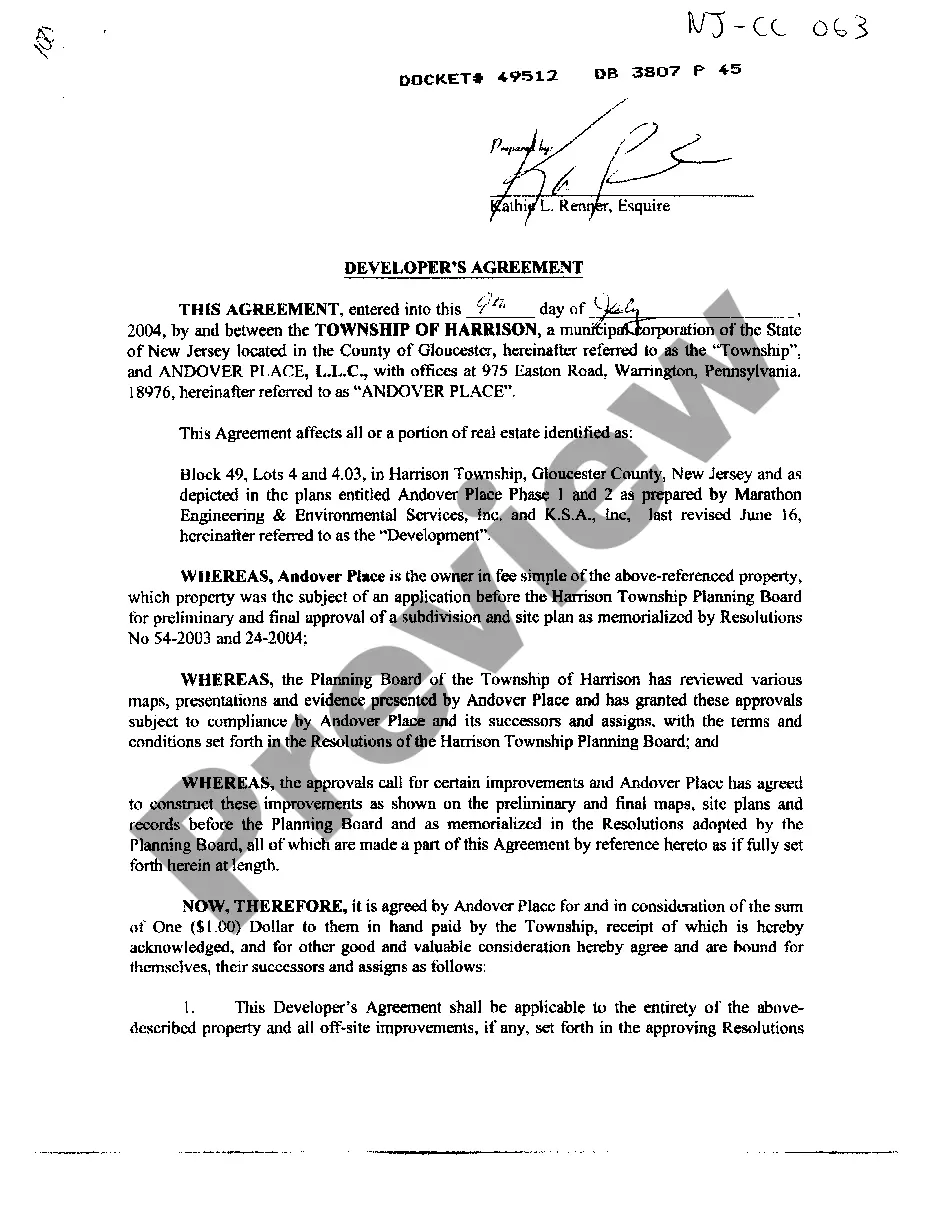

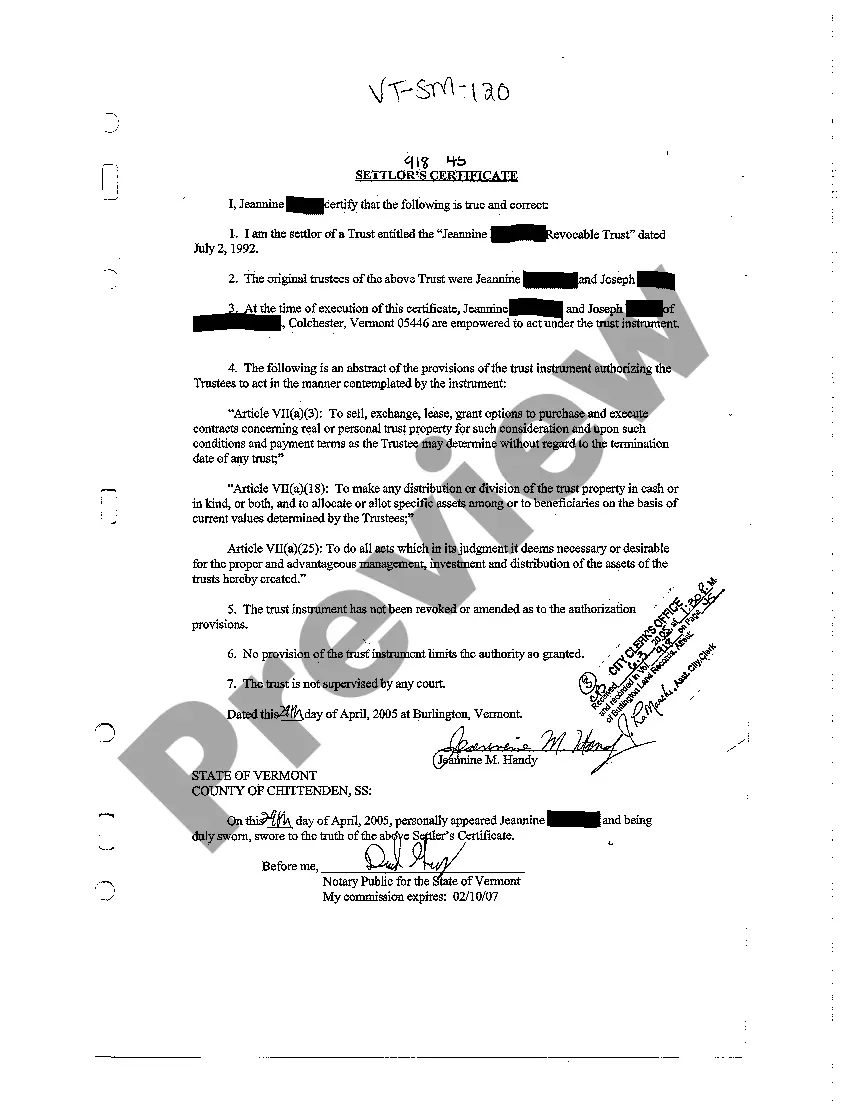

Vermont Settler's Certificate Identifying Settler of Revocable Trust

Description

How to fill out Vermont Settler's Certificate Identifying Settler Of Revocable Trust?

Looking for a Vermont Settler's Certificate Identifying Settler of Revocable Trust online can be stressful. All too often, you find papers which you believe are fine to use, but find out afterwards they’re not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional legal professionals according to state requirements. Have any form you are searching for within minutes, hassle free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll immediately be added to your My Forms section. In case you do not have an account, you should sign up and select a subscription plan first.

Follow the step-by-step instructions below to download Vermont Settler's Certificate Identifying Settler of Revocable Trust from the website:

- Read the form description and hit Preview (if available) to check if the template meets your requirements or not.

- In case the form is not what you need, get others with the help of Search engine or the provided recommendations.

- If it is appropriate, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the document in a preferable format.

- After getting it, it is possible to fill it out, sign and print it.

Obtain access to 85,000 legal forms straight from our US Legal Forms library. Besides professionally drafted samples, customers will also be supported with step-by-step guidelines regarding how to get, download, and fill out forms.

Form popularity

FAQ

In summary, the rule of thumb stating "never have the settlor serve as a trustee of an irrevocable trust" is a wise rule of thumb.

A settlor may be a beneficiary of a trust but cannot be the sole beneficiary, otherwise there would be no purpose to having the trust in the first place.

As stated, an irrevocable trust is usually for legal protection, tax reduction and estate planning.Settlors can still earn a return on the investments on trust assets. In some jurisdictions, the settlor can still be the beneficiary of the trust and receive the benefits of and income from the trust.

Trusts have 4 components: settlor, trustee, beneficiaries, and property. The settlor (aka grantor, trustor) creates the trust. The trustee manages the trust, and the beneficiaries receive the benefit of the trust.Often, the settlor and the trustee is the same person, and sometimes that person is also the beneficiary!

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.

A revocable trust becomes irrevocable at the death of the person that created the trust.The Trust becomes its own entity and needs a tax identification number for filing of returns. 2. The Grantor (also called the Trustor) of the Trust becomes incapacitated.

A settlor may be a beneficiary of a trust but cannot be the sole beneficiary, otherwise there would be no purpose to having the trust in the first place.

Irrevocable trusts offer lifetime giving to beneficiaries. While requiring some loss of grantor control, a properly drafted irrevocable living trust should allow individuals of substantial wealth to begin transferring assets to beneficiaries during their lifetime without incurring gift or estate tax.

There is nothing that says that couple must use a joint revocable trust.When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse. The surviving spouse is the trustee over both trusts.