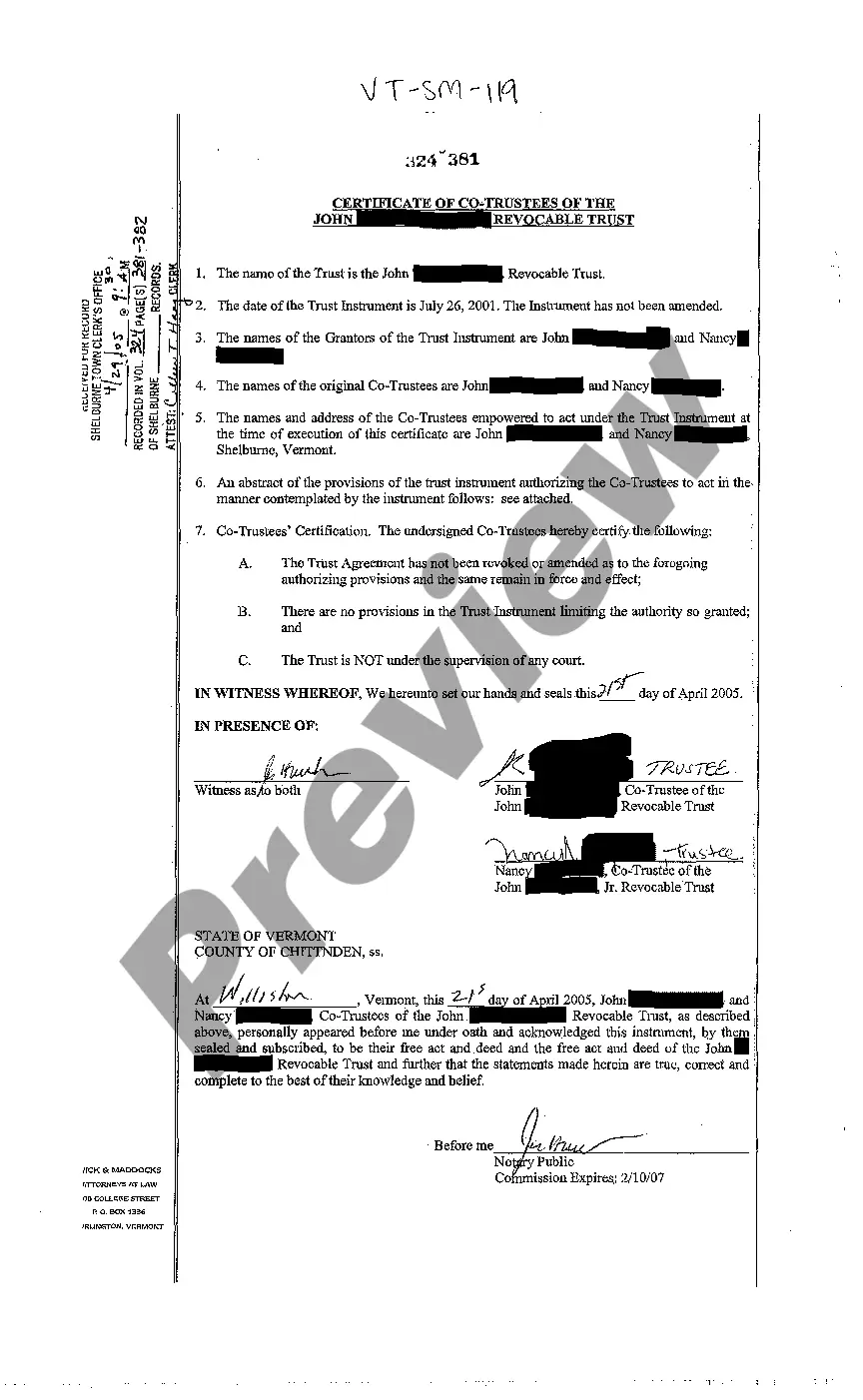

Vermont Certificate of Co-Trustees of Revocable Trust

Description

How to fill out Vermont Certificate Of Co-Trustees Of Revocable Trust?

Searching for a Vermont Certificate of Co-Trustees of Revocable Trust online might be stressful. All too often, you see files that you believe are ok to use, but discover afterwards they’re not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional legal professionals in accordance with state requirements. Have any document you are searching for quickly, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll automatically be added to your My Forms section. If you do not have an account, you should sign-up and pick a subscription plan first.

Follow the step-by-step instructions below to download Vermont Certificate of Co-Trustees of Revocable Trust from the website:

- See the document description and press Preview (if available) to check whether the template suits your expectations or not.

- In case the form is not what you need, find others using the Search engine or the provided recommendations.

- If it’s right, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the template in a preferable format.

- After downloading it, you are able to fill it out, sign and print it.

Obtain access to 85,000 legal templates from our US Legal Forms catalogue. In addition to professionally drafted templates, customers will also be supported with step-by-step guidelines regarding how to get, download, and complete forms.

Form popularity

FAQ

A certification of trust (or "trust certificate") is a short document signed by the trustee that simply states the trust's essential terms and certifies the trust's authority without revealing private details of the trust that aren't relevant to the pending transaction.

When a grantor establishes a trust, a single trustee manages the trust's assets on behalf of the named beneficiaries. However, there is no requirement for a trust to have only one trustee. When a grantor names multiple trustees, or co-trustees, they are responsible for co-managing the trust's assets.

The default rule in California is that co-trustees must act unanimously. In California, unlike most states, co-trustees must make administration decisions by unanimous consent.

It depends on the terms of the trust. If the trust designates that the trustees are to act together, and not independently, then yes, a signature by both trustees are required in order to transfer property out of the trust.

A trust is a legal document that governs how the grantor's assets pass to the named beneficiaries upon the grantor's death.However, there is no requirement for a trust to have only one trustee. When a grantor names multiple trustees, or co-trustees, they are responsible for co-managing the trust's assets.

To be legally valid, every living trust must have a trustee -- someone to manage the property held in trust. When you create a shared revocable living trust, both grantors are the trustees while you are alive. You'll name someone else to be the successor trustee, to take over after both of you have died.

While there's no limit to how many trustees one trust can have, it might be beneficial to keep the number low. Here are a few reasons why: Potential disagreements among trustees. The more trustees you name, the greater the chance they'll have different ideas about how your trust should be managed.

The person who makes decisions about the money or property in the revocable living trust is called the trustee.If there is more than one, they are co-trustees. A successor trustee may also be named and acts only if a trustee can no longer fulfill that role.

Certification of trustee is when the holder of the trust determines who has the power to move assets around within a trust. It also gives the trustee the power to sell or bequeath assets to other parties.