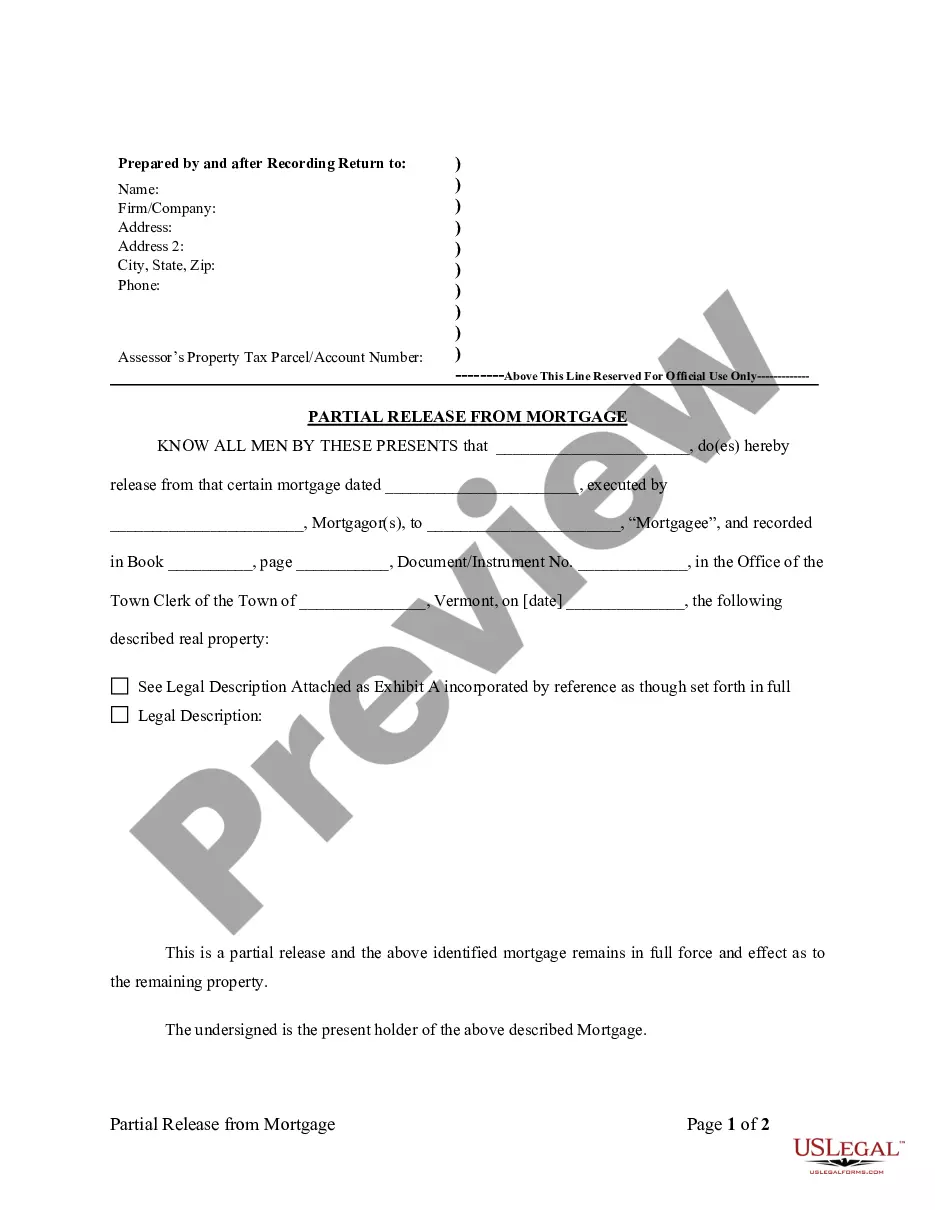

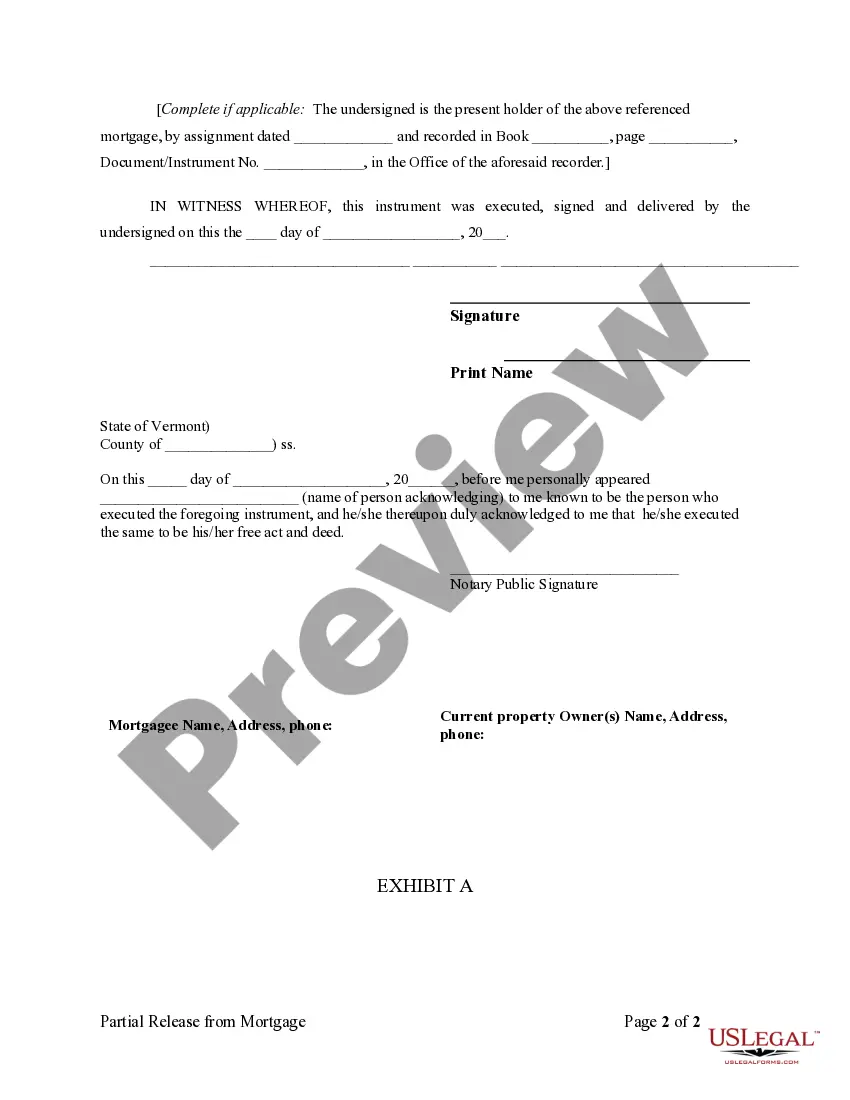

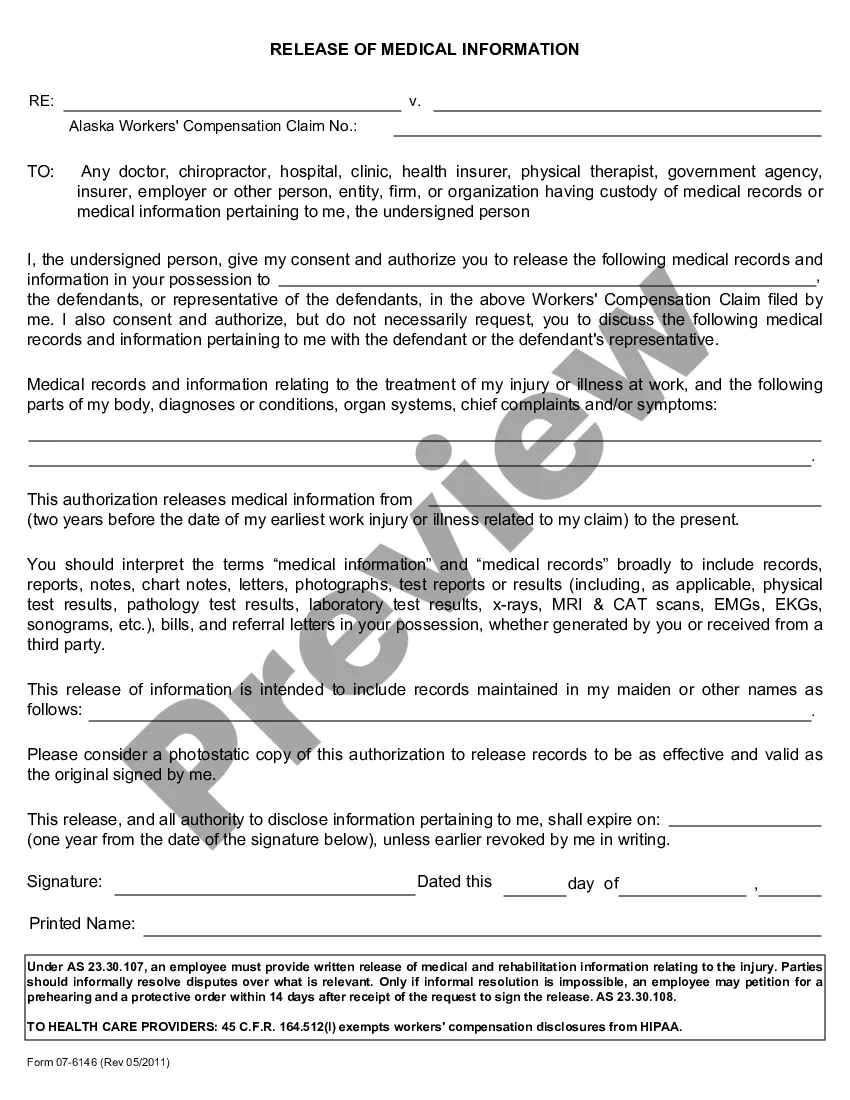

This form is for a holder of a deed of trust or mortgage (see title) to release a portion of the real property described as security. It asserts that the identified and referenced deed of trust or mortgage remains in full force or effect as to the remaining property.

Vermont Partial Release of Property From Mortgage by Individual Holder

Description

How to fill out Vermont Partial Release Of Property From Mortgage By Individual Holder?

Searching for a Vermont Partial Release of Property From Mortgage by Individual Holder online can be stressful. All too often, you find papers that you simply think are alright to use, but find out afterwards they are not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional lawyers in accordance with state requirements. Get any document you’re looking for within a few minutes, hassle free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will immediately be added to the My Forms section. If you don’t have an account, you should sign-up and choose a subscription plan first.

Follow the step-by-step instructions listed below to download Vermont Partial Release of Property From Mortgage by Individual Holder from our website:

- Read the document description and click Preview (if available) to check whether the form suits your expectations or not.

- If the document is not what you need, find others with the help of Search field or the provided recommendations.

- If it is appropriate, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the document in a preferable format.

- Right after downloading it, you can fill it out, sign and print it.

Get access to 85,000 legal templates right from our US Legal Forms catalogue. Besides professionally drafted samples, users can also be supported with step-by-step guidelines regarding how to find, download, and fill out forms.

Form popularity

FAQ

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

The Grantor is any person conveying or encumbering, whom any Lis Pendens, Judgments, Writ of Attachment, or Claims of Separate or Community Property shall be placed on record. The Grantor is the seller (on deeds), or borrower (on mortgages). The Grantor is usually the one who signed the document.

Pay off your debt. Fill out a release-of-lien form and have the lien holder sign it. Run out the statute of limitations. Get a court order. Make a claim with your title insurance company. Learn more:

If you can't find out which company took over, call the Federal Deposit Insurance Corporation's (FDIC) lien release number at (888) 206-4662 (toll free) or visit the Closed Banks and Asset Sales section on the FDIC's "Contact Us" page.

Take possession of all the papers. Get an NOC. Get your CIBIL report updated. Get the lien withdrawn. Get an encumbrance certificate.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

In most cases, the lien holder (the lender in this case) should send the release to be recorded within 30-90 days. If you aren't sure what the requirements are in your area, reach out to your real estate agent, title agent, or real estate attorney for guidance.

In general a discharge fee costs between $275 and $325, but may be higher or lower. Some states impose a "release of mortgage" fee.

Once your lender receives the payoff letter and funds, the loan is paid off in full. Lenders then need to prepare a release deed or release of lien to clear the title to the property. The release, once recorded, gives notice to the world that you have paid off the loan and that the lien is no longer valid.