The Vermont Employer Information Manual (VEIN) is an online publication developed by the Vermont Department of Labor to provide employers with information on labor laws, wage and hour requirements, and other information related to the employment of workers in the state of Vermont. It is designed to help employers understand their obligations under Vermont labor laws and to ensure compliance with state and federal laws. The VEIN includes information on topics such as the minimum wage, overtime pay, child labor, record keeping, and safety and health. The manual is divided into sections, including general information, wages and hours, workers' compensation, unemployment insurance, and labor relations. It also includes links to other resources, such as the Vermont Department of Labor website and other state and federal agencies. There are two types of Vermont Employer Information Manual: a print version, which is available for purchase, and an online version, which is accessible for free.

Vermont Employer Information Manual

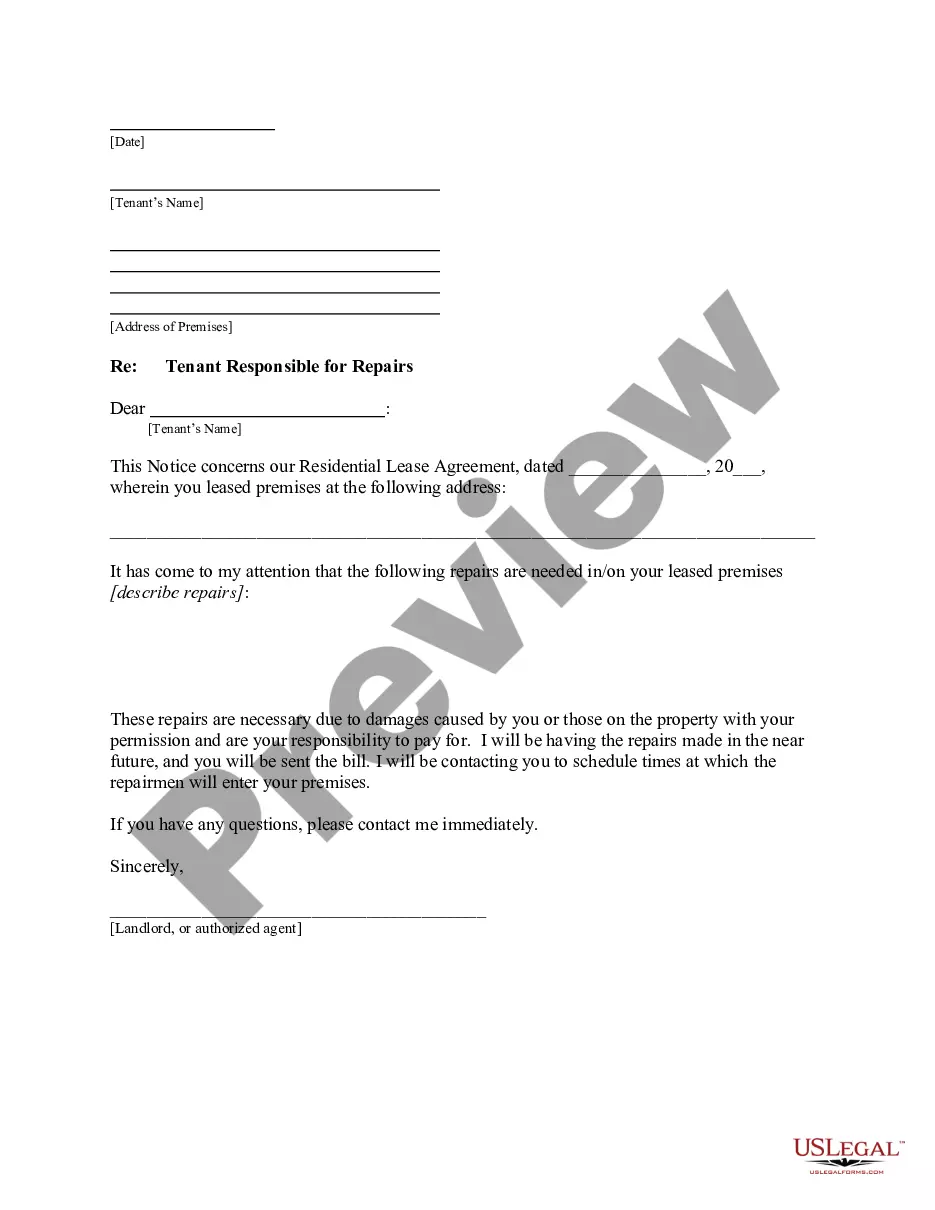

Description

How to fill out Vermont Employer Information Manual?

How much time and resources do you typically spend on drafting official documentation? There’s a better way to get such forms than hiring legal experts or spending hours browsing the web for a proper template. US Legal Forms is the premier online library that provides professionally designed and verified state-specific legal documents for any purpose, like the Vermont Employer Information Manual.

To get and complete an appropriate Vermont Employer Information Manual template, follow these simple instructions:

- Look through the form content to make sure it meets your state regulations. To do so, read the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your requirements, find a different one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Vermont Employer Information Manual. Otherwise, proceed to the next steps.

- Click Buy now once you find the right blank. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is totally reliable for that.

- Download your Vermont Employer Information Manual on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously purchased documents that you safely keep in your profile in the My Forms tab. Get them anytime and re-complete your paperwork as frequently as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most reliable web services. Join us today!

Form popularity

FAQ

If you work 35 hours or more or your earnings exceed your weekly benefit amount plus your disregarded earnings, you will be considered fully employed and will not be entitled to receive benefit for that week.

Vermont law requires employers to pay non-exempt employees 1.5 times their regular rate of pay for all hours worked over 40 in a workweek. The federal overtime rule stipulates that the minimum salary requirement for administrative, professional, and executive exemptions is $684 per week, or $35,568 per year.

Even though Vermont doesn't have a law requiring payment of accrued, unused vacation at termination, employers can still be responsible for paying this if there is a company policy that states so.

All claimants are required to complete a weekly work search in order to receive benefits unless you meet one of the following exemptions: Have a verified return-to-work date within 10 weeks of filing your initial claim. Enrolled in a qualified training or education program.

Notice Requirements Vermont does not have any laws requiring employers to provide employees notice of wage rates, dates of pay, employment policies, fringe benefits, or other terms and conditions of employment.

If the employer discharges an employee, the employee must be paid within 72 hours from the time of discharge. An employee who voluntarily leaves an employment position, shall be paid on the last regular payday, or if there is no regular payday, on the following Friday.

VT Dept. of Labor FAQs. An employer must pay an employee for accrued vacation upon separation from employment if its policy or contract provides for such payment.

In Vermont, the minimum wage is $9.15. This amount is higher than the federally-mandated minimum wage, which is $7.25 per hour. Under the Fair Labor Standards Act (FLSA), employees receive the higher of these two minimum wages.