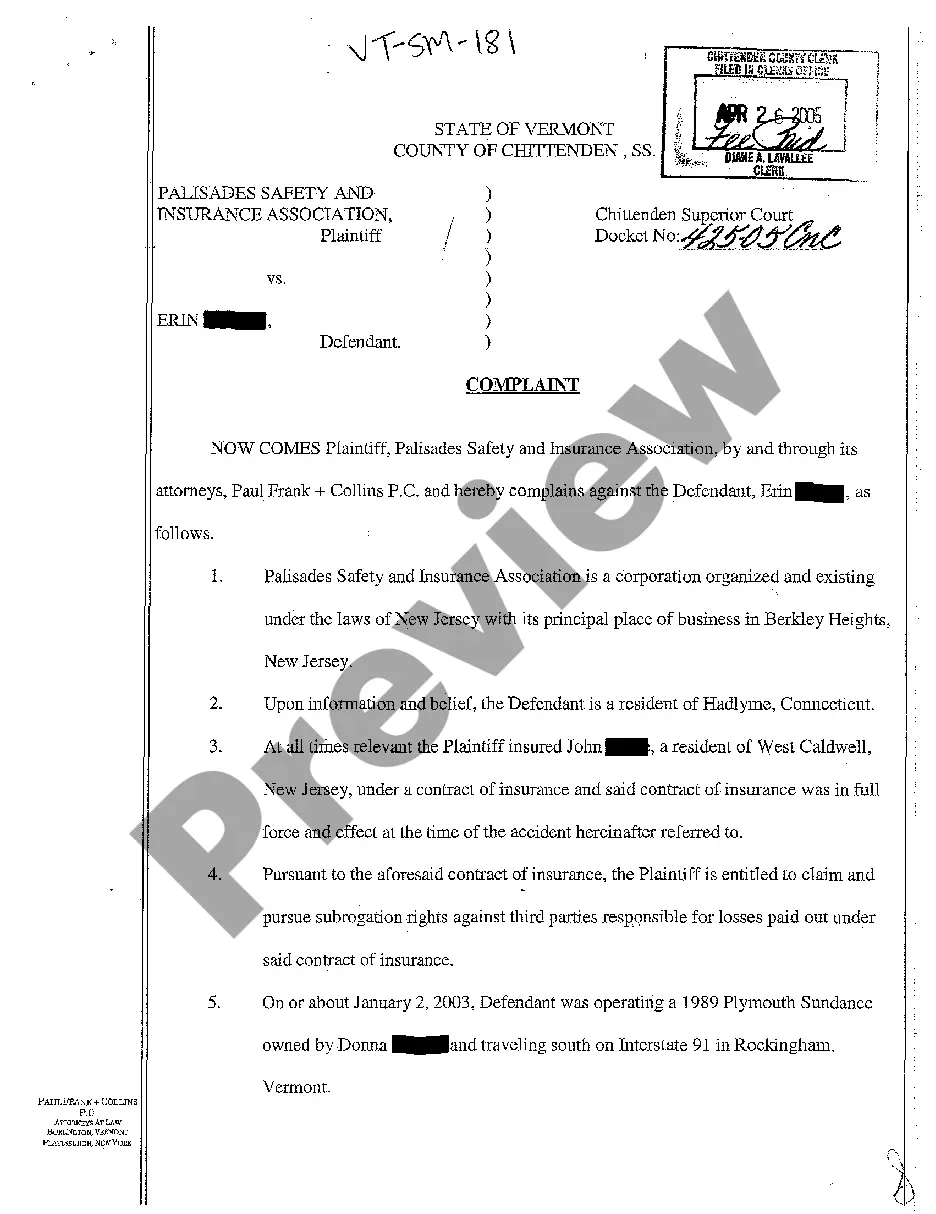

Vermont Complaint by Insurer for Personal Injuries to Subrogee Due to Negligent Operation of Motor Vehicle

Description

How to fill out Vermont Complaint By Insurer For Personal Injuries To Subrogee Due To Negligent Operation Of Motor Vehicle?

Searching for a Vermont Complaint by Insurer for Personal Injuries to Subrogee Due to Negligent Operation of Motor Vehicle on the internet can be stressful. All too often, you see files that you simply think are fine to use, but find out later on they’re not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional lawyers in accordance with state requirements. Get any document you are looking for within a few minutes, hassle free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will automatically be added in in your My Forms section. If you don’t have an account, you have to register and select a subscription plan first.

Follow the step-by-step guidelines listed below to download Vermont Complaint by Insurer for Personal Injuries to Subrogee Due to Negligent Operation of Motor Vehicle from our website:

- See the form description and hit Preview (if available) to check whether the template suits your expectations or not.

- In case the document is not what you need, find others with the help of Search field or the listed recommendations.

- If it’s right, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the template in a preferable format.

- Right after downloading it, it is possible to fill it out, sign and print it.

Obtain access to 85,000 legal forms straight from our US Legal Forms library. Besides professionally drafted samples, customers are also supported with step-by-step guidelines regarding how to get, download, and complete forms.

Form popularity

FAQ

Subrogation adjusters send letters to those who appear to be responsible for reimbursing the insurance company.If the recipient ignores the letter, the insurer may continue to mail requests for reimbursement or may choose to file a lawsuit against the responsible party.

Simply put, subrogation protects you and your insurer from paying for losses that aren't your fault.It lets your insurer pursue the person at fault to recover the money paid out for a claim that wasn't your fault. Here's an example of how auto subrogation works: You get rear-ended and the other driver is at fault.

An intervention for workers' compensation subrogation must be filed within thirty (30) days of the carrier having notice of a third-party complaint being filed, or it can recover nothing.

What is subrogation? Subrogation insurance is when your insurance company, after paying a loss, inherits your right to recoup its payment from another party, if that party is also partially responsible for the loss.

If an insurance company has the right to seek subrogation pay, it will have three years from the date of the accident to file a claim, in most cases. As a victim, you and your Orange County personal injury lawyer can negotiate subrogation to ensure you receive your fair share.

An insurer has no right to subrogation against its own insured for losses or liability for which the insured is covered under the policy.

John's insurance company decides to recover the amount of the claim from Sam, as he caused the damages. In such a case, John's insurance company can use the subrogation doctrine to recover its losses. The insurer can sue Sam to recover its losses while representing the interests of John in the court.

Subrogation is a term describing a right held by most insurance carriers to legally pursue a third party that caused an insurance loss to the insured. This is done in order to recover the amount of the claim paid by the insurance carrier to the insured for the loss.

Subrogation by contract commonly arises in contracts of insurance. The doctrine of subrogation confers upon the insurer the right to receive the benefit of such rights and remedies as the assured has against third parties in regard to the loss to the extent that the insurer has indemnified the loss and made it good.