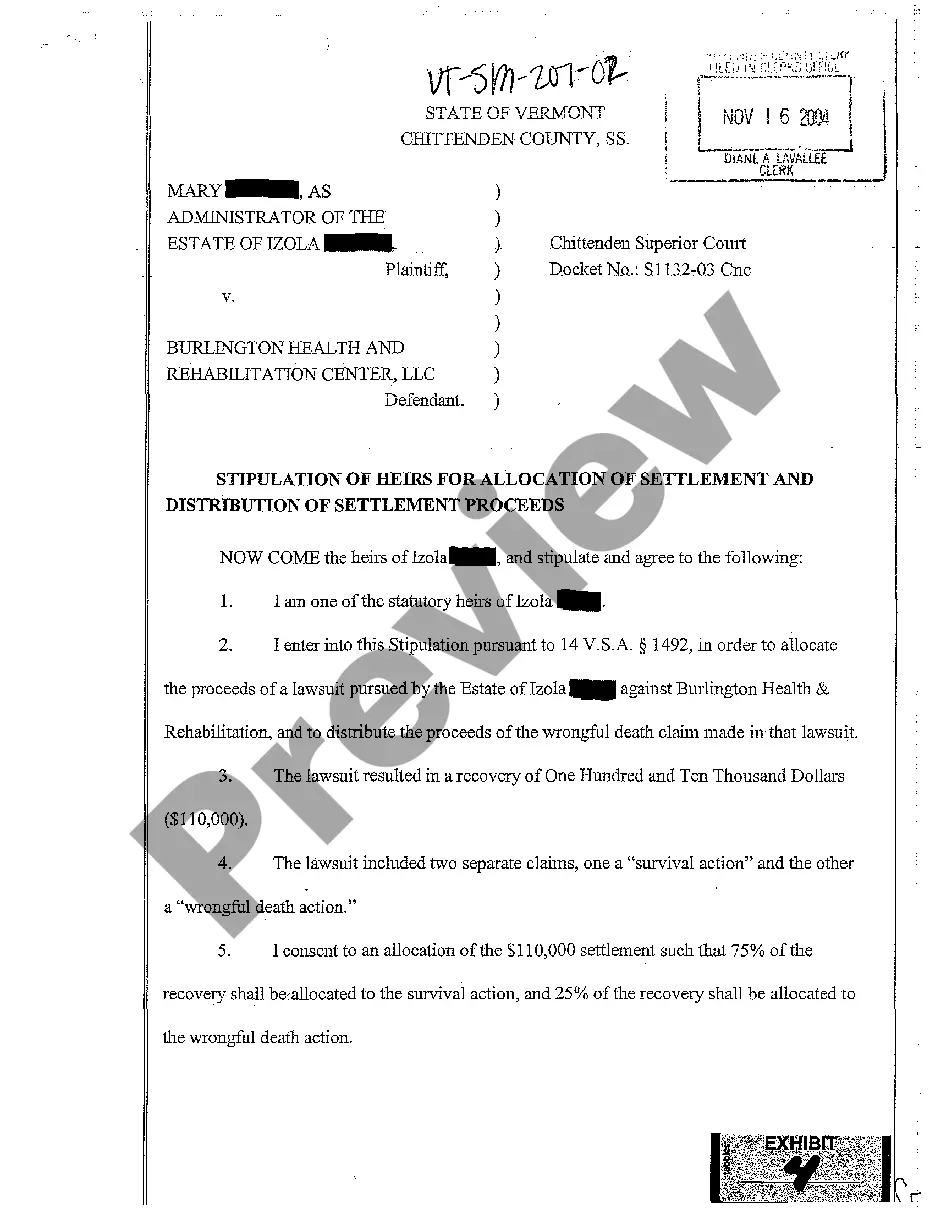

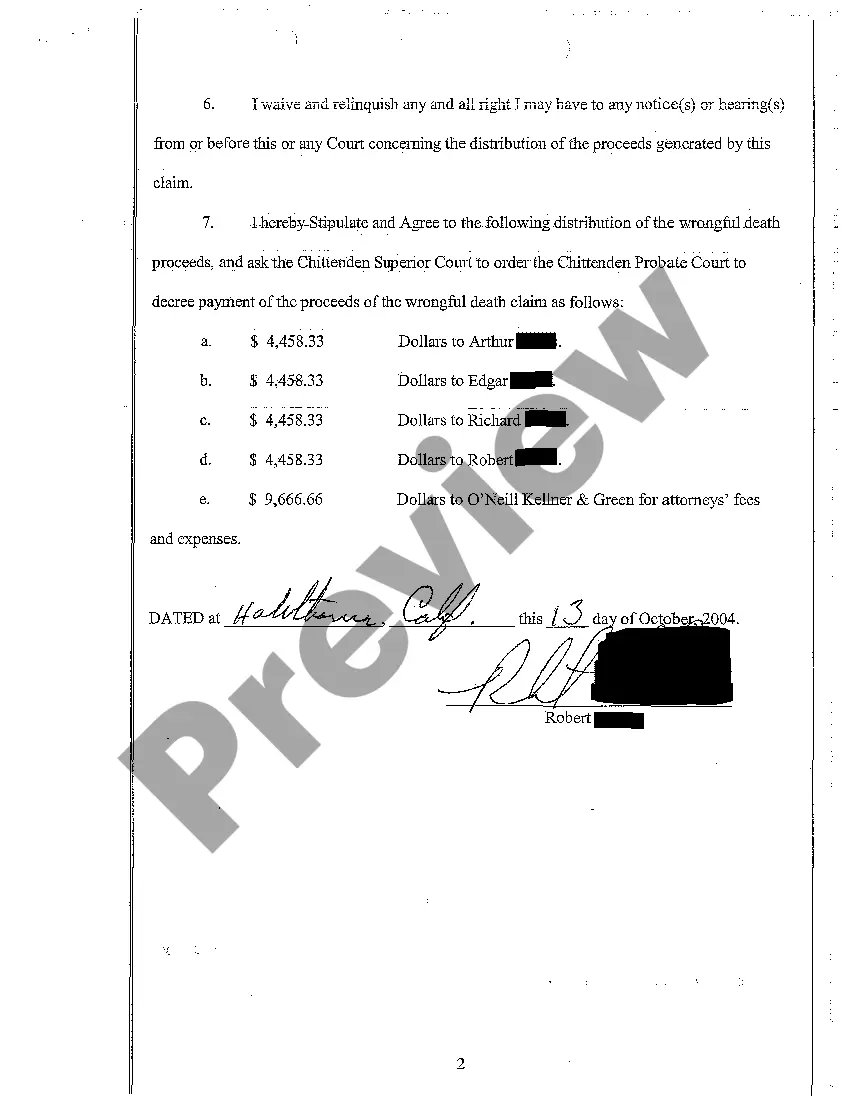

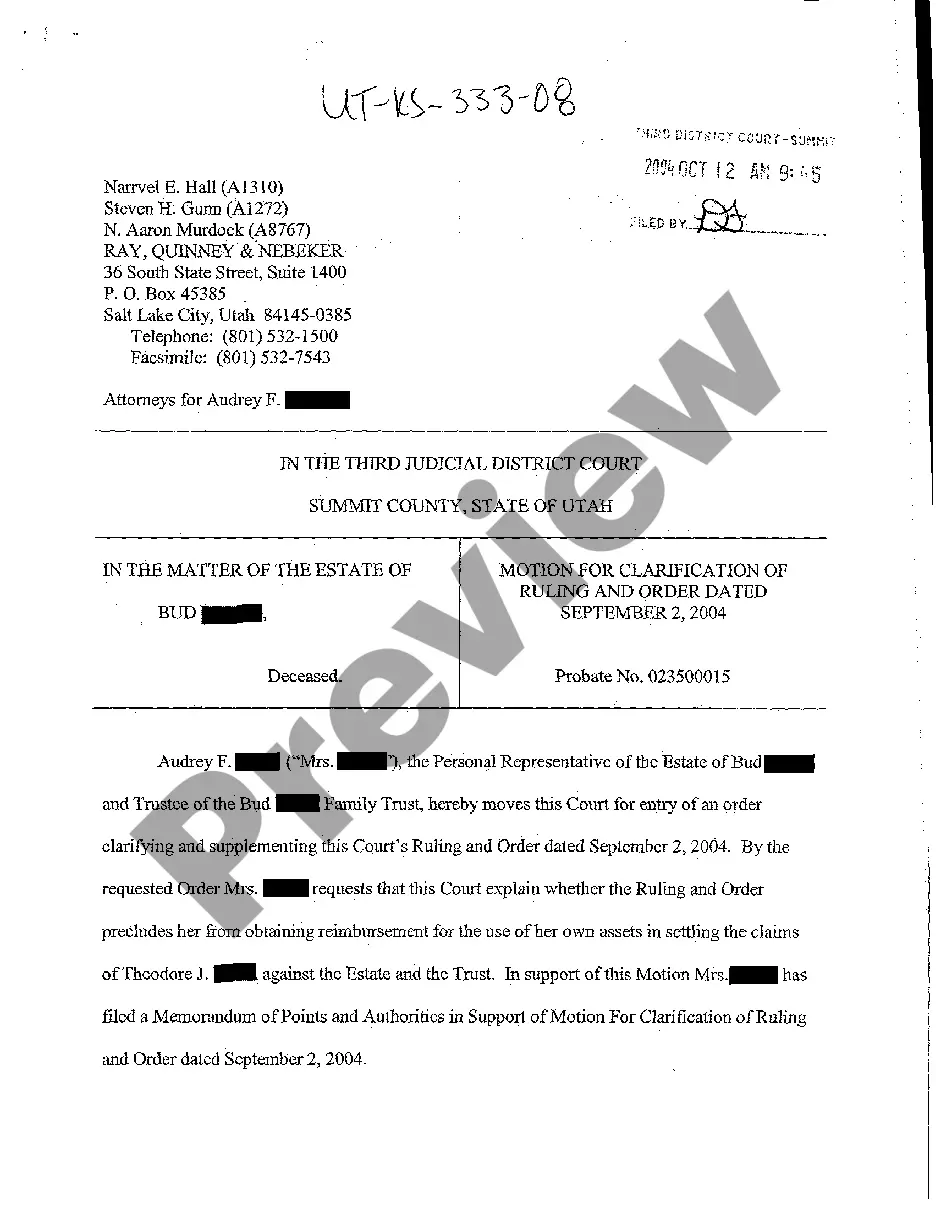

Vermont Stipulation of Heirs and Allocation of Settlement and Distribution of Settlement Proceeds

Description

How to fill out Vermont Stipulation Of Heirs And Allocation Of Settlement And Distribution Of Settlement Proceeds?

Looking for a Vermont Stipulation of Heirs and Allocation of Settlement and Distribution of Settlement Proceeds on the internet can be stressful. All too often, you find papers that you simply believe are alright to use, but discover later on they are not. US Legal Forms offers more than 85,000 state-specific legal and tax documents drafted by professional legal professionals in accordance with state requirements. Get any document you are searching for in minutes, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will instantly be included to your My Forms section. In case you do not have an account, you need to sign-up and select a subscription plan first.

Follow the step-by-step guidelines below to download Vermont Stipulation of Heirs and Allocation of Settlement and Distribution of Settlement Proceeds from our website:

- See the form description and press Preview (if available) to check if the template suits your expectations or not.

- If the form is not what you need, get others with the help of Search field or the listed recommendations.

- If it’s appropriate, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay via card or PayPal and download the template in a preferable format.

- Right after getting it, you may fill it out, sign and print it.

Obtain access to 85,000 legal forms straight from our US Legal Forms library. In addition to professionally drafted templates, customers will also be supported with step-by-step instructions on how to get, download, and complete forms.

Form popularity

FAQ

Dying Without a Will in VermontIf you die without a valid will, you'll lose control over what happens to your assets after your death.If there isn't a will, the probate court must appoint someone to serve as the executor or personal representative. Usually the surviving spouse or adult child is chosen for this role.

Common law marriages in Vermont are not recognized, as is the case in all but ten states and Washington D.C. If you enter into this relationship in another state, you will need to consider getting formally married if you move. Your common law marriage in VT is not valid.

In Vermont, you can make a living trust to avoid probate for virtually any asset you own -- real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Under California Probate Code, the executor typically receives 4% on the first $100,000, 3% on the next $100,000 and 2% on the next $800,000, says William Sweeney, a California-based probate attorney. For an estate worth $600,000 the fee works out at approximately $15,000.

As an aside, Vermont Statute Title 32 § 1143 states that executors may be paid $4 per day spent in court, but this is geared towards the court paying appointed agents, and that amount was set in 1866.

In Vermont the courts generally accept a fair and reasonable property division the parties agree to, but if the parties cannot agree, the Family Court divides the property within the Judgment of Divorce. Vermont is an equitable distribution state.

Equitable distribution is a method of dividing property at the time of divorce. All states except for Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin follow the principles of equitable distribution.

In Vermont, the court will award alimony in an amount to bring a supported spouse up to the standard of living the couple had during the marriage.age and physical condition of each spouse. ability of the paying spouse to pay alimony, and. inflation related to the cost of living.

Grounds for divorce: Vermont allows a no-fault divorce. That requires that you and your spouse live separate and apart for at least six consecutive months and that you are not likely to get back together.You can't have a final divorce hearing until you've been separated for six months.