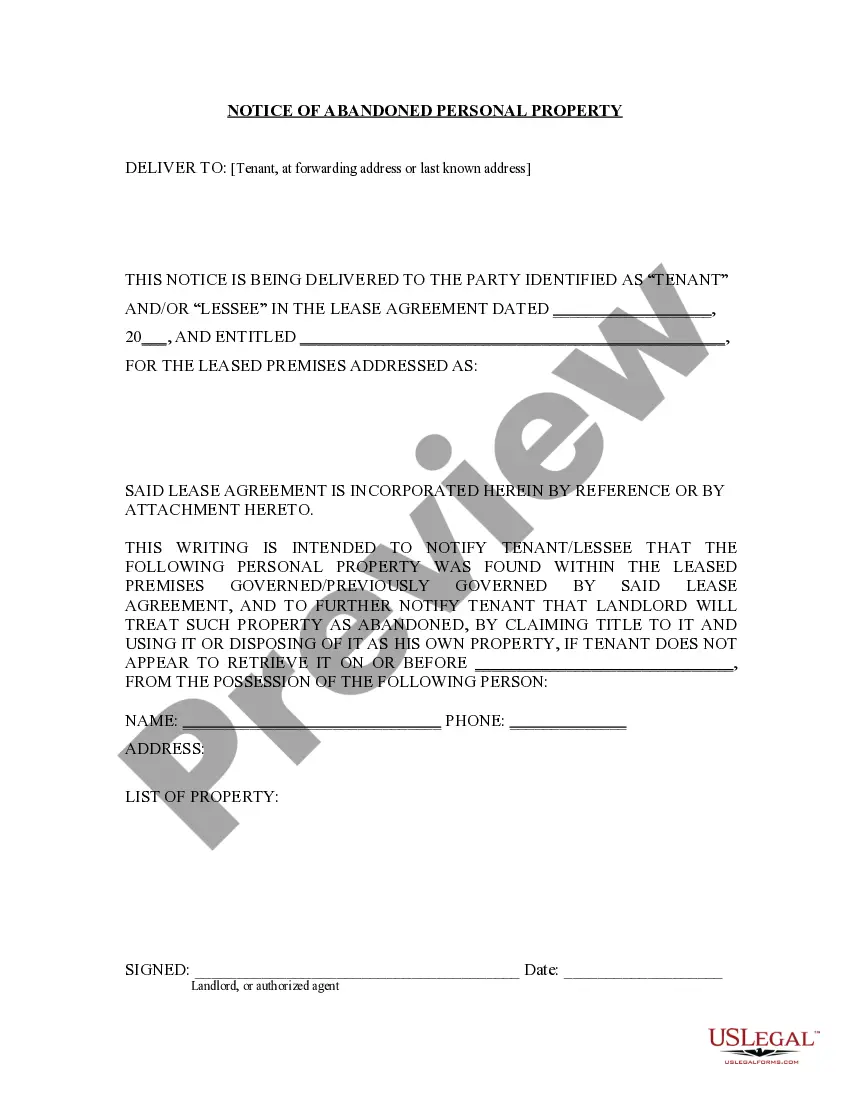

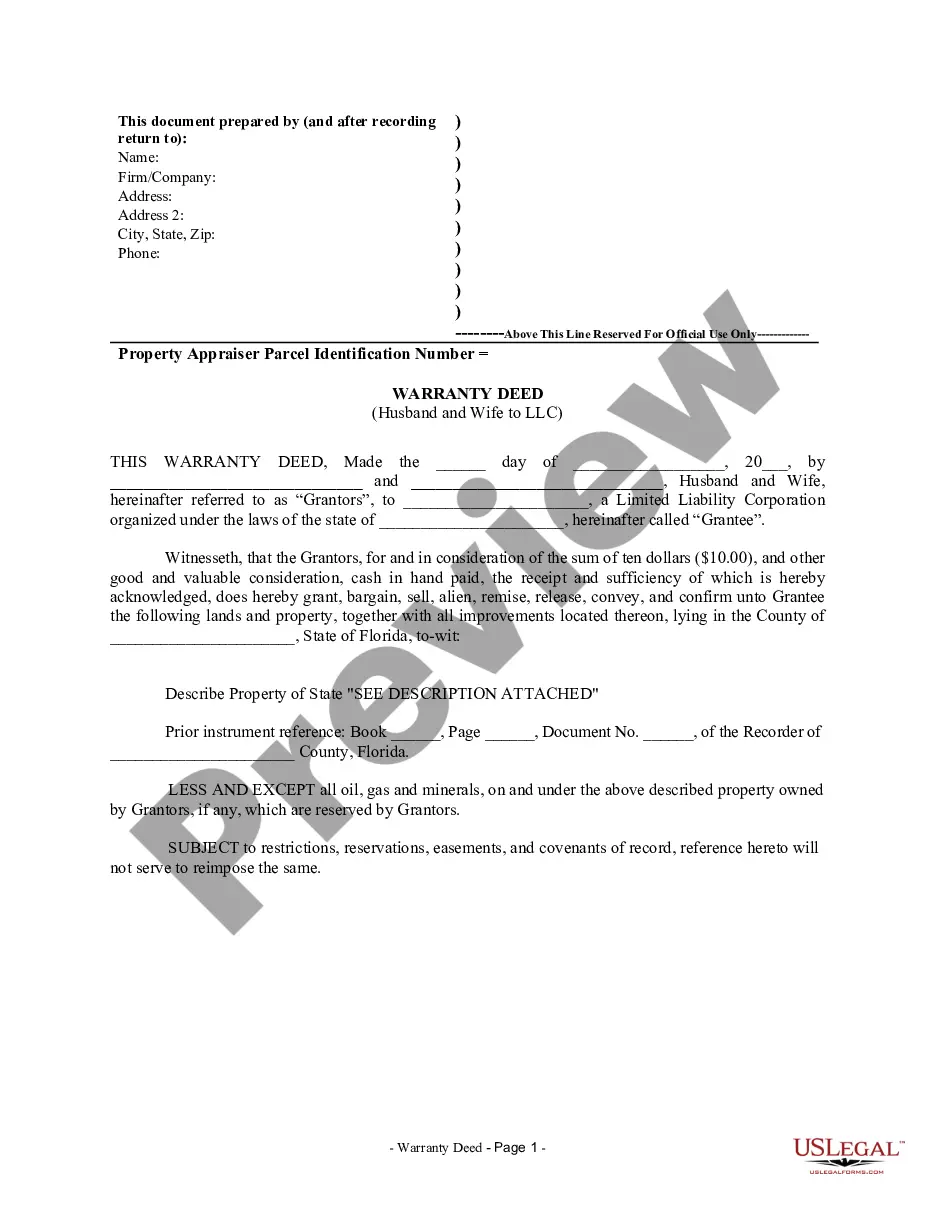

The Vermont Report of Fiduciary of Small Estate is a document used by a fiduciary to report the administration of a small estate in Vermont. The report is required when a person has died and left an estate valued at less than $100,000 and the estate is not in probate. It is the fiduciary’s responsibility to collect all assets, pay debts and taxes, and distribute what is left to the rightful heirs. The report must include information such as the decedent’s name, date of death, the total value of the estate, the name of the fiduciary, and the names of the heirs. It must also list all assets and liabilities of the estate, including the gross value of the assets, the amount of taxes paid, and the amount of money or property distributed to the heirs. The Vermont Report of Fiduciary of Small Estate must be signed by the fiduciary and filed with the probate court in the county where the decedent died. There are two types of reports: the short form and the long form. The short form is used if the estate does not include real estate, and the long form is used if the estate does include real estate.

Vermont Report of Fiduciary of Small Estate

Description

How to fill out Vermont Report Of Fiduciary Of Small Estate?

Working with legal paperwork requires attention, precision, and using properly-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Vermont Report of Fiduciary of Small Estate template from our library, you can be certain it complies with federal and state regulations.

Working with our service is simple and fast. To get the necessary document, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to obtain your Vermont Report of Fiduciary of Small Estate within minutes:

- Make sure to attentively check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for an alternative official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Vermont Report of Fiduciary of Small Estate in the format you prefer. If it’s your first time with our website, click Buy now to continue.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to submit it paper-free.

All documents are created for multi-usage, like the Vermont Report of Fiduciary of Small Estate you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

Vermont probate follows this general flow: contact the court, get appointed as personal representative, submit will if it exists, inventory and submit valuations of all relevant assets, have the court and beneficiaries approve it, and then distribute the assets to beneficiaries.

Rule 5 - Appearance Before a Judicial Officer (a)In General. When a person arrested with or without a warrant, or served a citation or summons, is brought or appears before a judicial officer as provided in Rules 3 and 4, the judicial officer shall proceed in ance with this rule.

Settling an Estate in Vermont Someone files a petition with the court to open probate. The court has a hearing and appoints someone to act as personal representative or approves the person named in the will. The executor notifies the heirs and any creditors. They publish notification in a local newspaper.

How Do You Avoid Probate in Vermont? While most estates need to undergo the probate process, the best way to avoid probate in Vermont is by creating a living trust before dying. Assets will then transfer to your beneficiaries without the need to go to court.

A small estate involves a simpler process when the estate is valued under $45,000, there is no real estate, and there is a surviving spouse, children, or parents. An estate may be considered ancillary if the deceased resided outside of Vermont but owned property in the state.

(1) The fiduciary may, but is not required to, give notice to creditors pursuant to law. Whether or not notice is given to creditors, the fiduciary shall pay known debts of the deceased and the funeral and burial expenses of the deceased from the assets of the estate.

A Vermont small estate affidavit, also known as the 'Petition to Open Small Estate', can be used to speed distribution of assets for estates valued at $45,000 or less. The affidavit cannot be used to claim real estate.

Probate Process Every estate passes through probate following the owner's death. Probate can take anywhere from a few months to more than a year. If there is a will, and one or more of the heirs chooses to contest the document, the process can take a lot longer.