Vermont License to Mortgage or Lease is a state-regulated document that allows lenders to offer financing to borrowers for the purchase of a residential property. It is required for any person or entity who wishes to engage in the business of mortgage brokering, mortgage loan origination, or mortgage loan servicing in the state of Vermont. The license is issued by the Vermont Department of Financial Regulation and is valid for a period of two years. There are three types of Vermont License to Mortgage or Lease: 1. Mortgage Broker License: This license allows individuals or businesses to act as a broker for the purpose of obtaining a mortgage loan on behalf of a borrower. 2. Mortgage Loan Originator License: This license allows individuals to act as a loan originator for the purpose of obtaining a mortgage loan on behalf of a borrower. 3. Mortgage Loan Service License: This license allows individuals or businesses to act as a service for the purpose of servicing a loan on behalf of a borrower. All applicants must submit a completed application form, pay the applicable fee, and provide the required documentation to be considered for a license. The Department of Financial Regulation may also require applicants to pass an examination and submit to a background check.

Vermont License to Mortgage or Lease

Description

How to fill out Vermont License To Mortgage Or Lease?

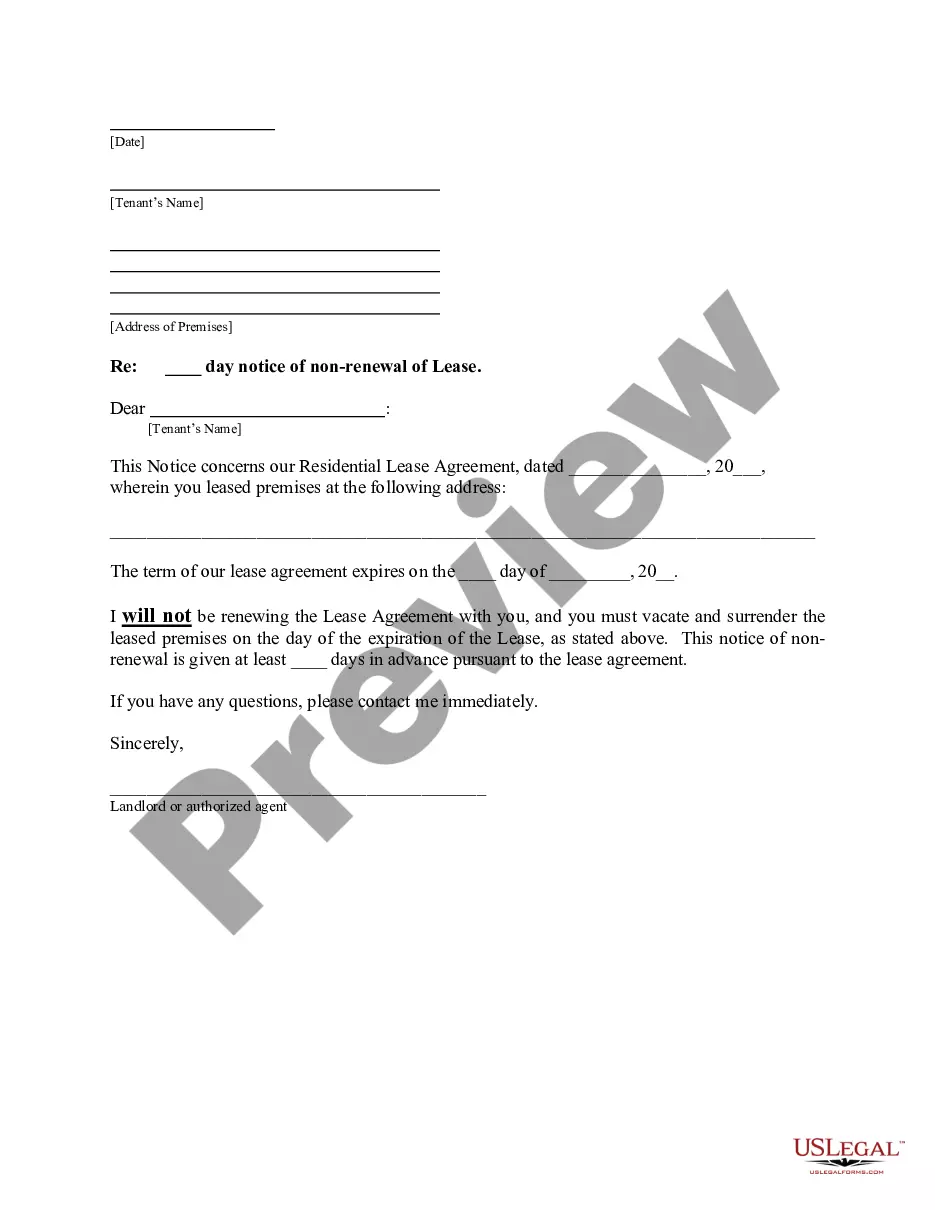

Coping with official paperwork requires attention, accuracy, and using well-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Vermont License to Mortgage or Lease template from our library, you can be sure it meets federal and state regulations.

Working with our service is simple and fast. To get the required document, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to obtain your Vermont License to Mortgage or Lease within minutes:

- Make sure to attentively look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for another formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Vermont License to Mortgage or Lease in the format you prefer. If it’s your first time with our service, click Buy now to continue.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to prepare it paper-free.

All documents are created for multi-usage, like the Vermont License to Mortgage or Lease you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

Vermont home buyer stats ?Minimum? down payment assumes 3% down on a conventional mortgage with a minimum credit score of 620. If you're eligible for a VA loan (backed by the Department of Veterans Affairs) or a USDA loan (backed by the US Department of Agriculture), you may not need any down payment at all.

Vermont home buyer stats Average Home Sale Price in VT$331,520Minimum Down Payment in VT (3%)$9,94620% Down Payment in VT$66,304Average Credit Score in VT1736Maximum VT Home Buyer Loan2$40,000 as a repayable loan from NeighborWorks

Qualifying for Florida Housing First-Time Homebuyer Benefits 620 or higher credit score. The property must be in Florida. It must be the buyer's primary residence.

In Vermont, first-time homebuyers, qualifying veterans and those purchasing in specific target areas are eligible for a mortgage credit certificate (MCC), a tax credit on their mortgage interest equal to up to $2,000 per year.

Although you are not required by law to have legal representation when buying or selling a property in Vermont, it is in your best interest to do so. Additionally, if you are financing your lender may require that you hire a title attorney.

You meet credit score requirements: Conventional, USDA and VA Loans: 640 or higher. FHA Loans: 650 or higher.