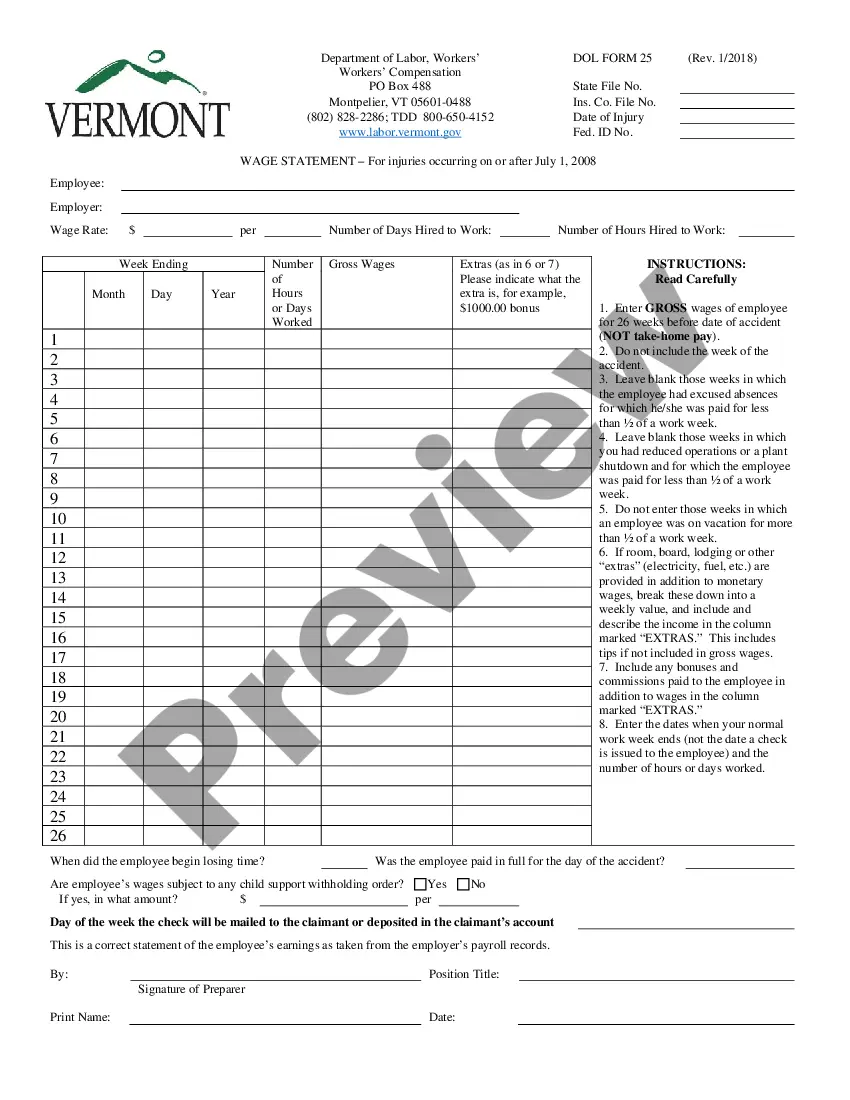

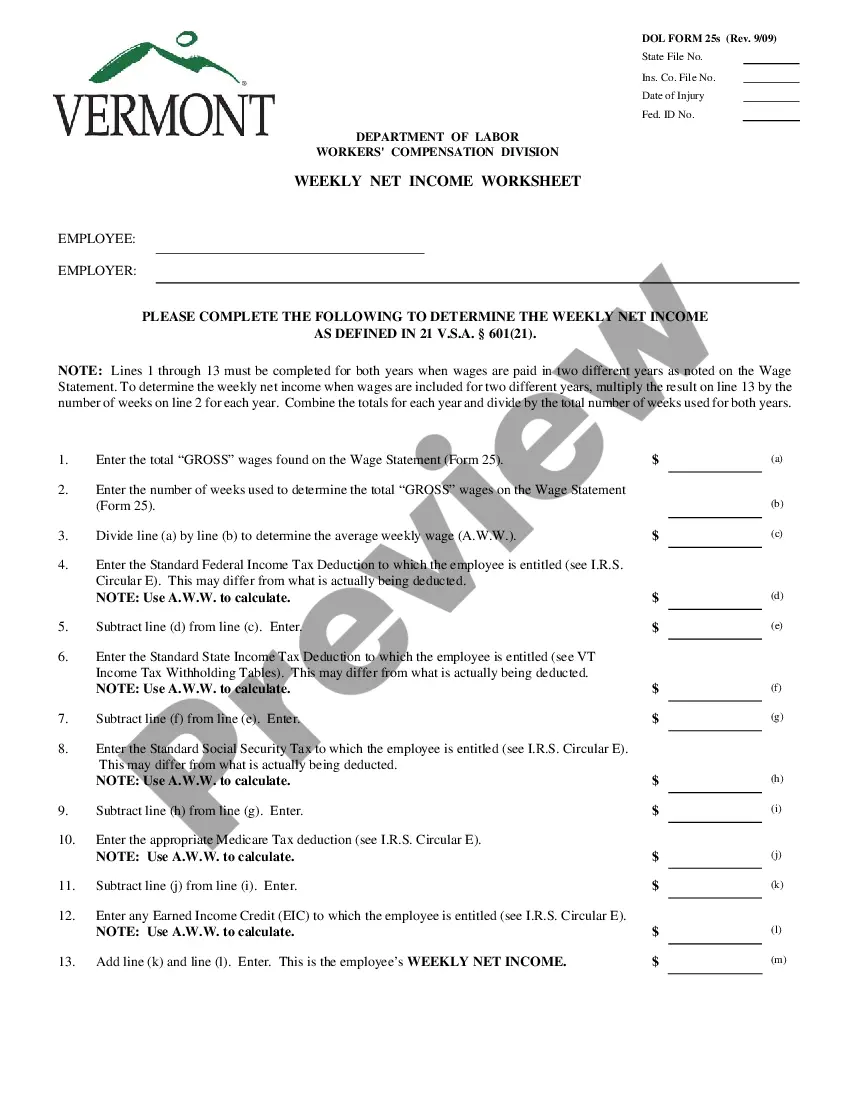

Vermont Weekly Net Income Worksheet is a document used to calculate weekly net income for individuals or businesses in the state of Vermont. It is used to track income and expenses for a given week, and is typically used for tax, budgeting, and accounting purposes. The worksheet is designed to help individuals or businesses accurately calculate their net income for the week, and to ensure that their taxes are paid appropriately. There are two different types of Vermont Weekly Net Income Worksheets; one for individuals, and another for businesses. The individual worksheet includes sections for income, deductions, and total net income; while the business worksheet includes sections for income, expenses, and total net income. Both worksheets also include a section for submitting the completed form to the Vermont Department of Taxes.

Vermont Weekly Net Income Worksheet

Description

How to fill out Vermont Weekly Net Income Worksheet?

How much time and resources do you typically spend on drafting official paperwork? There’s a better option to get such forms than hiring legal experts or wasting hours searching the web for a proper template. US Legal Forms is the premier online library that provides professionally designed and verified state-specific legal documents for any purpose, like the Vermont Weekly Net Income Worksheet.

To obtain and complete a suitable Vermont Weekly Net Income Worksheet template, adhere to these simple steps:

- Examine the form content to ensure it complies with your state laws. To do so, check the form description or take advantage of the Preview option.

- In case your legal template doesn’t satisfy your needs, find a different one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Vermont Weekly Net Income Worksheet. If not, proceed to the next steps.

- Click Buy now once you find the right blank. Opt for the subscription plan that suits you best to access our library’s full service.

- Create an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally reliable for that.

- Download your Vermont Weekly Net Income Worksheet on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously acquired documents that you safely store in your profile in the My Forms tab. Get them anytime and re-complete your paperwork as often as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most trustworthy web services. Sign up for us now!

Form popularity

FAQ

Vermont workers' compensation insurance can help: Pay for medical care if an employee gets hurt or sick from their job. Replace most of their lost wages if they miss work due to an injury or illness from their job. Pay for funeral costs if they lose their life due to a work accident or work-related illness.

21 Days calculating in case of FORM 5 If an Employee's Notice of Injury and Claim for Compensation (Form 5) is filed by an injured worker, the employer/carrier shall investigate the claim immediately to determine whether any compensation is due within 21 days.

If you become unemployed and have worked in Vermont anytime in the past 18 months, you may be eligible to receive unemployment insurance benefits. Once you become totally or partially unemployed, the time to establish a new claim is during the first week you work less than 35 hours.

The current maximum weekly benefit amount is $668. This amount applies only to regular unemployment insurance benefits, and goes not apply to federal programs enacted in response to COVID-19. More information about federal programs may be found on VDOL's COVID-19 Response page.

If your employer does not file a workers' compensation claim, then you can contact our office (802) 828-2286 and request a Form 5 ? Employee's Notice of Injury and Claim for Compensation PDF. If you file a Form 5 you will be required to provide evidence that your injury was as a result of your employment.

An injured worker's wage paid is 66 2/3%. The weekly payment minimum is $351, 50% of the Vermont state average weekly wage of the workers average wage if less. The weekly maximum is $1,053, 150% of the Vermont state average weekly wage. Maximum period of payments is for the length of the disability.

Workers' compensation insurance is mandatory for all Vermont employers. Most employers are aware of their coverage obligations and they know that it provides an injured worker with certain benefits.