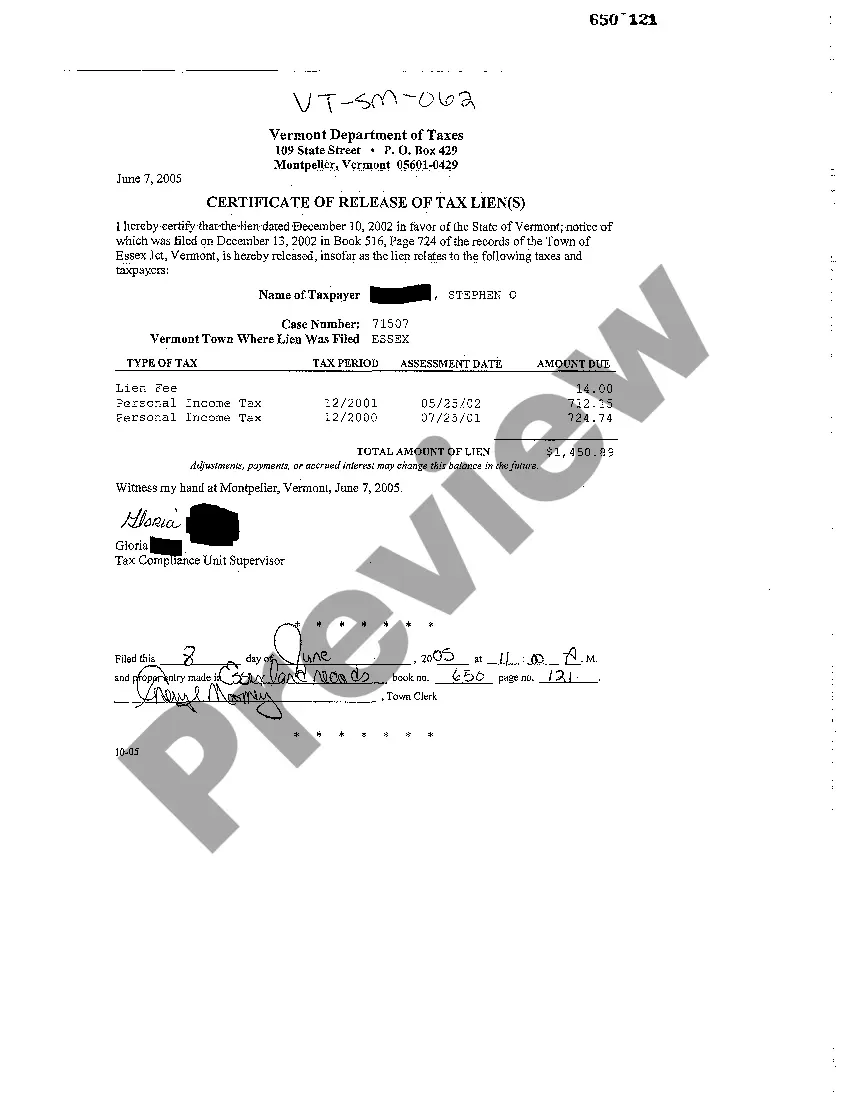

Vermont Certificate of Release of Tax Liens

Description

How to fill out Vermont Certificate Of Release Of Tax Liens?

Looking for a Vermont Certificate of Release of Tax Liens online might be stressful. All too often, you see documents that you believe are alright to use, but find out afterwards they’re not. US Legal Forms offers over 85,000 state-specific legal and tax documents drafted by professional lawyers according to state requirements. Have any form you’re searching for quickly, hassle free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will immediately be included to the My Forms section. If you don’t have an account, you have to sign-up and choose a subscription plan first.

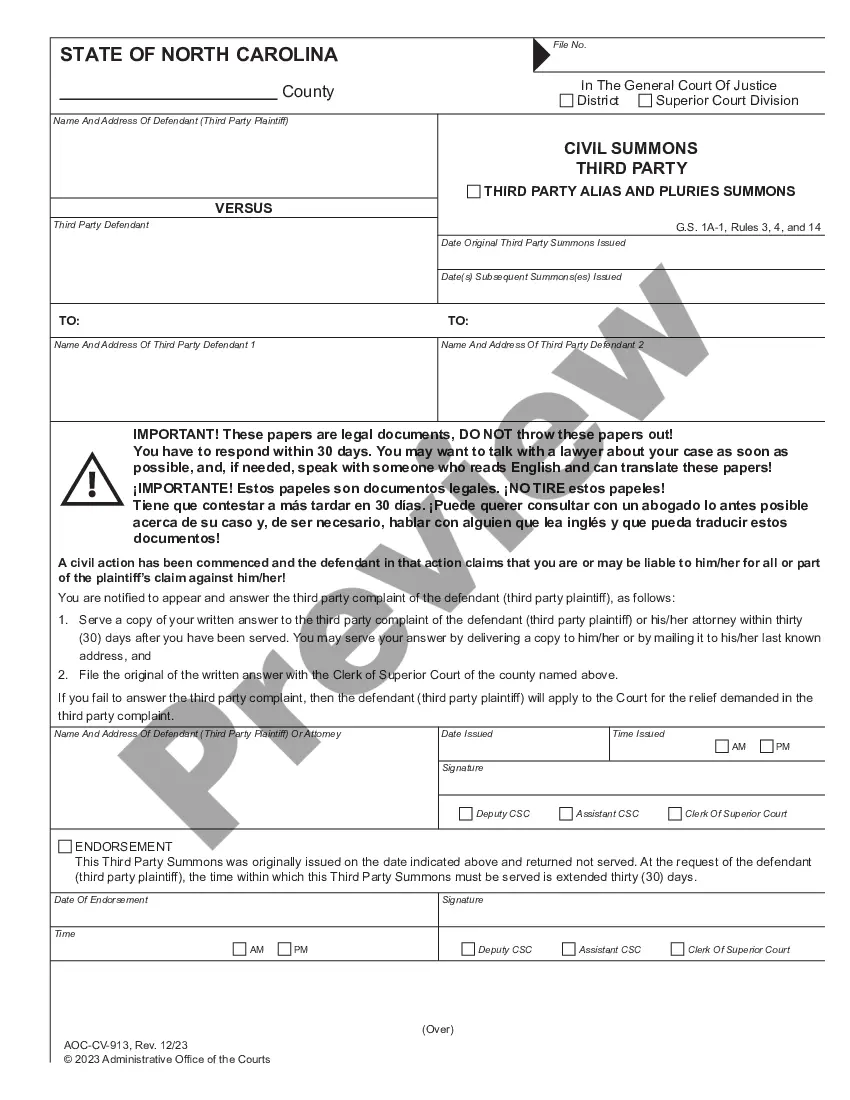

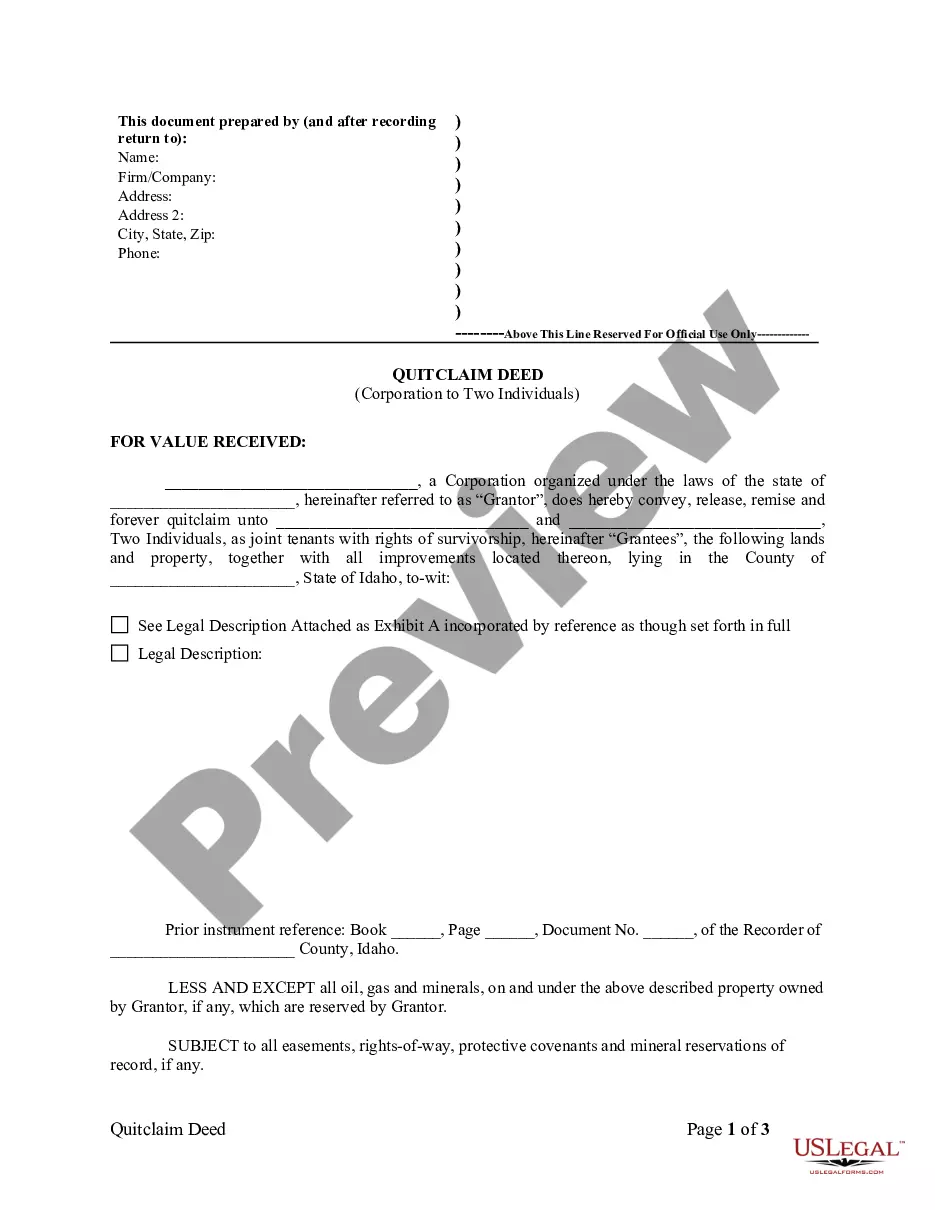

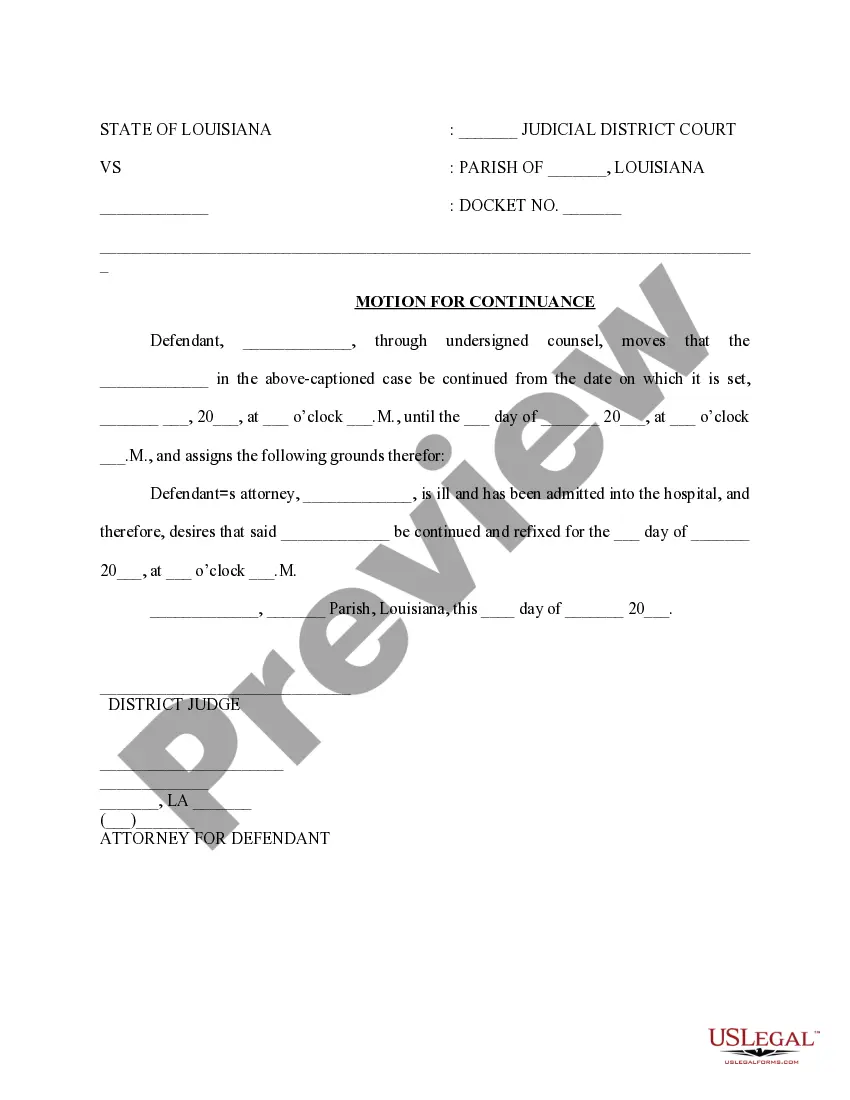

Follow the step-by-step recommendations listed below to download Vermont Certificate of Release of Tax Liens from our website:

- Read the document description and click Preview (if available) to check whether the template meets your expectations or not.

- If the document is not what you need, get others with the help of Search engine or the listed recommendations.

- If it is appropriate, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the document in a preferable format.

- After getting it, it is possible to fill it out, sign and print it.

Obtain access to 85,000 legal templates right from our US Legal Forms library. In addition to professionally drafted templates, users will also be supported with step-by-step guidelines concerning how to get, download, and fill out forms.

Form popularity

FAQ

When you pay off your full tax balance or when the IRS runs out of time to collect the balance, the IRS will automatically release your tax lien. This removes the lien from your property. If the lien isn't automatically released, you can write to the IRS to request the release certificate.

Paying your tax debt - in full - is the best way to get rid of a federal tax lien. The IRS releases your lien within 30 days after you have paid your tax debt. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist.

A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. Also called a lien, the warrant is a public record that allows the government to claim your personal property or assets to satisfy the unpaid taxes.

Tax liens, or outstanding debt you owe to the IRS, no longer appear on your credit reportsand that means they can't impact your credit scores.

A tax warrant is a document that the department uses to establish the debt of a taxpayer. When a tax warrant is filed with the Superior Court in the county where the taxpayer owns real or personal property, a lien is created.

Tax liens put your assets at risk. To remove them you'll need to work with the IRS to pay your back taxes.Tax liens (and their cousins, tax levies) are serious business if you owe back taxes.

Use Value Appraisal, or Current Use as it is commonly known, is a property tax incentive available to owners of agricultural and forestry land in Vermont. Eligible landowners can enroll in the program to have their land appraised at its Current Use (farming or forestry) value rather than fair market value.

A release occurs when the individual or company does not take action after receiving the NFTL. To obtain the money they are owed, the IRS will go forward with their intent to file and place a lien on your accounts or property.

A lien release is used to cancel a lien that has already been filed. Lien releases are also referred to as a release of lien, cancellation of lien, or a lien cancellation. These are typically used to cancel the filed claim from public records.