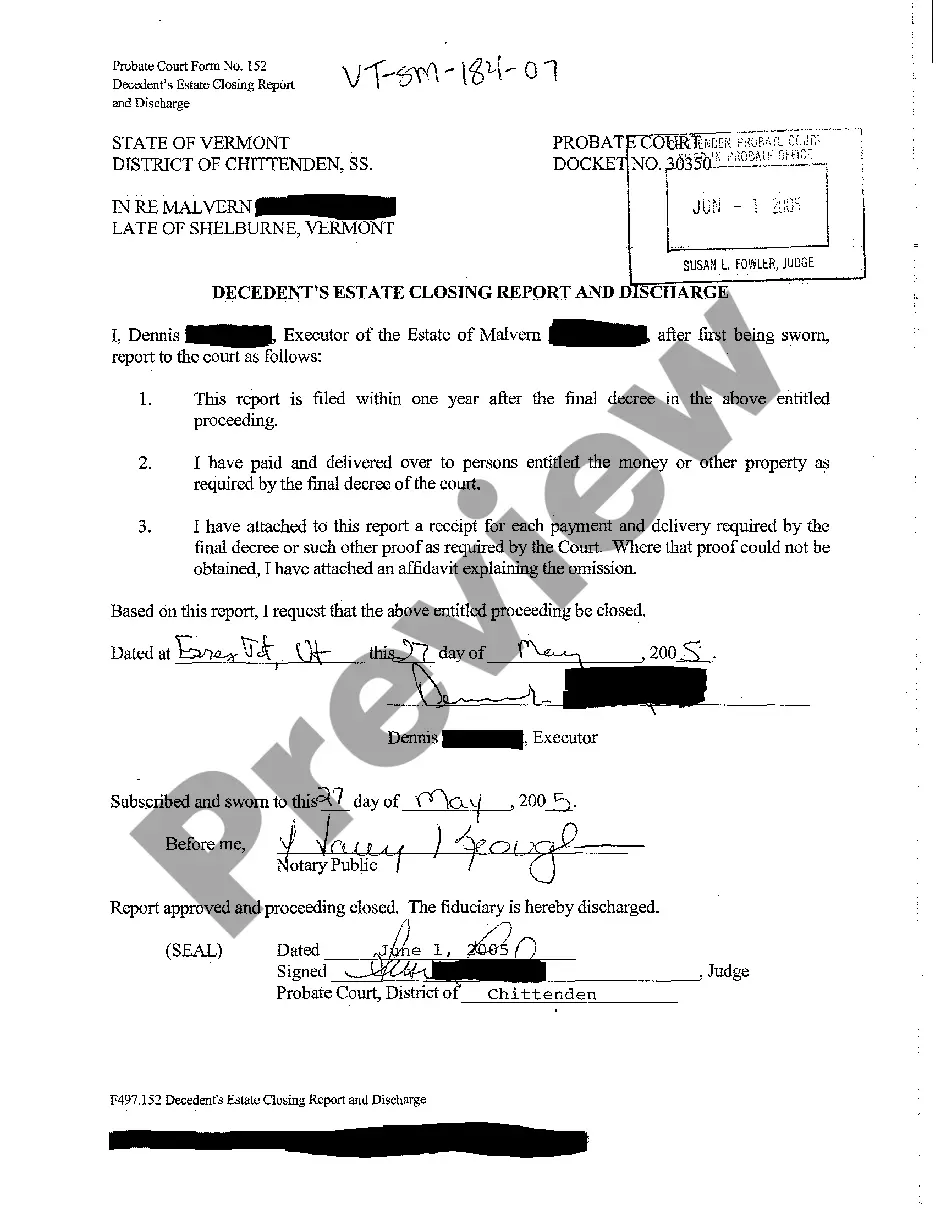

Vermont Decedent's Estate Closing Report and Discharge regarding Testate Estate

Description

How to fill out Vermont Decedent's Estate Closing Report And Discharge Regarding Testate Estate?

Searching for a Vermont Decedent's Estate Closing Report and Discharge regarding Testate Estate online can be stressful. All too often, you see files that you simply believe are fine to use, but discover later they are not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional lawyers in accordance with state requirements. Get any document you are searching for in minutes, hassle free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll automatically be included to the My Forms section. If you do not have an account, you need to register and choose a subscription plan first.

Follow the step-by-step instructions listed below to download Vermont Decedent's Estate Closing Report and Discharge regarding Testate Estate from our website:

- Read the document description and hit Preview (if available) to verify if the template suits your expectations or not.

- If the document is not what you need, get others with the help of Search field or the provided recommendations.

- If it’s appropriate, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the document in a preferable format.

- Right after getting it, you can fill it out, sign and print it.

Get access to 85,000 legal forms right from our US Legal Forms catalogue. Besides professionally drafted templates, users are also supported with step-by-step guidelines on how to find, download, and complete templates.

Form popularity

FAQ

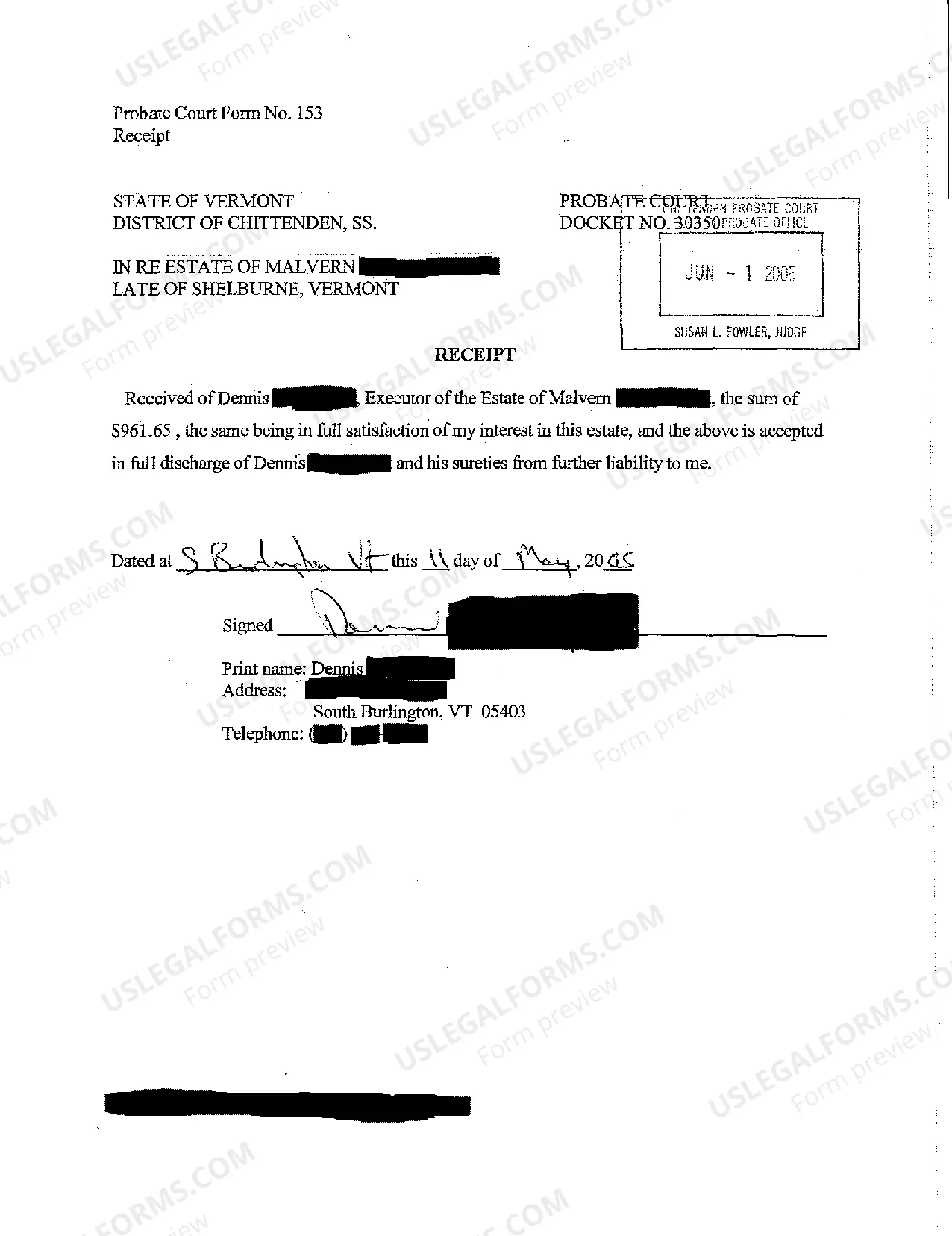

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

An executor acts until the estate administration is completed or if they resign, die or are removed for cause.

Generally, an executor has 12 months from the date of death to distribute the estate. This is known as 'the executor's year'. However, for various reasons the executor may have been delayed and has not distributed the estate within this time frame.

There is no requirement that a will or property go through probate, but if the decedent owned property that is not arranged specifically to avoid probate, there is no way for the beneficiaries to obtain legal ownership without it.

If an estate is not properly probated and closed in a timely manner, there may be a number of consequences that can jeopardize the estate: The statute of limitations for creditors' claims is extended. Assets may lose value or be lost altogether. The state may claim the assets.

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

The Executor's Final Act, Closing an Estate The personal representative, now without any estate funds to pay his lawyer, must respond. Even if the charges are baseless, the executor is stuck paying the legal bill. Instead, before making any distribution, the administrator should insist on receiving a release.