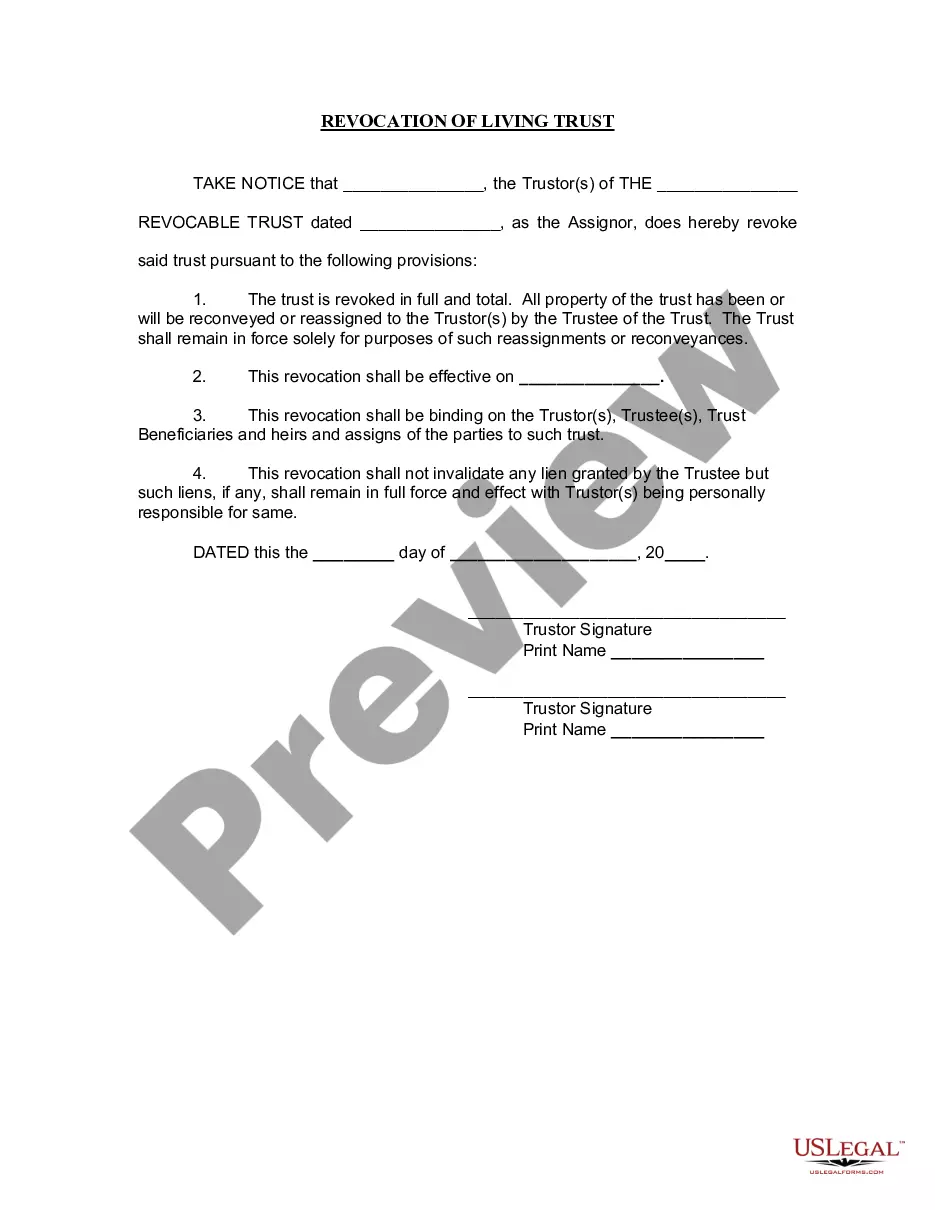

This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

Vermont Revocation of Living Trust

Description Revocation Of Living Trust Forms

How to fill out Vermont Revocation Of Living Trust?

Searching for a Vermont Revocation of Living Trust online can be stressful. All too often, you see files which you think are alright to use, but discover afterwards they’re not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional lawyers in accordance with state requirements. Get any document you’re looking for in minutes, hassle free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll instantly be added in to the My Forms section. In case you do not have an account, you need to sign-up and choose a subscription plan first.

Follow the step-by-step instructions listed below to download Vermont Revocation of Living Trust from our website:

- Read the document description and hit Preview (if available) to check if the form meets your requirements or not.

- If the document is not what you need, get others using the Search field or the listed recommendations.

- If it is appropriate, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the template in a preferable format.

- Right after getting it, you may fill it out, sign and print it.

Get access to 85,000 legal templates from our US Legal Forms catalogue. Besides professionally drafted templates, users are also supported with step-by-step guidelines concerning how to get, download, and fill out templates.

Form popularity

FAQ

In some states, your trustee must submit a formal accounting of the trust's operation to all beneficiaries.Trustees can sometimes waive this requirement if all beneficiaries agree in writing. In either case, after the report is made, the trust's assets can be distributed and the trust can be dissolved.

When a trust dissolves, all income and assets moving to its beneficiaries, it becomes an empty vessel. That's why no income tax return is required it no longer has any income. That income is charged to the beneficiaries instead, and they must report it on their own personal tax returns.

EXAMPLE: Yvonne and Andre make a living trust together. Step 1: Transfer ownership of trust property from yourself as trustee back to yourself. Step 2: A revocation prints out with your trust document. Step 3: Complete the Revocation of Trust by filling in the date, and then sign it in front of a notary public.

A revocation of a will generally means that the beneficiaries will no longer receive the specified property or financial assets. A beneficiary may have been depending on the trust property for various reasons. If the revocation occurs at a certain time, it can cause legal conflicts in many cases.

The terms of an irrevocable trust may give the trustee and beneficiaries the authority to break the trust. If the trust's agreement does not include provisions for revoking it, a court may order an end to the trust. Or the trustee and beneficiaries may choose to remove all assets, effectively ending the trust.

A revocable trust, or living trust, is a legal entity to transfer assets to heirs without the expense and time of probate.A living trust also can be revoked or dissolved if there is a divorce or other major change that can't be accommodated by amending the trust.

$500: initial filing fee for the Trust or Will Contest. (Most Probate Courts are a bit less than $500, but that's a good number for the required fees at initial filing)

Irrevocable trusts can remain up and running indefinitely after the trustmaker dies, but most revocable trusts disperse their assets and close up shop. This can take as long as 18 months or so if real estate or other assets must be sold, but it can go on much longer.

The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it.Such documents, often called a trust revocation declaration or revocation of living trust," can be downloaded from legal websites; local probate courts may also provide copies of them.