Under Vermont statutes, when an application has been made to the judge of probate for the appointment of an administrator or executor of an estate, that application may request that the estate be dealt with as a small estate of less than $45,000 in value. If the judge finds that the burial expenses have been paid, the court may forthwith discharge such executor without further accounting and without notice.

Vermont Small Estate Package for Estates under $45,000

Description

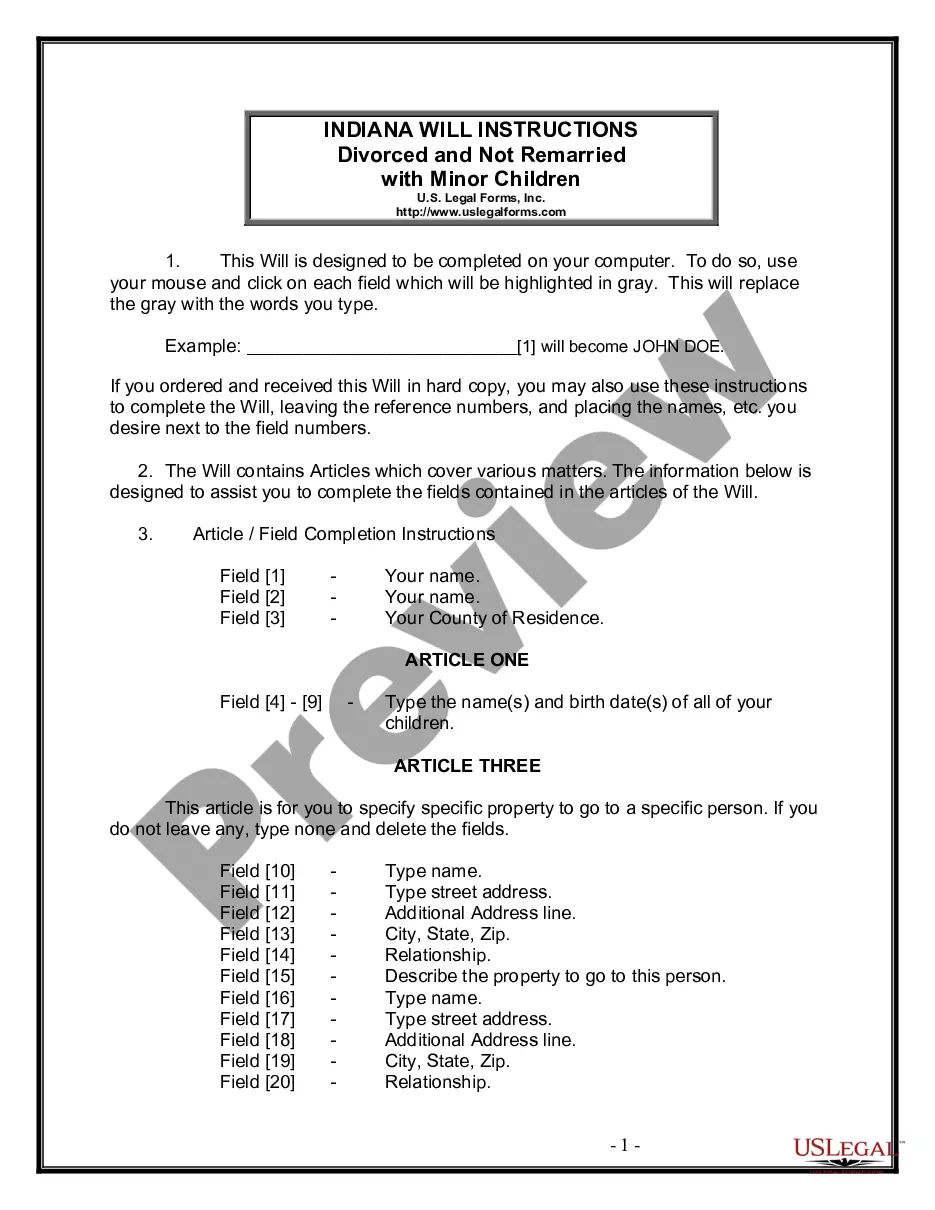

How to fill out Vermont Small Estate Package For Estates Under $45,000?

Looking for a Vermont Small Estate Package for Estates under $45,000 on the internet can be stressful. All too often, you find documents that you simply believe are fine to use, but find out later on they’re not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional legal professionals in accordance with state requirements. Get any document you’re searching for in minutes, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will immediately be added in in your My Forms section. In case you don’t have an account, you should register and choose a subscription plan first.

Follow the step-by-step guidelines below to download Vermont Small Estate Package for Estates under $45,000 from the website:

- Read the document description and press Preview (if available) to check if the template meets your requirements or not.

- In case the form is not what you need, get others with the help of Search field or the listed recommendations.

- If it is appropriate, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the document in a preferable format.

- After downloading it, you can fill it out, sign and print it.

Obtain access to 85,000 legal forms right from our US Legal Forms library. In addition to professionally drafted samples, customers may also be supported with step-by-step guidelines concerning how to get, download, and fill out templates.

Form popularity

FAQ

State law typically provides for payment of the executor. By Mary Randolph, J.D. Most executors are entitled to payment for their work, either by the terms of the will or under state law.

The laws in most areas simply stipulate that the fees must be fair and reasonable . Alberta estate law differs in this respect. Executors in this province are expected to keep their fees between 1 and 5 percent of the total value of the estate.

As an aside, Vermont Statute Title 32 § 1143 states that executors may be paid $4 per day spent in court, but this is geared towards the court paying appointed agents, and that amount was set in 1866.

Typically, the probate court will find executor compensation reasonable if it is in line with what people have received in the past as compensation in that area. For example, if in the last year, executor fees were typically 1.5%, then 1.5% would be considered reasonable and 3% may be unreasonable.

Under California Probate Code, the executor typically receives 4% on the first $100,000, 3% on the next $100,000 and 2% on the next $800,000, says William Sweeney, a California-based probate attorney. For an estate worth $600,000 the fee works out at approximately $15,000.

Dying Without a Will in VermontIf you die without a valid will, you'll lose control over what happens to your assets after your death.If there isn't a will, the probate court must appoint someone to serve as the executor or personal representative. Usually the surviving spouse or adult child is chosen for this role.

Common expenses of an estate include executors fees, attorneys fees, accounting fees, court fees, appraisal costs, and surety bonds. Most estates are settled though probate in about 6 to 18 months, assuming there is no litigation involved.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

Vermont Department of Taxes imposes an estate tax on the transfer of Vermont estates of decedents dying while a resident of Vermont.Then on January 1, 2021, the estate tax exclusion increases to $5,000,000.00, and will apply to estates of decedents with a date of death on or after January 1, 2021.