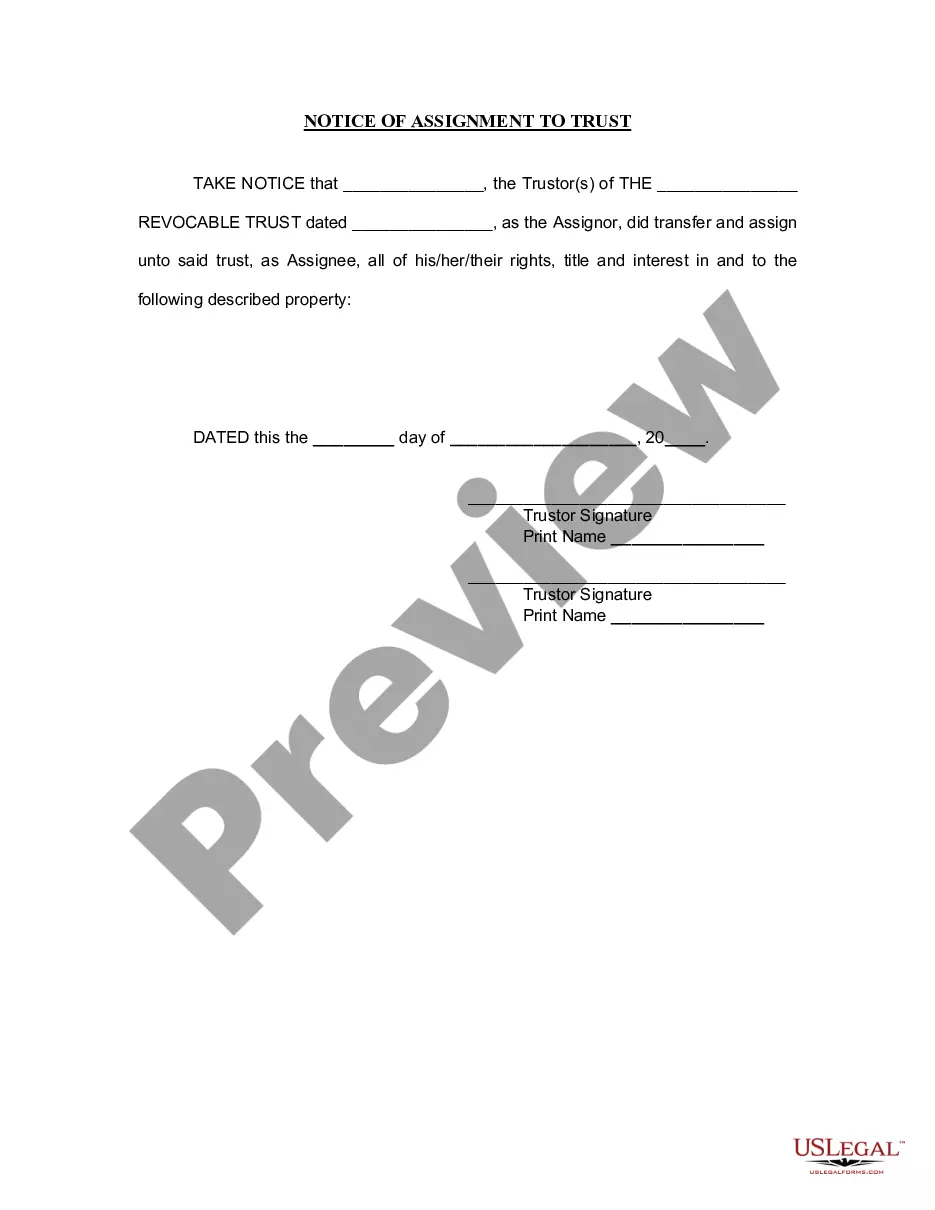

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Vermont Notice of Assignment to Living Trust

Description

How to fill out Vermont Notice Of Assignment To Living Trust?

Searching for a Vermont Notice of Assignment to Living Trust on the internet might be stressful. All too often, you find files that you believe are fine to use, but discover later they are not. US Legal Forms provides over 85,000 state-specific legal and tax forms drafted by professional legal professionals in accordance with state requirements. Have any document you’re looking for within minutes, hassle-free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll immediately be included to the My Forms section. If you do not have an account, you need to register and choose a subscription plan first.

Follow the step-by-step recommendations below to download Vermont Notice of Assignment to Living Trust from our website:

- See the form description and press Preview (if available) to verify whether the template meets your expectations or not.

- If the document is not what you need, find others with the help of Search engine or the provided recommendations.

- If it is right, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the template in a preferable format.

- After getting it, you may fill it out, sign and print it.

Get access to 85,000 legal templates straight from our US Legal Forms library. Besides professionally drafted templates, users are also supported with step-by-step instructions on how to find, download, and complete templates.

Form popularity

FAQ

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

The first step is determining which type of trust you'll need. Next, you'll want to take stock of your assets and property. You'll also need to choose a trustee. Make the trust document. Sign the trust document in front of a notary. Put the property you want inside the trust.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

An estate plan that includes a trust costs $1,000 to $3,000, versus $300 or less for a simple will. What a living-trust promoter may not tell you: You don't need a trust to protect assets from probate. You can arrange for most of your valuable assets to go to your heirs outside of probate.

After the agreement has been signed, the settlor must fund his or her assets into the trust. Funding a trust involved transferring property to the trust.For some assets you will need to transfer ownership to the trust. For others, you may need to designate the trust as a beneficiary.

Cash Accounts. Rafe Swan / Getty Images. Non-Retirement Investment and Brokerage Accounts. Non-qualified Annuities. Stocks and Bonds Held in Certificate Form. Tangible Personal Property. Business Interests. Life Insurance. Monies Owed to You.

Although a typical will package costs $1,000 to $1,200, and a trust can run $2,500, a legal insurance plan like Texas Legal can save Texans hundreds or even thousands on their estate planning costs.

Assets Held in the Trustee's Name Kahane Revocable Living Trust or the Nessler Family Trust. In particular, look for a list of assets at the end of the document. It will likely be labeled Schedule A or something similar, and should list the items the person who set up the trust intended to hold in the trust.

In Texas a trust is not a legal entity. Rather, it is a legal relationship in which a trustee holds legal title for the benefit of another person called the beneficiary. Unlike a corporation, which is required to file a certificate of formation with the Secretary of State, there is no such requirement for a trust.