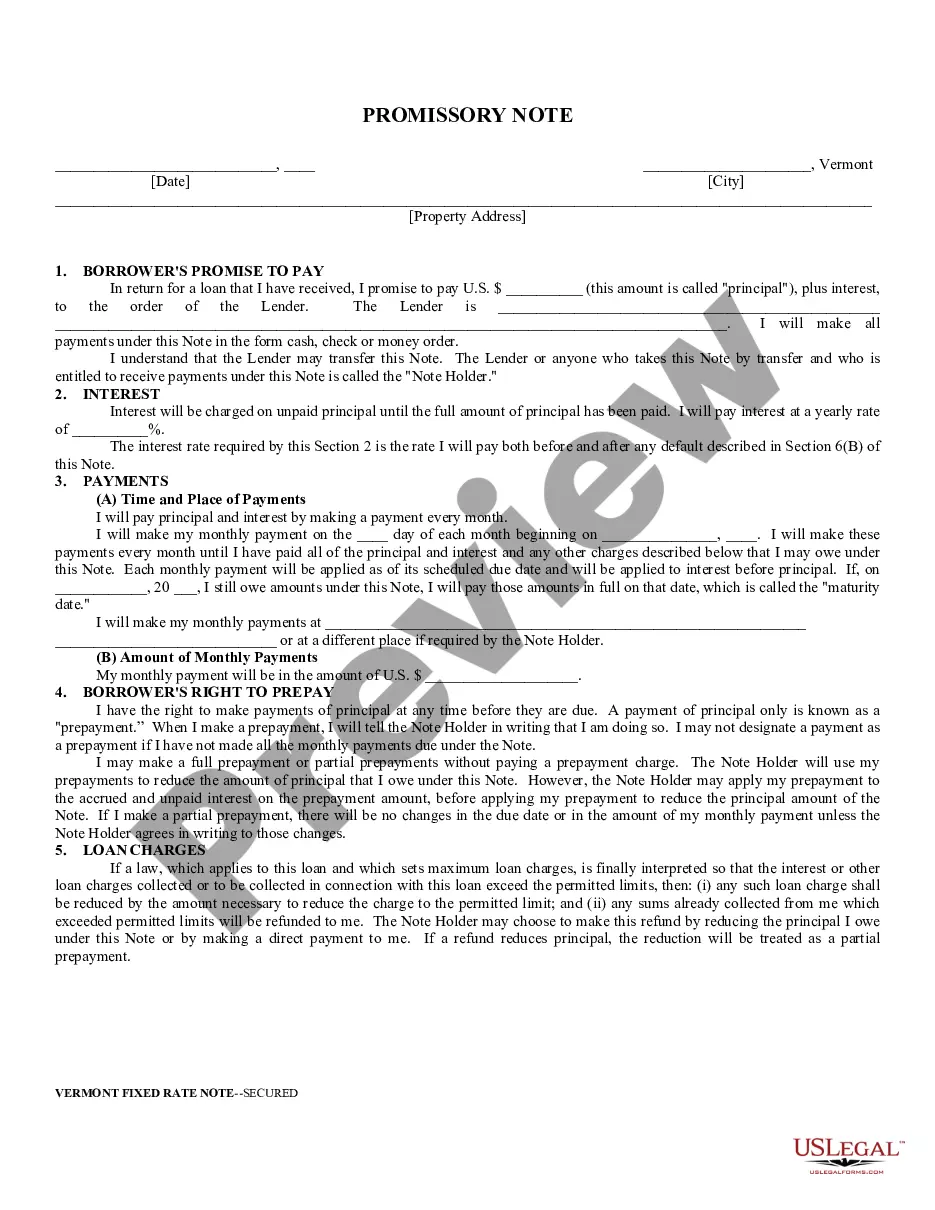

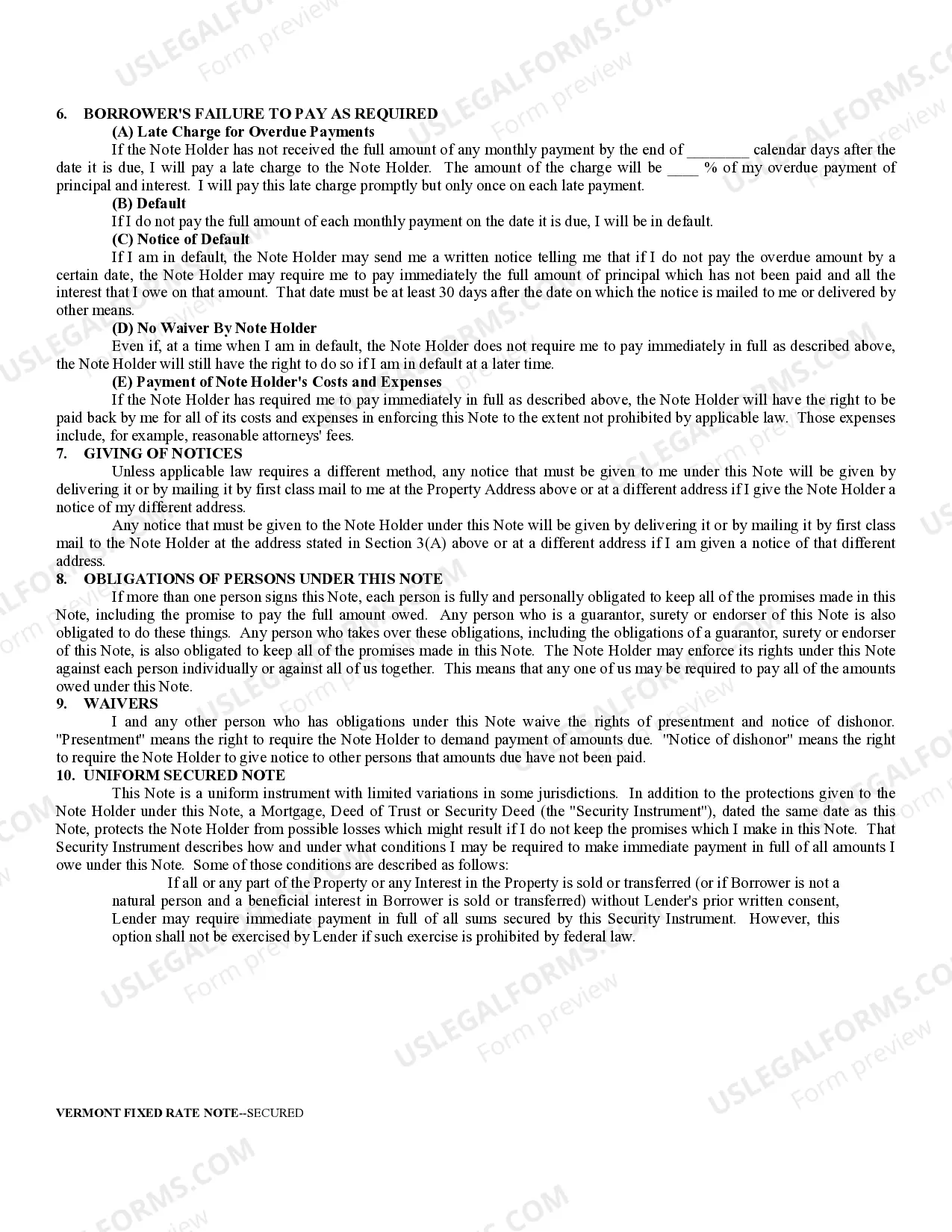

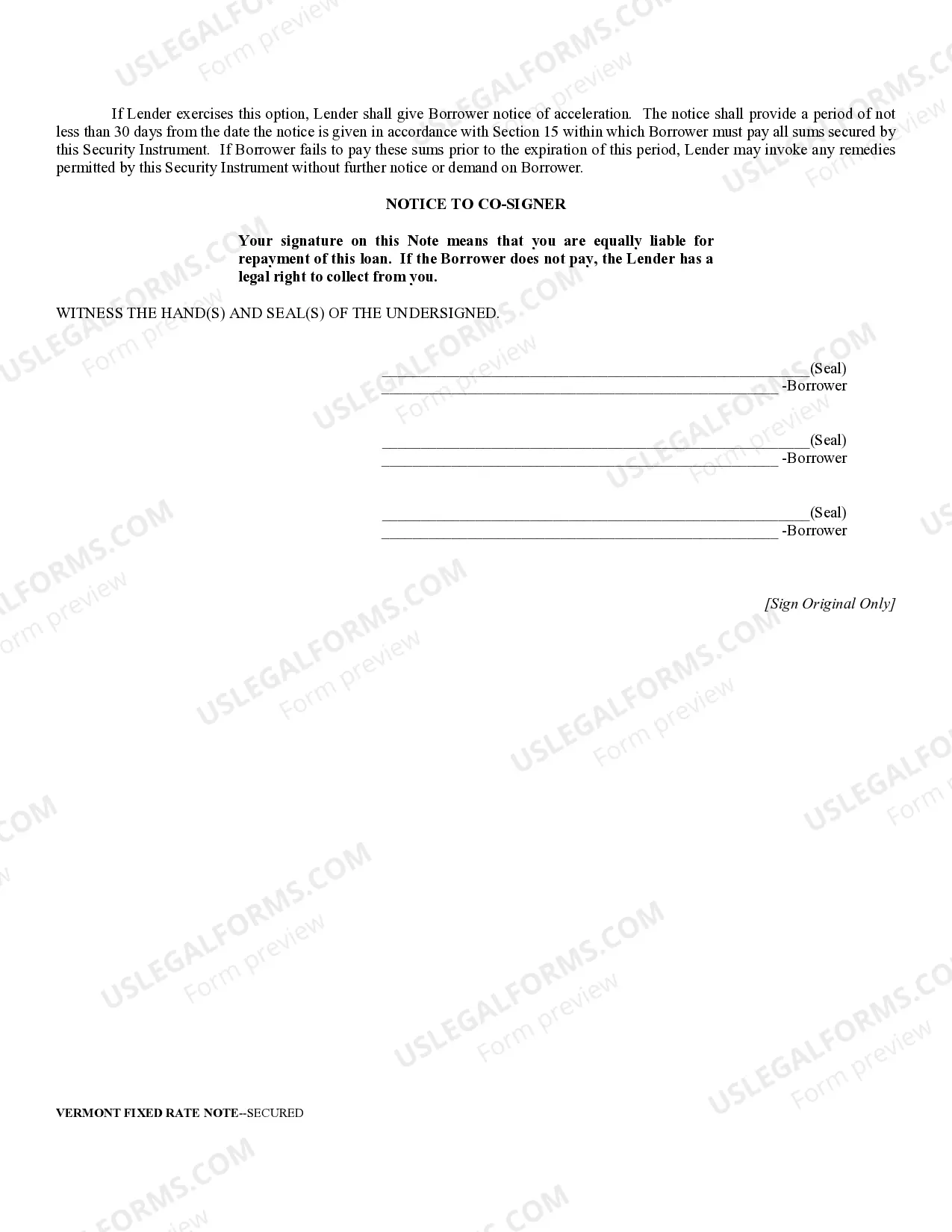

This is a Promissory Note for your state. The promissory note is secured, with a fixed interest rate, and contains a provision for installment payments.

Vermont Secured Promissory Note

Description

How to fill out Vermont Secured Promissory Note?

Searching for a Vermont Secured Promissory Note on the internet can be stressful. All too often, you see papers that you simply think are ok to use, but find out later they are not. US Legal Forms offers over 85,000 state-specific legal and tax forms drafted by professional lawyers according to state requirements. Have any form you’re looking for in minutes, hassle-free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll instantly be added to your My Forms section. In case you don’t have an account, you must register and pick a subscription plan first.

Follow the step-by-step instructions below to download Vermont Secured Promissory Note from our website:

- See the document description and press Preview (if available) to verify whether the template meets your expectations or not.

- In case the document is not what you need, find others with the help of Search field or the listed recommendations.

- If it’s appropriate, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the template in a preferable format.

- After downloading it, you can fill it out, sign and print it.

Obtain access to 85,000 legal templates from our US Legal Forms catalogue. Besides professionally drafted samples, users are also supported with step-by-step instructions on how to get, download, and complete templates.

Form popularity

FAQ

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

Enforcing a secured promissory note is simply a matter of either repossessing the secured asset through your own efforts, or hiring a professional agency to accomplish the task on your behalf. These agencies will charge a set fee for their services, but they usually have a very high rate of success.

Secured or unsecured? Generally, promissory notes are unsecured which means it is more like a formal IOU. However, lenders can request some security for the loan. For personal secured promissory notes, a house or car is often used as collateral.

In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.The US Supreme Court in Reves recognizes that most notes are, in fact, not securities.

Small businesses frequently borrow money, or extend credit, in the course of their operations. A promissory note is the document that sets forth the terms of a loan's repayment. A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

Types of Property that can be used as collateral. Speak to them in person. Draft a Demand / Notice Letter. Write and send a Follow Up Letter. Enlisting a Professional Collection Agency. Filing a petition or complaint in court. Selling the Promissory Note. Final Tips.