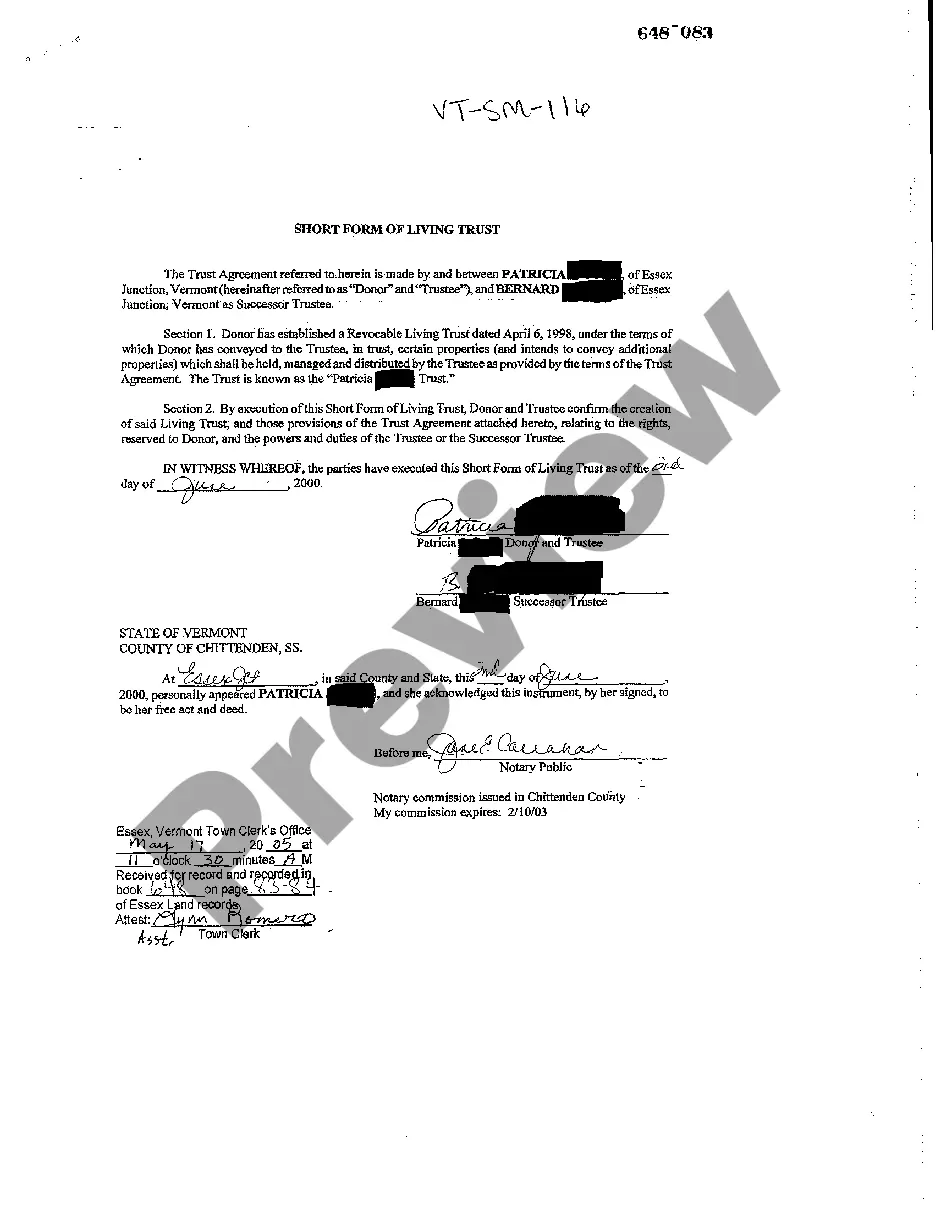

Vermont Short Form of Living Trust

Description Vermont Short Form

How to fill out Vermont Short Form Of Living Trust?

Looking for a Vermont Short Form of Living Trust online might be stressful. All too often, you find papers which you believe are alright to use, but discover later they are not. US Legal Forms offers over 85,000 state-specific legal and tax documents drafted by professional lawyers according to state requirements. Get any document you are searching for within minutes, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will instantly be added in to the My Forms section. In case you don’t have an account, you need to sign up and choose a subscription plan first.

Follow the step-by-step guidelines listed below to download Vermont Short Form of Living Trust from the website:

- See the form description and press Preview (if available) to verify whether the template meets your requirements or not.

- If the form is not what you need, find others with the help of Search engine or the listed recommendations.

- If it is appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the document in a preferable format.

- After getting it, it is possible to fill it out, sign and print it.

Obtain access to 85,000 legal templates straight from our US Legal Forms library. Besides professionally drafted samples, users may also be supported with step-by-step guidelines regarding how to get, download, and complete forms.

Form popularity

FAQ

A deed of trust (DOT), also known as a trust deed, is a document that conveys title to real property to a trustee as security for a loan until the grantor (borrower) repays the lender according to terms defined in an attached promissory note.

A complex trust is any trust that does not meet the requirements for a simple trust.Assets in a revocable trust are included in the grantor's gross estate for federal estate tax purposes. Revocable trusts also called living trusts, are one of the more frequently misunderstood trust concepts.

A living trust, also known as an inter vivos trust, is different from a testamentary trust, which is created by will and does not take effect until the death of the settlor.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

A living trust, also known as a revocable living trust or a revocable trust, is a legal document that establishes a trust for any assets you wish to transfer into it.

Sure you can write your own revocable living trust.The discussion of your need for a revocable living trust is in another of my articles, but it is safe to say that if you own real property and have a significant estate (over about $50,000), then you could use a trust and it would help your loved ones.

A living trust is an important part of your estate plan. Most people can create a living trust without an attorney using software or an online service.

You should still have a durable power of attorney for finances.You may even want to empower your attorney-in-fact to transfer into your living trust any property that becomes yours after you become incapacitated. Only a durable power of attorney for finances can grant that authority.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.