This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

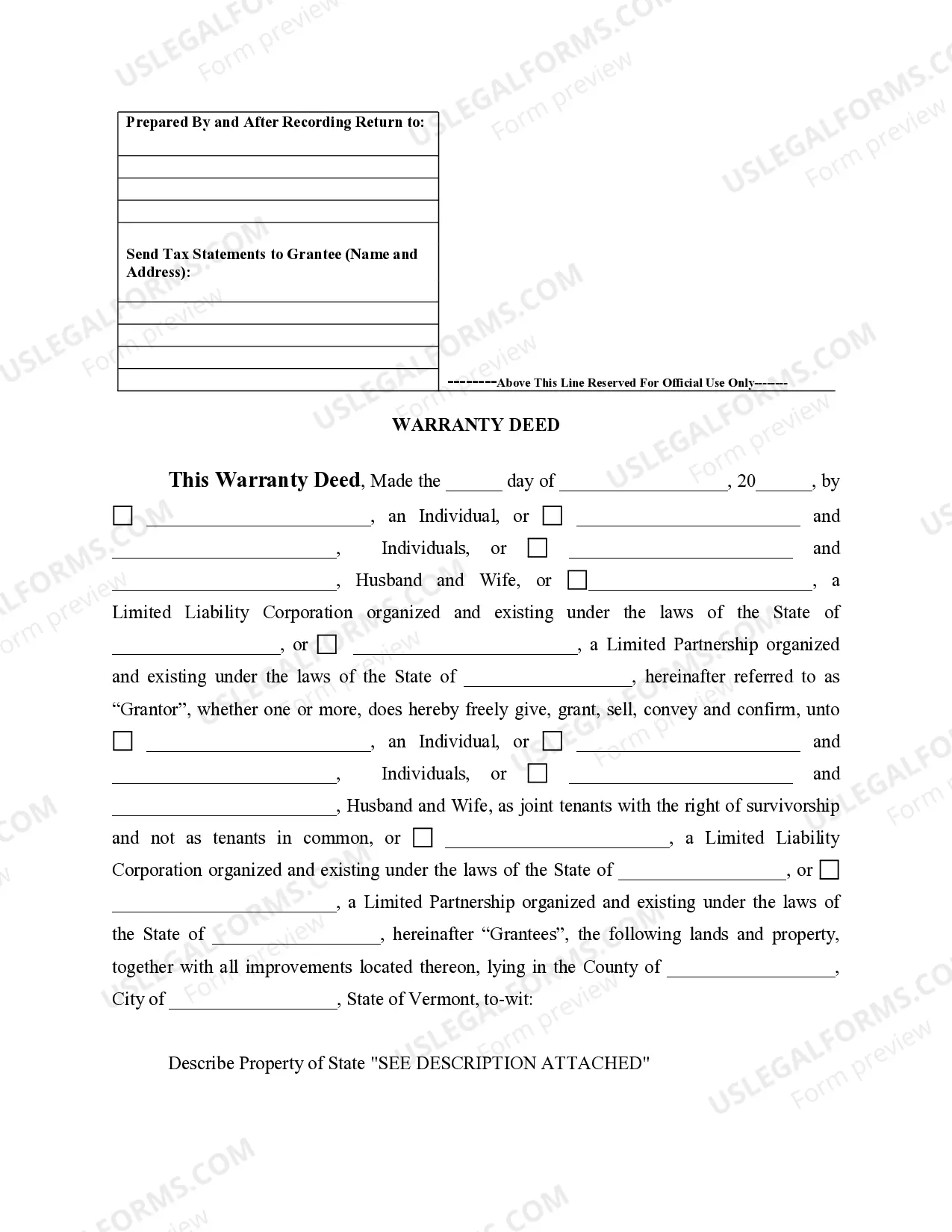

Vermont Warranty Deed for Limited Partnership or LLC is the Grantor, or Grantee

Description Warranty Deed Form Vermont

How to fill out Vermont Warranty Deed For Limited Partnership Or LLC Is The Grantor, Or Grantee?

Among lots of free and paid templates that you can get on the web, you can't be sure about their reliability. For example, who created them or if they’re qualified enough to deal with the thing you need those to. Keep relaxed and make use of US Legal Forms! Get Vermont Warranty Deed for Limited Partnership or LLC is the Grantor, or Grantee templates created by skilled lawyers and get away from the high-priced and time-consuming process of looking for an lawyer and then having to pay them to write a papers for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you are trying to find. You'll also be able to access all of your previously saved documents in the My Forms menu.

If you’re using our website for the first time, follow the instructions listed below to get your Vermont Warranty Deed for Limited Partnership or LLC is the Grantor, or Grantee easily:

- Ensure that the file you see is valid where you live.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing process or find another template using the Search field found in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

When you’ve signed up and purchased your subscription, you may use your Vermont Warranty Deed for Limited Partnership or LLC is the Grantor, or Grantee as often as you need or for as long as it remains active in your state. Edit it with your preferred online or offline editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

To form a limited partnership, you must file with your state agency, usually the secretary of state's office, and pay a filing fee, which varies by state. For example, in Delaware, one of the most common states in which to incorporate a business, it costs $200 to file for a certificate of limited partnership.

A limited partnership is usually a type of investment partnership, often used as investment vehicles for investing in such assets as real estate. LPs differ from other partnerships in that partners can have limited liability, meaning they are not liable for business debts that exceed their initial investment.

Limited partners are simply investors in the business; they don't have control of day-to-day operations, and they're only liable for as much as they invest in the company.They're considered passive investors because they contribute money to the partnership but don't have control over decisions.

Some LLP examples can include veterinarian's offices, dental offices, auditing firms, law firms, financial advising services, business consultancies and real estate agencies. However, state laws might place restrictions on the types of businesses that use this partnership model.

Limited partnerships are generally used by hedge funds and investment partnerships as they offer the ability to raise capital without giving up control. Limited partners invest in an LP and have little to no control over the management of the entity, but their liability is limited to their personal investment.

Limited partnership are usually found in time-restricted projects, like filmmaking and real estate businesses.Medical partnerships, law firms, and accounting firms are common examples of Limited Liability Partnership.

A few examples of businesses where limited partnership works best are the real estate industry, small and medium scale business, professional knowledge ones like a lawyer and so on.

Limited Partnership Interest means the ownership interest of a Limited Partner, including its interest in distributions, including liquidating distributions, and profits and losses of the Partnership and all of its other rights, duties and obligations under the Partnership Agreement.

GoPro & Red Bull. Pottery Barn & Sherwin-Williams. Casper & West Elm. Bonne Belle & Dr. Pepper. BMW & Louis Vuitton. Uber & Spotify. Apple & MasterCard. Airbnb & Flipboard.