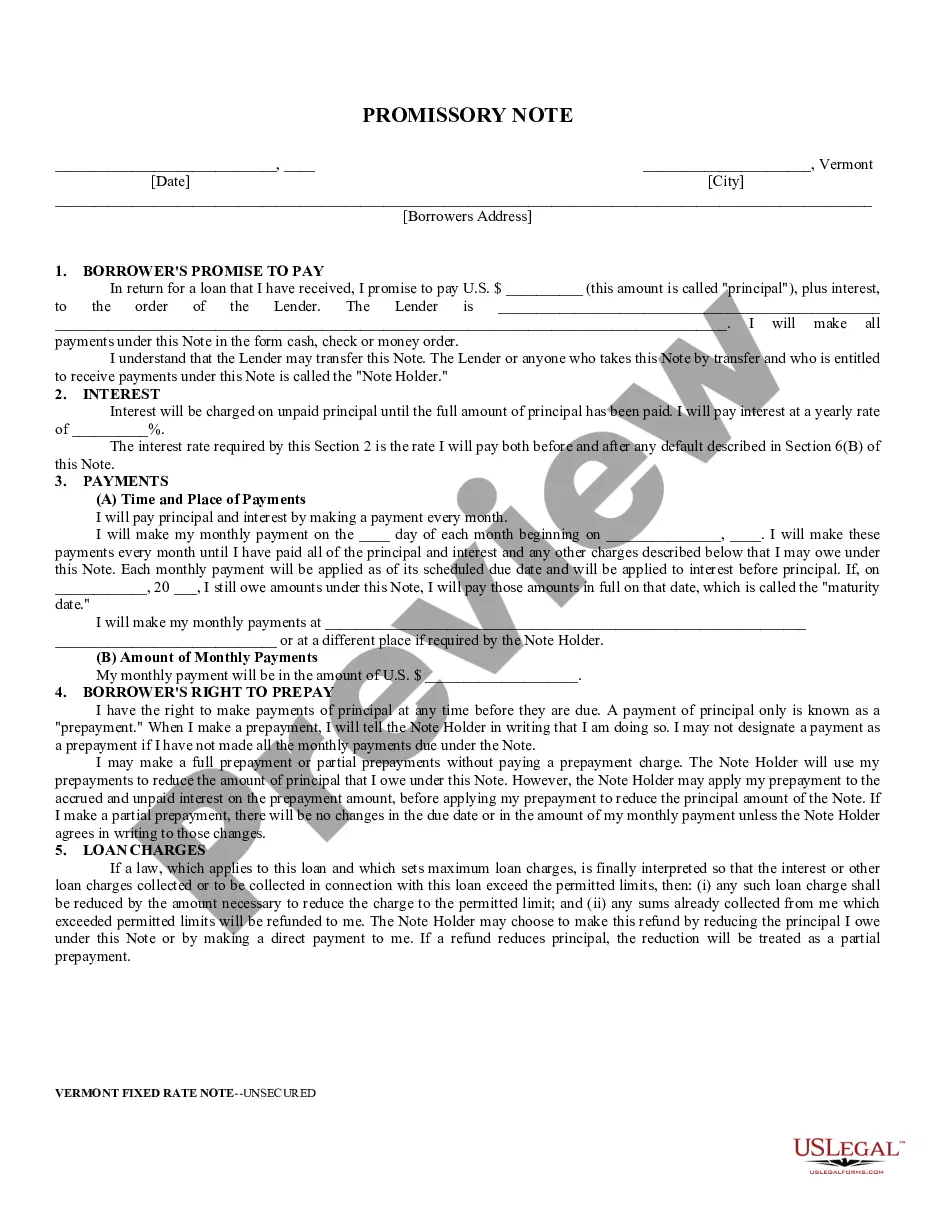

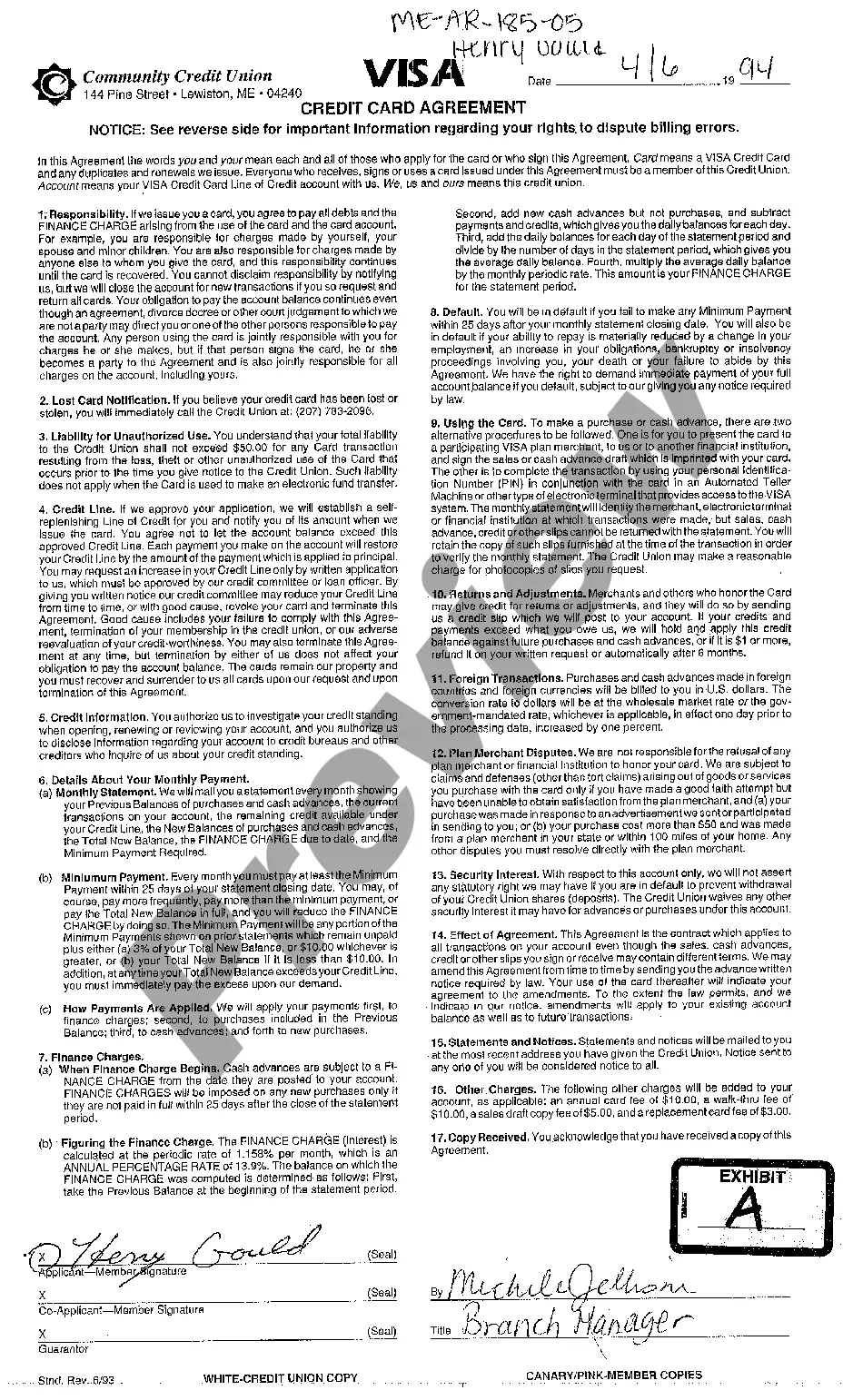

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Vermont Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Vermont Unsecured Installment Payment Promissory Note For Fixed Rate?

Looking for a Vermont Unsecured Installment Payment Promissory Note for Fixed Rate online might be stressful. All too often, you see papers that you believe are alright to use, but discover later on they are not. US Legal Forms provides more than 85,000 state-specific legal and tax documents drafted by professional lawyers in accordance with state requirements. Have any document you are searching for quickly, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will instantly be included to your My Forms section. In case you don’t have an account, you should sign up and select a subscription plan first.

Follow the step-by-step guidelines listed below to download Vermont Unsecured Installment Payment Promissory Note for Fixed Rate from the website:

- Read the form description and hit Preview (if available) to check if the template suits your requirements or not.

- If the form is not what you need, get others using the Search field or the listed recommendations.

- If it’s right, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the document in a preferable format.

- After downloading it, you can fill it out, sign and print it.

Get access to 85,000 legal templates from our US Legal Forms catalogue. Besides professionally drafted samples, customers may also be supported with step-by-step instructions regarding how to get, download, and fill out templates.

Form popularity

FAQ

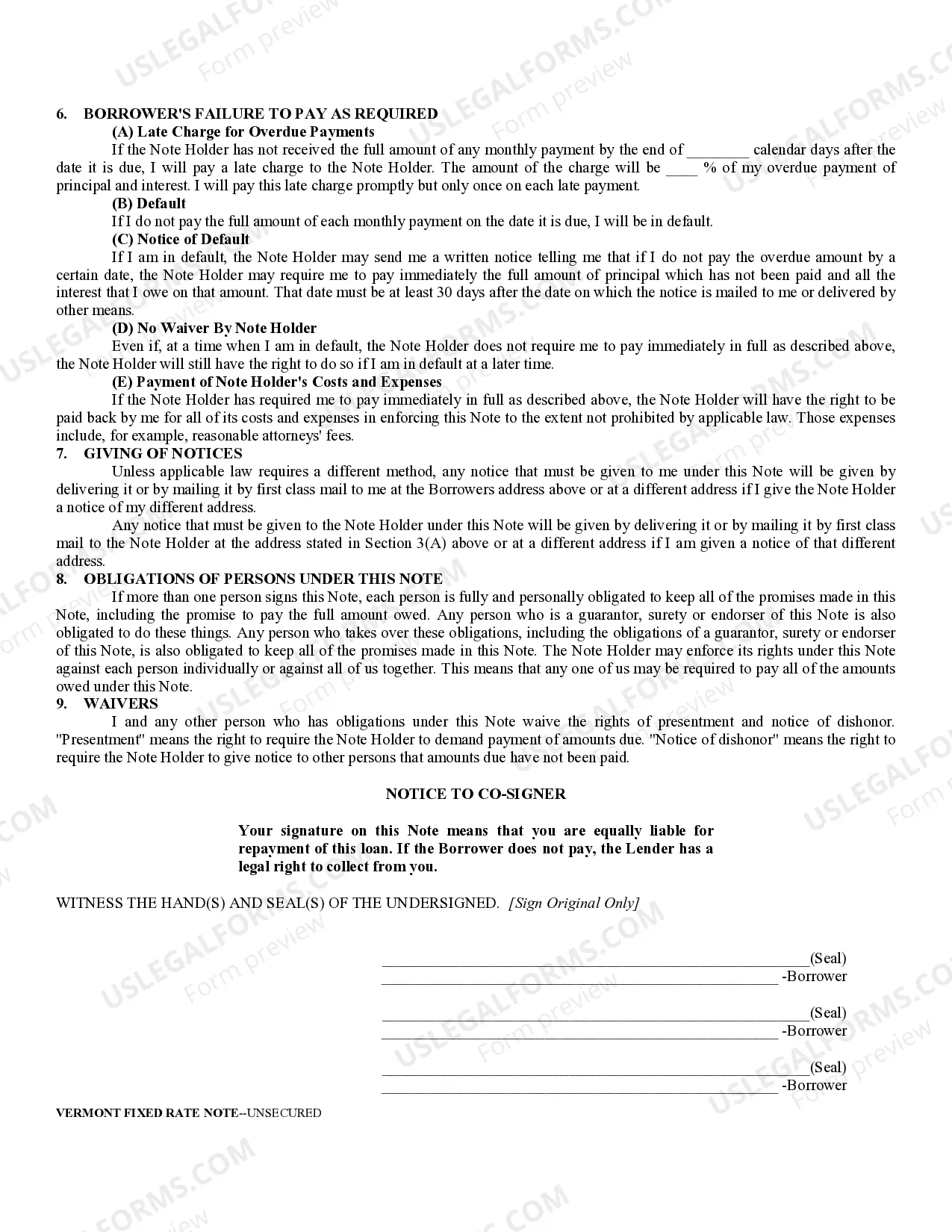

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Date. The promissory note should include the date it was created at the top of the page. Amount. Loan terms. Interest rate. Collateral. Lender and borrower information. Signatures.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.