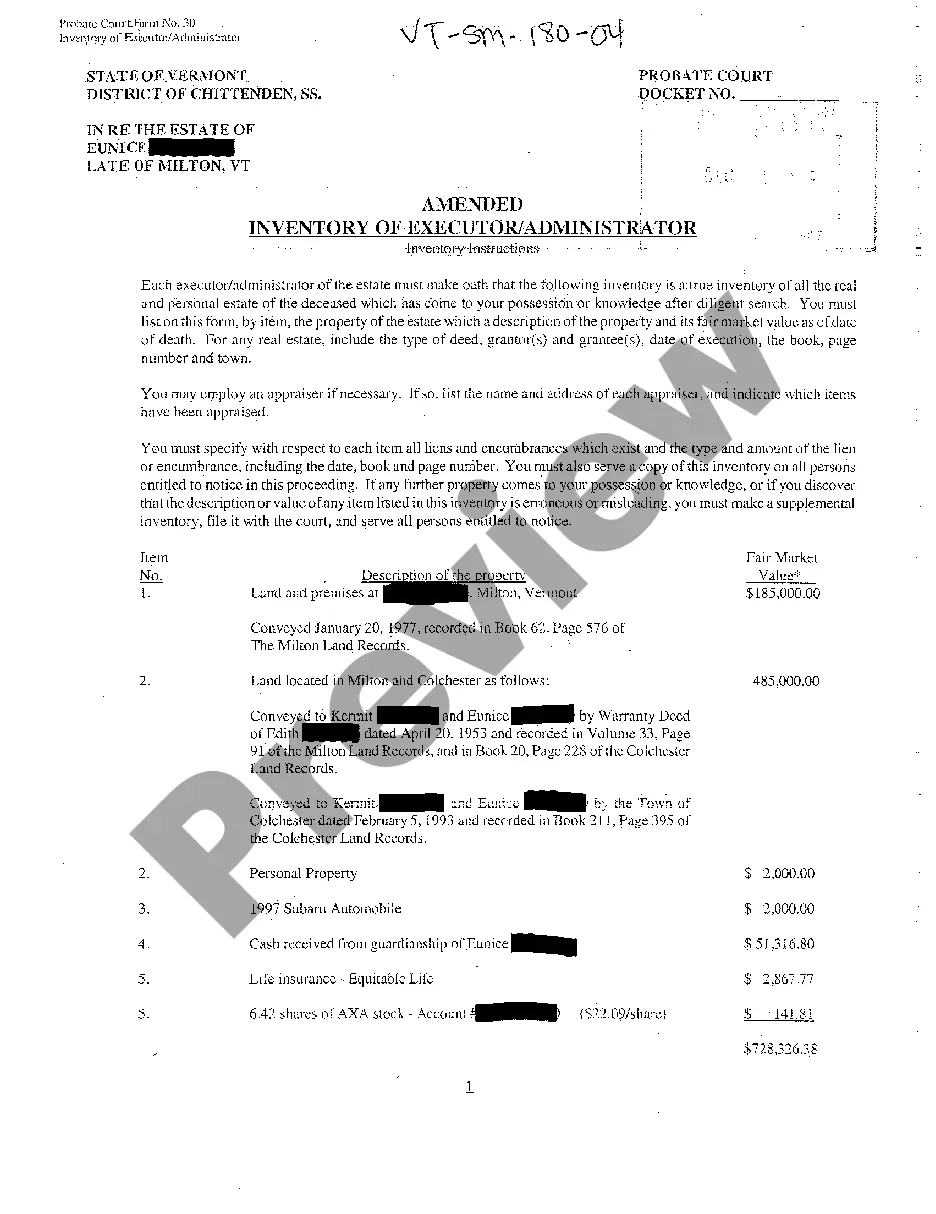

Vermont Amended Inventory of Executor Administrator

Description

How to fill out Vermont Amended Inventory Of Executor Administrator?

Searching for a Vermont Amended Inventory of Executor Administrator online might be stressful. All too often, you find files that you believe are ok to use, but find out later they’re not. US Legal Forms provides more than 85,000 state-specific legal and tax documents drafted by professional lawyers according to state requirements. Have any form you’re searching for in minutes, hassle free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll automatically be added in your My Forms section. In case you do not have an account, you must sign up and pick a subscription plan first.

Follow the step-by-step guidelines below to download Vermont Amended Inventory of Executor Administrator from the website:

- See the form description and click Preview (if available) to verify whether the form meets your expectations or not.

- If the form is not what you need, get others with the help of Search field or the listed recommendations.

- If it is right, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay via card or PayPal and download the template in a preferable format.

- After getting it, you may fill it out, sign and print it.

Obtain access to 85,000 legal templates straight from our US Legal Forms catalogue. Besides professionally drafted samples, users can also be supported with step-by-step guidelines concerning how to find, download, and fill out forms.

Form popularity

FAQ

Paying any debts and liabilities of the estate, owing prior to death; defending the Will of the deceased if litigation is started against the deceased's estate; attending to tax returns for the deceased and their estate; distributing the estate in accordance with the deceased's Will.

ANSWER: No one should remove items from a home of a person who has died until the executor or administrator of the estate gives approval.The executor also must account for the decedent's interest in real property, which includes things like land, commercial buildings, and homes.

Duties and Responsibilities After debts, taxes, and expenses are paid, the remaining assets are distributed to the decedent's beneficiaries.It is the executor's or the administrator's responsibility to collect and distribute the assets and to pay any death taxes and expenses of the decedent.

Can the administrator-child withdraw cash from the estate and say that he is just withdrawing his own cash? The answer to that is absolutely not. Even though the administrator is one of the beneficiaries of the estate account, at the end of the day the account is not his. The estate belongs to all the beneficiaries.

An administrator will take title legally on the estate's assets, and has legal responsibility to file all tax returns and pay all related taxes.In certain cases, the administrator may have personal liability for any unpaid tax amounts due for the estate.

The executor can sell property without getting all of the beneficiaries to approve.The administrator will come in with a buyer and a contract and if someone else in court wants to pay more for the property than that contract price then the judge will allow that.

As an Executor, what you cannot do is go against the terms of the Will, Breach Fiduciary duty, fail to act, self-deal, embezzle, intentionally or unintentionally through neglect harm the estate, and cannot do threats to beneficiaries and heirs.

There should be absolutely no legal issue with your selling the items prior to the grant of probate having been issued (provided the Will is valid and you are the executor).

An executor is a person named in a Will whom the deceased person appointed to administer their estate.An administrator is the person appointed by the court to administer the deceased person's estate where the deceased did not have a Will, no executor is appointed, or the appointed executors do not or cannot act.