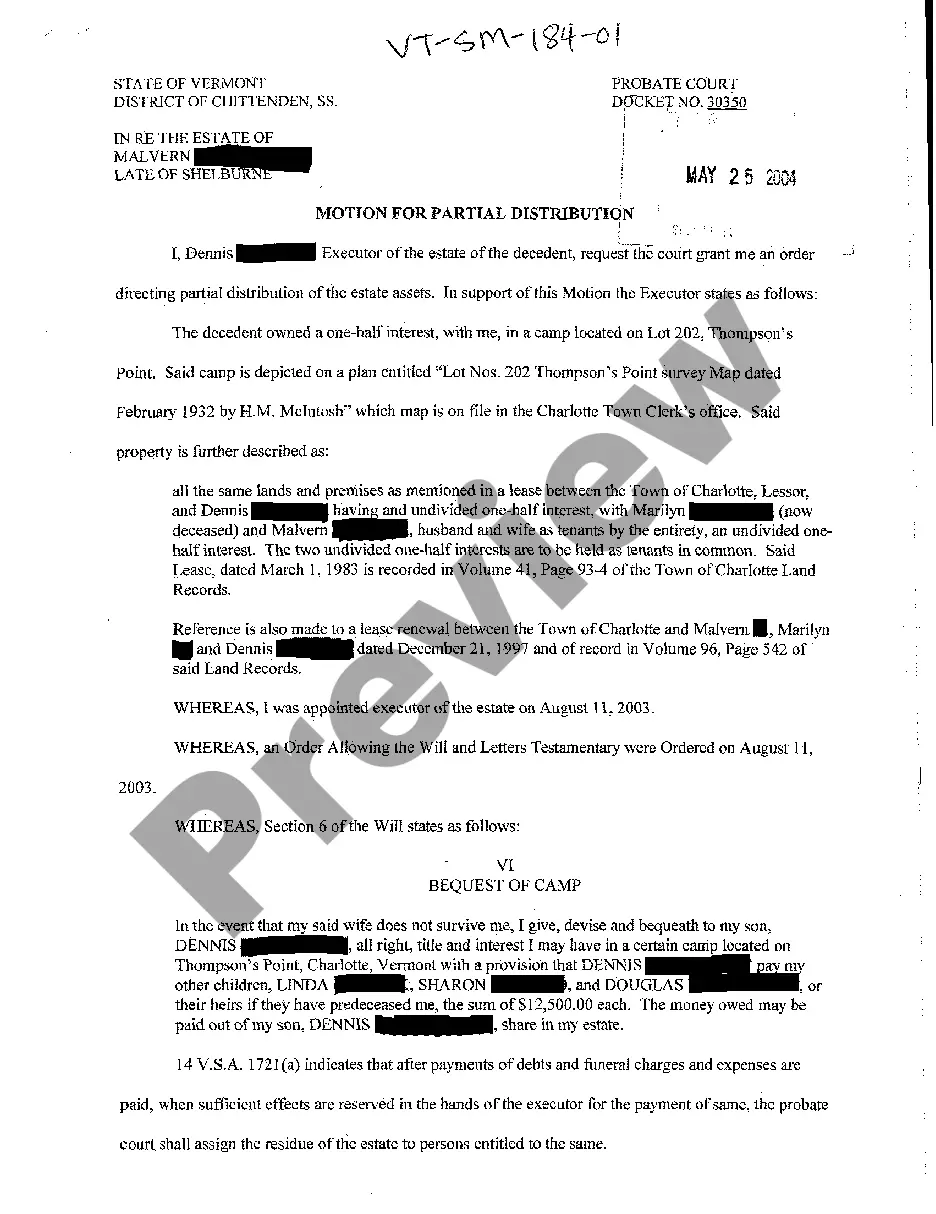

Vermont Motion for Partial Distribution of Estate Assets regarding Testate Estate

Description

How to fill out Vermont Motion For Partial Distribution Of Estate Assets Regarding Testate Estate?

Searching for a Vermont Motion for Partial Distribution of Estate Assets regarding Testate Estate online can be stressful. All too often, you find papers that you simply think are ok to use, but find out afterwards they’re not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional lawyers according to state requirements. Get any document you are looking for quickly, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll immediately be added to your My Forms section. If you don’t have an account, you have to sign-up and select a subscription plan first.

Follow the step-by-step instructions listed below to download Vermont Motion for Partial Distribution of Estate Assets regarding Testate Estate from our website:

- Read the form description and press Preview (if available) to check whether the form meets your expectations or not.

- In case the form is not what you need, get others using the Search engine or the listed recommendations.

- If it’s right, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the document in a preferable format.

- After getting it, you may fill it out, sign and print it.

Get access to 85,000 legal forms right from our US Legal Forms catalogue. Besides professionally drafted templates, users are also supported with step-by-step instructions regarding how to get, download, and fill out templates.

Form popularity

FAQ

Generally, beneficiaries have to wait a certain amount of time, say at least six months. That time is used to allow creditors to come forward and to pay them off with the estate assets. (In some cases, an executor may make partial distributions to the heirs after he or she estimates the debts.

Those requirements are: That the estate assets are distributed at least 6 months after the deceased's date of death; That the executor has published a 30 day notice of his/her intent to distribute the estate; and. That the time specified in the notice has expired.

A personal representative has the discretion to make a partial distribution of assets during the administration of the estate.Once final expenses have been made and the estate is ready to close, the personal representative can distribute the remaining assets to the beneficiaries.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

Divide up assets based on their value. Instruct your executor to divide assets equally. Instruct your executor to sell everything and then distribute the proceeds to your beneficiaries equally.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.

After someone dies, it can be a number of months before the assets are distributed to the beneficiaries. If a Grant of Probate is necessary, the Supreme Court needs to be informed of the current assets and liabilities of the deceased before probate can occur.

Life insurance or 401(k) accounts where a beneficiary was named.Assets under a Living Trust.Funds, securities, or US savings bonds that are registered on transfer on death (TOD) or payable on death (POD) forms.Funds held in a pension plan.Probate Assets - Do Household Items go through Probate Trust & Will\ntrustandwill.com > learn > probate-assets