Satisfaction, Release or Cancellation of Mortgage by Corporation

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Vermont Law

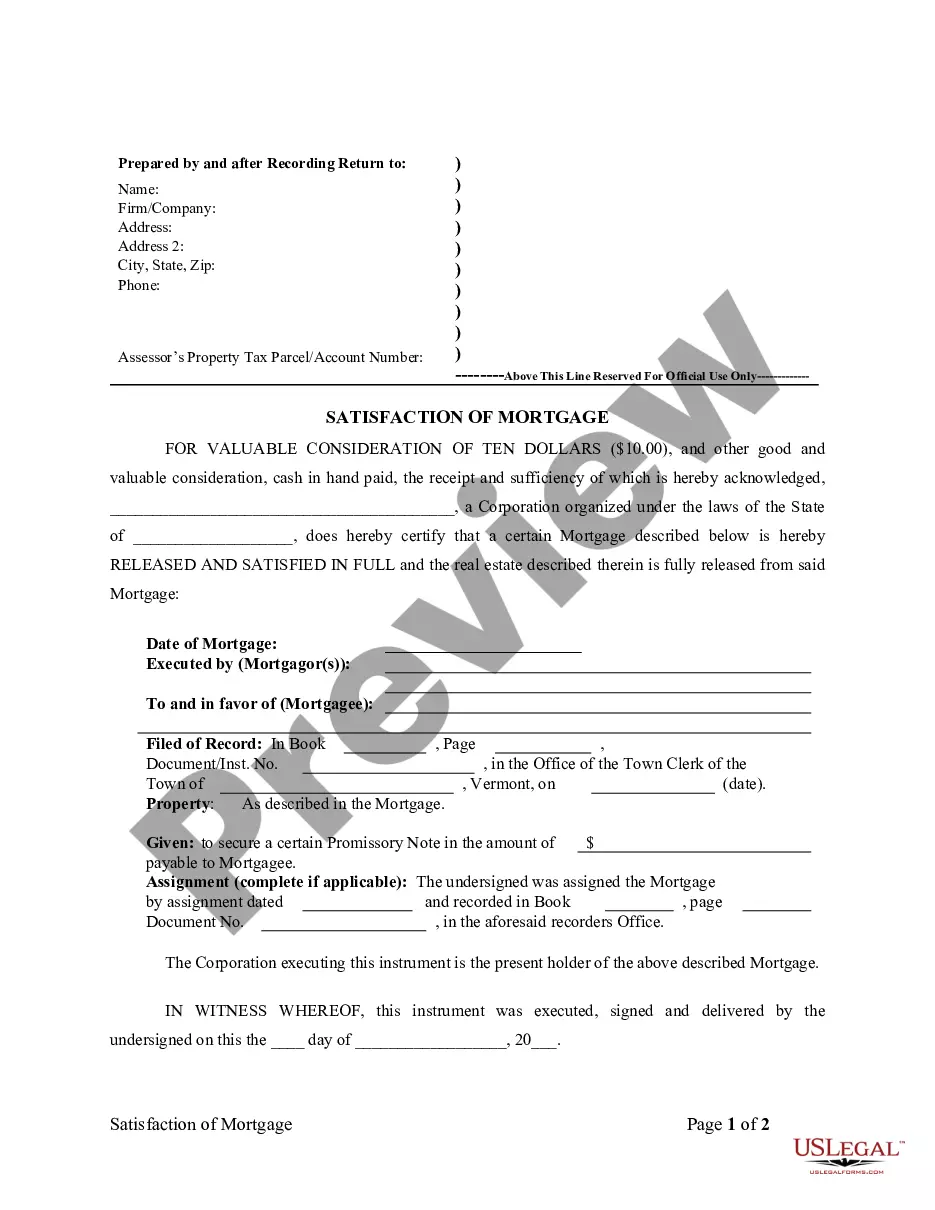

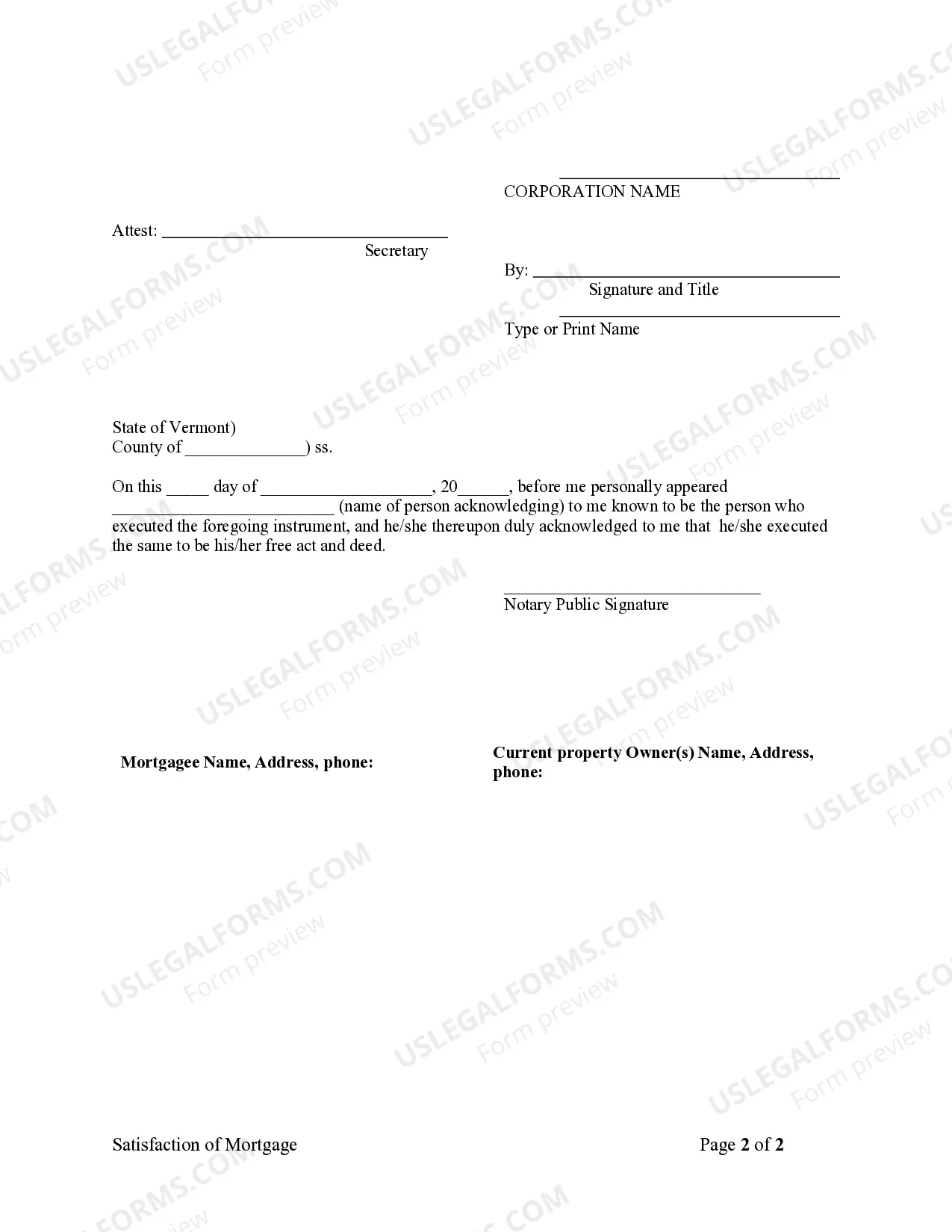

Execution of Assignment or Satisfaction: Shall be executed by the mortgagee or authorized agent.

Assignment: An assignment must be in writing and recorded.

Demand to Satisfy: Following full pay-off, mortgagor is not required to notify mortgagee, who must, within 30 days, satisfy the mortgage of record.

Recording Satisfaction: An assignment or discharge of a mortgage or judgment lien shall be duly recorded in the records of the town.

Marginal Satisfaction: Mortgages may be discharged by an entry on the margin of the record thereof in the record of deeds, acknowledging satisfaction of the mortgage, signed by the mortgagee and witnessed by the clerk having custody of the record.

Penalty: In addition to any statutory damages ($25.00 per day after the expiration of the 30 days following full pay-off, up to an aggregate maximum of $5,000.00), the mortgagee shall also be liable for consequential damages, punitive damages, court costs and reasonable attorney's fees to any aggrieved party who substantially prevails in an action.

Acknowledgment: An assignment or satisfaction must contain a proper Vermont acknowledgment, or other acknowledgment approved by Statute.

Vermont Statutes

§ 461. By entry on record

Mortgages may be discharged by an entry on the margin of the record thereof in the record of deeds, acknowledging satisfaction of the mortgage, signed by the mortgagee or by his or her executor, administrator, assignee, attorney at law, or attorney acting under a duly executed and recorded power of attorney, such signature to be witnessed by the town clerk or assistant town clerk having custody of such record. Such entry shall have the same effect as a deed of release acknowledged and recorded.

§ 462. By acknowledgment of payment

Mortgages may also be discharged by the mortgagee or by his or her executor, administrator, assignee, attorney at law, or attorney acting under a duly executed and recorded power of attorney, acknowledging payment thereof by an entry on the mortgage deed, signing the same in the presence of one or more witnesses, which entry, upon being recorded on the margin of the record of such mortgage in the record of deeds, shall discharge such mortgage and bar all actions brought thereon.

§ 463. By separate instrument

(a) Mortgages may be discharged by an acknowledgment of satisfaction, executed by the mortgagee or his or her attorney, executor, administrator, or assigns, which shall be substantially in the following form:

I hereby certify that the following described mortgage is paid in full and satisfied, viz: ________ mortgagor to ________ mortgagee, dated ________ 20__, and recorded in book ___, page ___, of the land records of the town of __________________________.

§ 1158. Assignment or discharge of mortgage or judgment lien

An assignment or discharge of a mortgage or judgment lien shall be duly recorded in the records of the town. A mortgage or judgment lien may be discharged by the mortgagee, judgment creditor or assignee of such mortgage or judgment lien in writing on the margin of the mortgage record or judgment lien notice. A satisfaction or assignment of the mortgage or judgment lien recorded elsewhere shall bear a marginal notation of the book and page of the mortgage or judgment lien record and a corresponding cross-reference shall be made on the margin of the mortgage or judgment lien notice record.

§ 464. Liability of mortgagee for failure to provide payoff statements and refusal to discharge

(a) Within five business days after the mortgagee's receipt of a written request for a statement of the amount of funds or other obligations required to satisfy a note or other obligation secured by a mortgage, the mortgagee shall provide a written payoff statement to the mortgagor. The mortgagee shall not impose a fee or other charge for providing the payoff statement, unless the request specifically asks for expedited service. A request for a payoff statement shall include the name of the mortgagor, the loan number assigned to the loan, and the address of the property securing the loan. If a written payoff statement is not deposited in the U.S. mail, delivered to a courier service, sent by facsimile, or sent by other method of service customarily used for delivery of messages, within five business days after receiving the request, the holder and any servicer shall be jointly and severally liable to any aggrieved party in a civil action for statutory damages equal to $25.00 per day after the expiration of the five business days, up to an aggregate maximum of $5,000.00 for all aggrieved parties; provided, however, any servicer not authorized to issue a payoff statement shall not be liable as set forth herein.

(b) Within 30 days after full performance of the conditions of the mortgage, the mortgagee of record shall execute and deliver a valid and complete discharge as provided in sections 461-463 of this title, together with any instrument necessary to establish the mortgagee's record ownership of the mortgage and to establish the authority to executethe discharge. As used in this section, the term “mortgagee” shall mean both the holder of the mortgage at the time it is satisfied and any servicer who receives the final payment satisfying the debt. If a discharge is not executed and delivered within 30 days, the holder and any servicer shall be jointly and severally liable to any aggrieved party in a civil action for statutory damages equal to $25.00 per day after the expiration of the 30 days, up to an aggregate maximum of $5,000.00 for all aggrieved parties; provided, however, any servicer not authorized to execute such discharge shall not be liable as set forth in this subsection. With respect to a mortgagee securing an open-end line of credit, the 30-day period to deliver a discharge commences after the mortgagor delivers to the address designated for payments under the line of credit a written request to terminate the line of credit and mortgage, together with payment in full of all amounts secured by the mortgage.<br />

<br />

(c) The aggrieved party may file an action under subsection (a) or (b) of this section in superior court or, if the action is for monetary damages only and if the ad damnum requested is equal to or less than the maximum jurisdiction of a small claims proceeding, the complaint may be filed as a small claims action.<br />

<br />

(d) In addition to any statutory damages, the mortgagee shall also be liable for consequential damages, punitive damages, court costs, and reasonable attorney’s fees to any aggrieved party who substantially prevails in an action under this section. An aggrieved party may file an action to recover such damages, costs and fees in superior court. The court shall equitably allocate punitive damages among multiple aggrieved parties and may grant such other relief as the court deems appropriate.