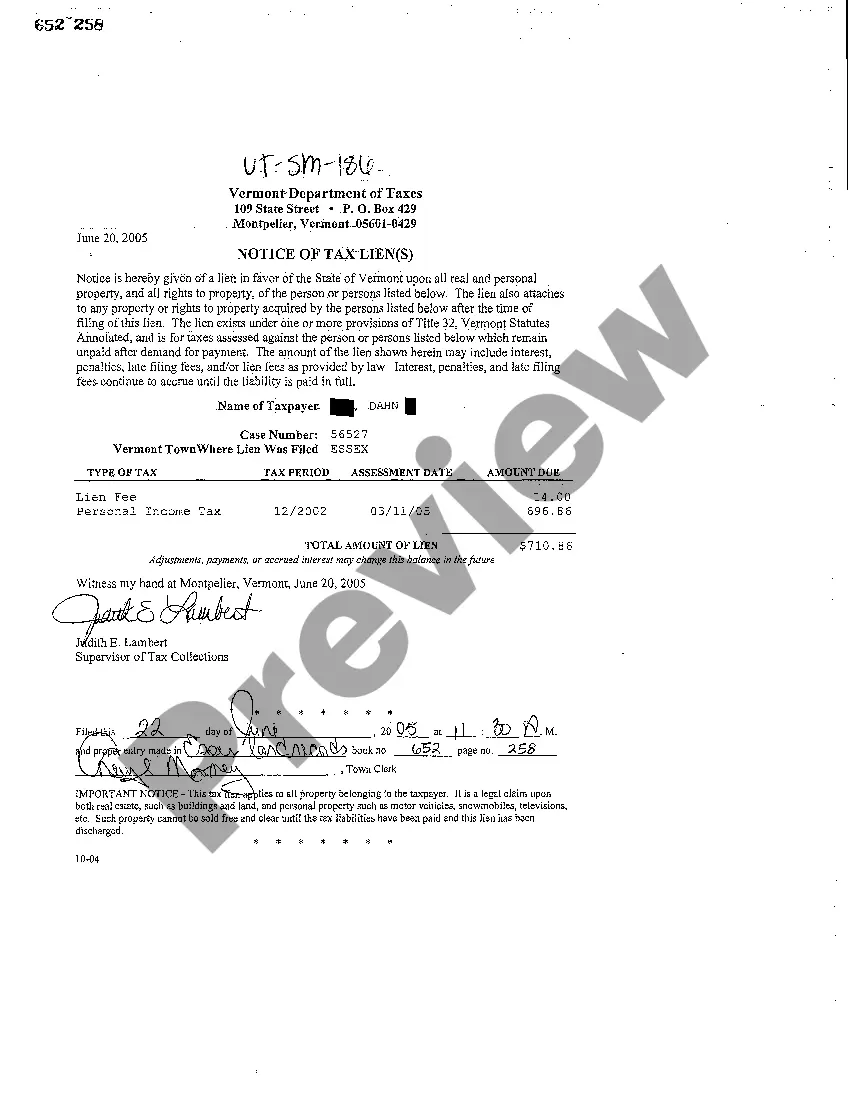

Vermont Notice of Tax Liens

Description

How to fill out Vermont Notice Of Tax Liens?

Looking for a Vermont Notice of Tax Liens on the internet can be stressful. All too often, you find papers which you believe are ok to use, but find out later they are not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional legal professionals according to state requirements. Have any form you’re searching for within a few minutes, hassle free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will automatically be included to your My Forms section. In case you do not have an account, you have to register and pick a subscription plan first.

Follow the step-by-step recommendations below to download Vermont Notice of Tax Liens from the website:

- Read the document description and click Preview (if available) to check if the form meets your requirements or not.

- In case the form is not what you need, find others using the Search engine or the provided recommendations.

- If it is right, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the document in a preferable format.

- After getting it, it is possible to fill it out, sign and print it.

Obtain access to 85,000 legal templates straight from our US Legal Forms catalogue. Besides professionally drafted templates, users will also be supported with step-by-step instructions on how to get, download, and fill out forms.

Form popularity

FAQ

If you don't contact us, we may take action to collect the taxes. We may file a Notice of Federal Tax Lien in the public record to notify your creditors of your tax debt.In certain situations, the IRS may withdraw a Notice of Federal Tax Lien even when you still owe the tax debt.

The Federal Tax Lien Statute of Limitations is 10 years. This means that the Internal Revenue Service has 10 years to collect unpaid tax debts from you. After the 10 years expires, the IRS will wipe your tax debt clean and stop making attempts to collect the tax debts from you.

In general, the Internal Revenue Service (IRS) has 10 years to collect unpaid tax debt. After that, the debt is wiped clean from its books and the IRS writes it off. This is called the 10 Year Statute of Limitations.

Information About Bank Levies If the IRS levies your bank, funds in the account are held and after 21 days sent to the IRS.

We may file a Notice of Federal Tax Lien in the public record to notify your creditors of your tax debt.The federal tax lien arises automatically when the IRS sends the first notice demanding payment of the tax debt assessed against you and you fail to pay the amount in full.

An IRS tax lien lasts for 10 years, or until the statute of limitations on your tax debt expires.

Contrary to popular belief, the IRS does not have to record an NFTL before it can levy bank accounts or receivables. Once the Final Notice has been issued and 30 days have passed, the IRS can levy bank accounts and/or accounts receivable. The IRS does not perform a lien search prior to issuing a levy.

IRS live phone assistance is extremely limited at this time. For Economic Impact Payment questions, call 800-919-9835.

Centralized Lien Operation To resolve basic and routine lien issues: verify a lien, request lien payoff amount, or release a lien, call 800-913-6050 or e-fax 855-390-3530.