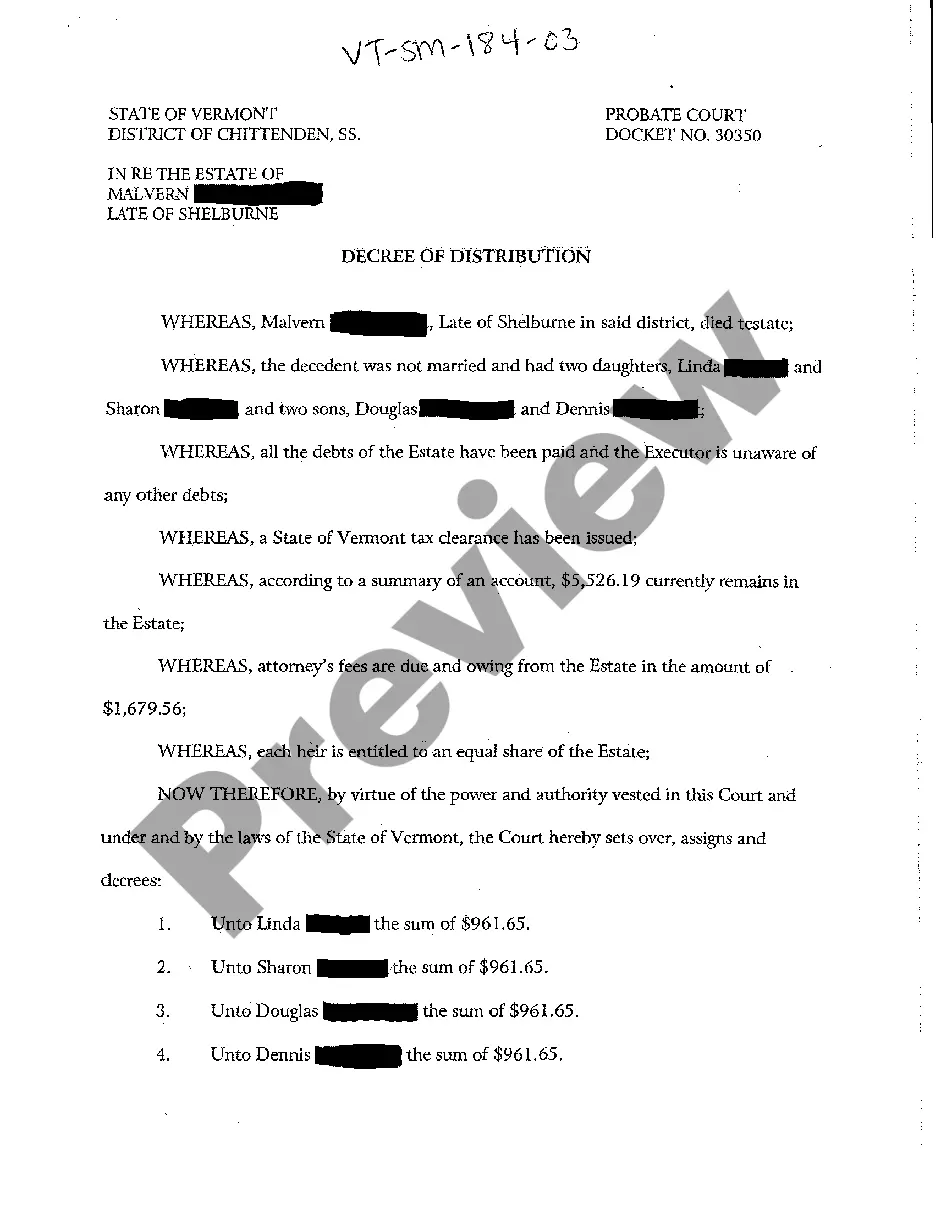

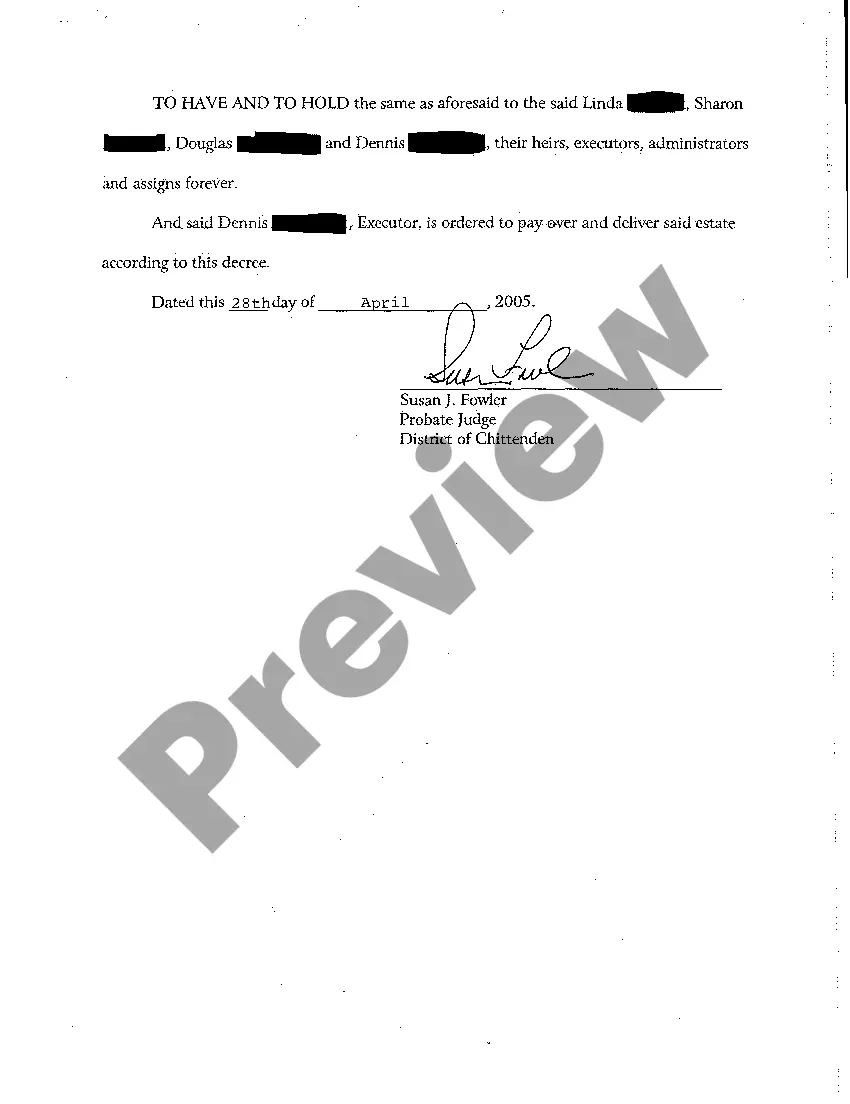

Vermont Decree of Distribution regarding Testate Estate

Description

How to fill out Vermont Decree Of Distribution Regarding Testate Estate?

Searching for a Vermont Decree of Distribution regarding Testate Estate online can be stressful. All too often, you find files that you just think are alright to use, but find out later they are not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional legal professionals in accordance with state requirements. Get any form you are looking for in minutes, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll instantly be added in to the My Forms section. In case you do not have an account, you should sign up and select a subscription plan first.

Follow the step-by-step instructions below to download Vermont Decree of Distribution regarding Testate Estate from the website:

- See the form description and hit Preview (if available) to verify if the form meets your expectations or not.

- In case the form is not what you need, find others using the Search engine or the listed recommendations.

- If it is right, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay via card or PayPal and download the document in a preferable format.

- Right after downloading it, it is possible to fill it out, sign and print it.

Get access to 85,000 legal templates straight from our US Legal Forms catalogue. In addition to professionally drafted samples, customers can also be supported with step-by-step instructions on how to find, download, and complete forms.

Form popularity

FAQ

Generally, beneficiaries have to wait a certain amount of time, say at least six months. That time is used to allow creditors to come forward and to pay them off with the estate assets. (In some cases, an executor may make partial distributions to the heirs after he or she estimates the debts.

Unfortunately, every estate is different, and that means timelines can vary. A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

After someone dies, it can be a number of months before the assets are distributed to the beneficiaries. If a Grant of Probate is necessary, the Supreme Court needs to be informed of the current assets and liabilities of the deceased before probate can occur.

Generally, beneficiaries have to wait a certain amount of time, say at least six months. That time is used to allow creditors to come forward and to pay them off with the estate assets. (In some cases, an executor may make partial distributions to the heirs after he or she estimates the debts.

A personal representative has the discretion to make a partial distribution of assets during the administration of the estate.Once final expenses have been made and the estate is ready to close, the personal representative can distribute the remaining assets to the beneficiaries.

After the Grant of Probate has been issued, our Probate Solicitors estimate that for a straightforward estate, it will take another 3 to 6 months before the funds can be distributed to the beneficiaries.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

Those requirements are: That the estate assets are distributed at least 6 months after the deceased's date of death; That the executor has published a 30 day notice of his/her intent to distribute the estate; and. That the time specified in the notice has expired.