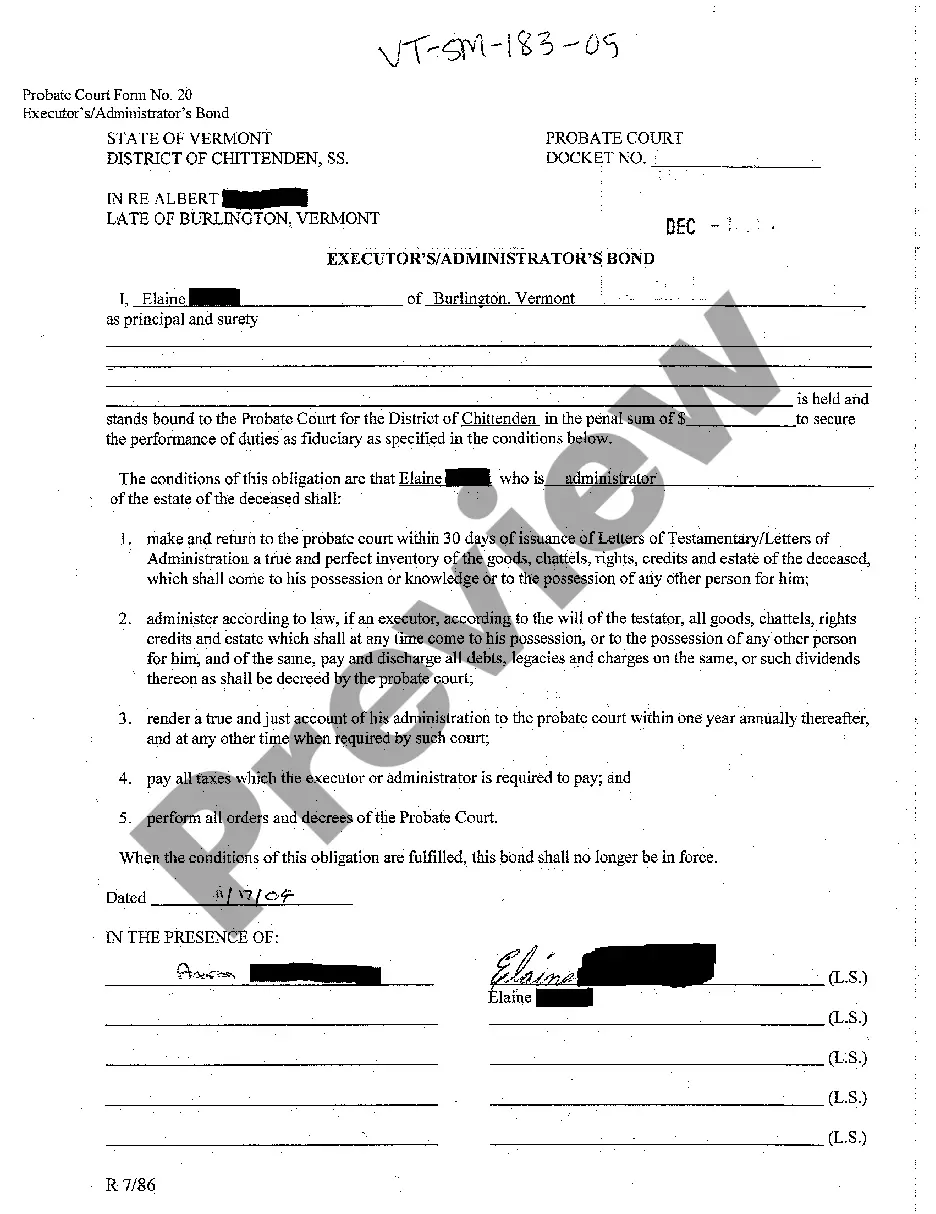

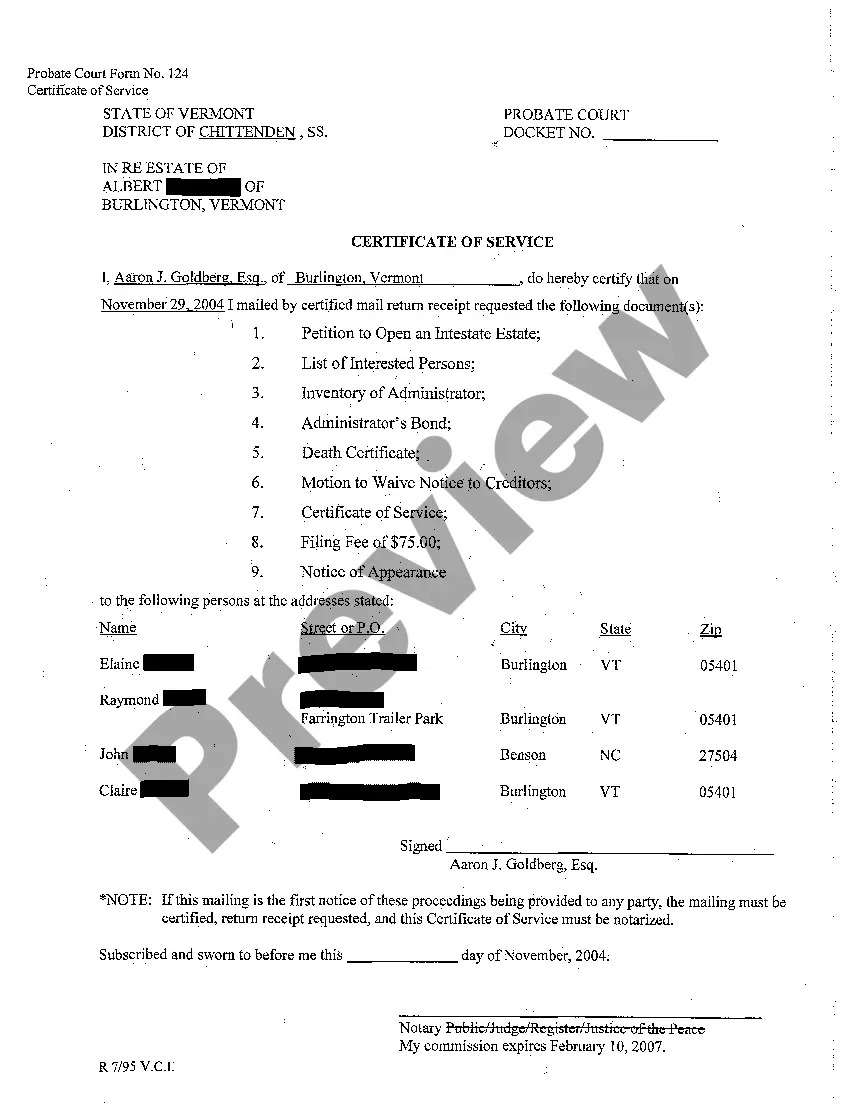

Vermont Executor's Administrator's Bond

Description

How to fill out Vermont Executor's Administrator's Bond?

Searching for a Vermont Executor's Administrator's Bond online can be stressful. All too often, you find documents that you simply believe are ok to use, but discover afterwards they are not. US Legal Forms offers over 85,000 state-specific legal and tax forms drafted by professional legal professionals in accordance with state requirements. Get any form you’re looking for quickly, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll instantly be added in to the My Forms section. In case you do not have an account, you have to sign-up and choose a subscription plan first.

Follow the step-by-step instructions below to download Vermont Executor's Administrator's Bond from the website:

- See the document description and click Preview (if available) to check if the template meets your expectations or not.

- In case the document is not what you need, find others using the Search field or the listed recommendations.

- If it’s right, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the document in a preferable format.

- After downloading it, it is possible to fill it out, sign and print it.

Get access to 85,000 legal forms right from our US Legal Forms catalogue. Besides professionally drafted templates, users may also be supported with step-by-step guidelines on how to get, download, and complete templates.

Form popularity

FAQ

An administration bond is a bond that is posted on behalf of an administrator of an estate to provide assurance that they will conduct their duties according to the provisions of the will and/or the legal requirements of the jurisdiction.

The Executor is responsible for wrapping up the deceased person's affairs and distributing the assets to, or for the benefit of, the persons named in the will (beneficiaries). An Administrator is the person in charge of the estate when my someone dies without a Last Will and Testament.

The laws in most areas simply stipulate that the fees must be fair and reasonable . Alberta estate law differs in this respect. Executors in this province are expected to keep their fees between 1 and 5 percent of the total value of the estate.

An Executor Bond is a type of surety bond that guarantees the Executor will administer the estate according to law. An Executor Bond gives beneficiaries peace of mind, reassuring them that even if the Executor somehow loses or mishandles the estate's assets, the bond will protect them and they will be compensated.

Under California Probate Code, the executor typically receives 4% on the first $100,000, 3% on the next $100,000 and 2% on the next $800,000, says William Sweeney, a California-based probate attorney. For an estate worth $600,000 the fee works out at approximately $15,000.

As an aside, Vermont Statute Title 32 § 1143 states that executors may be paid $4 per day spent in court, but this is geared towards the court paying appointed agents, and that amount was set in 1866.

State law typically provides for payment of the executor. By Mary Randolph, J.D. Most executors are entitled to payment for their work, either by the terms of the will or under state law.

Typically, the probate court will find executor compensation reasonable if it is in line with what people have received in the past as compensation in that area. For example, if in the last year, executor fees were typically 1.5%, then 1.5% would be considered reasonable and 3% may be unreasonable.

An executor (male) or executrix (female) is the person named in a will to perform these duties. An administrator (male) or administratrix (female) is the person appointed by the probate court to complete these tasks when there is no will or no executor or executrix has been named in the will.