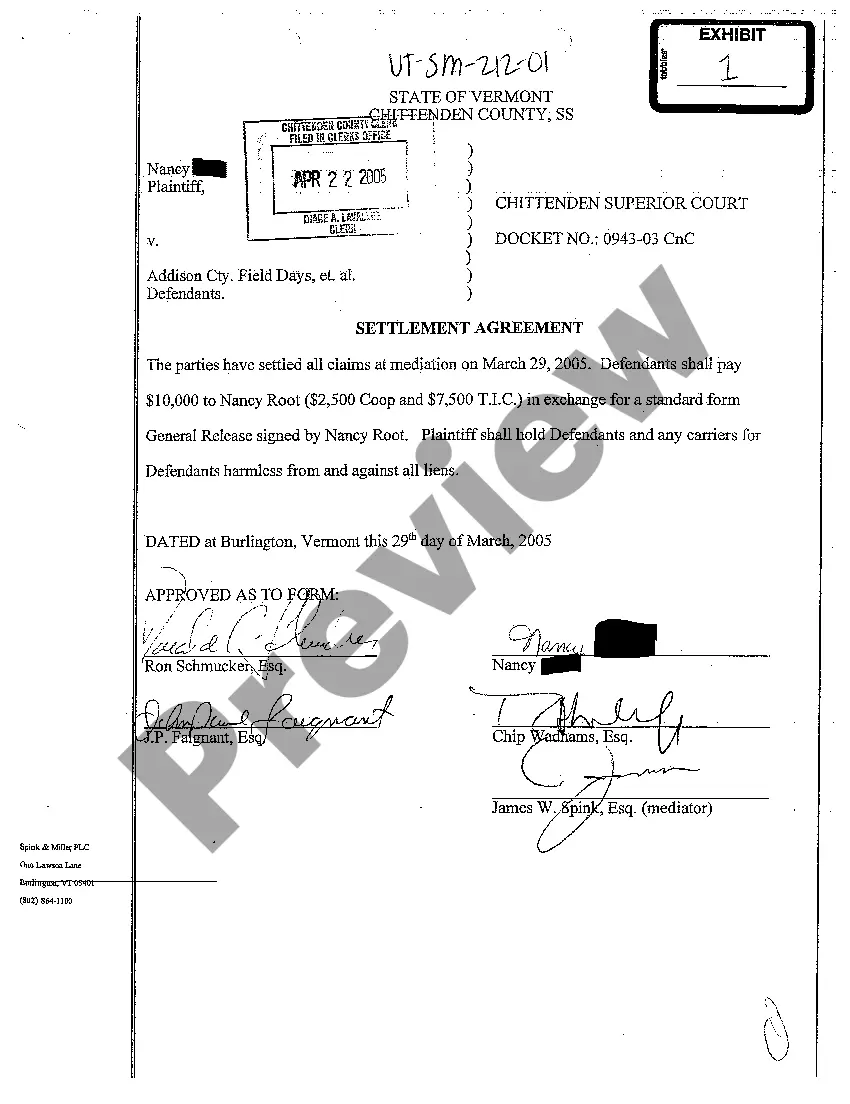

Vermont Settlement Agreement Releasing Defendants from Liens

Description

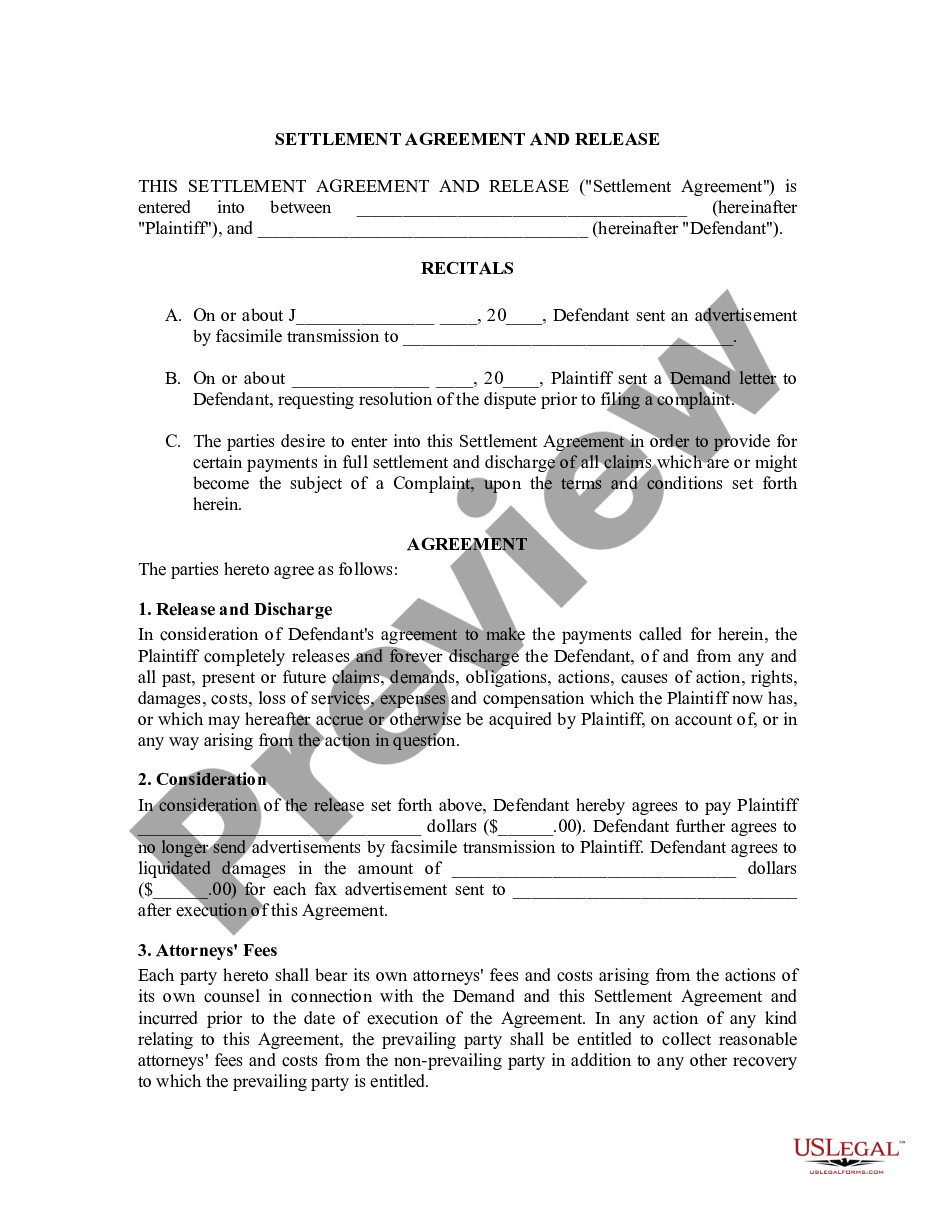

How to fill out Vermont Settlement Agreement Releasing Defendants From Liens?

Looking for a Vermont Settlement Agreement Releasing Defendants from Liens online might be stressful. All too often, you see files that you simply believe are ok to use, but find out afterwards they’re not. US Legal Forms offers more than 85,000 state-specific legal and tax documents drafted by professional legal professionals according to state requirements. Get any form you are searching for within minutes, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will instantly be added in to your My Forms section. If you do not have an account, you have to sign-up and pick a subscription plan first.

Follow the step-by-step guidelines below to download Vermont Settlement Agreement Releasing Defendants from Liens from our website:

- See the document description and click Preview (if available) to check if the template meets your expectations or not.

- If the form is not what you need, find others with the help of Search engine or the provided recommendations.

- If it’s appropriate, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the template in a preferable format.

- Right after downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal forms from our US Legal Forms catalogue. Besides professionally drafted templates, customers will also be supported with step-by-step instructions concerning how to get, download, and fill out templates.

Form popularity

FAQ

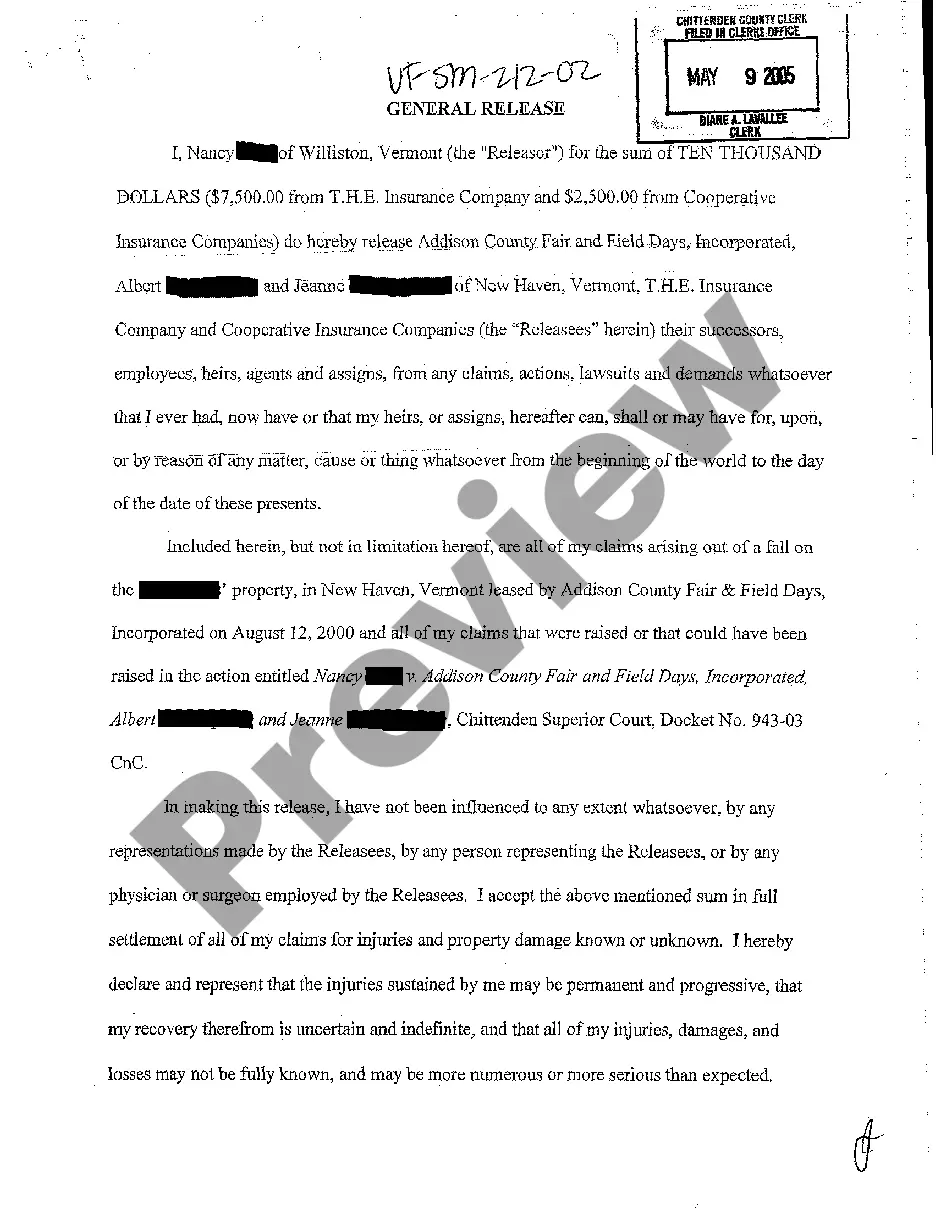

The Grantor is any person conveying or encumbering, whom any Lis Pendens, Judgments, Writ of Attachment, or Claims of Separate or Community Property shall be placed on record. The Grantor is the seller (on deeds), or borrower (on mortgages). The Grantor is usually the one who signed the document.

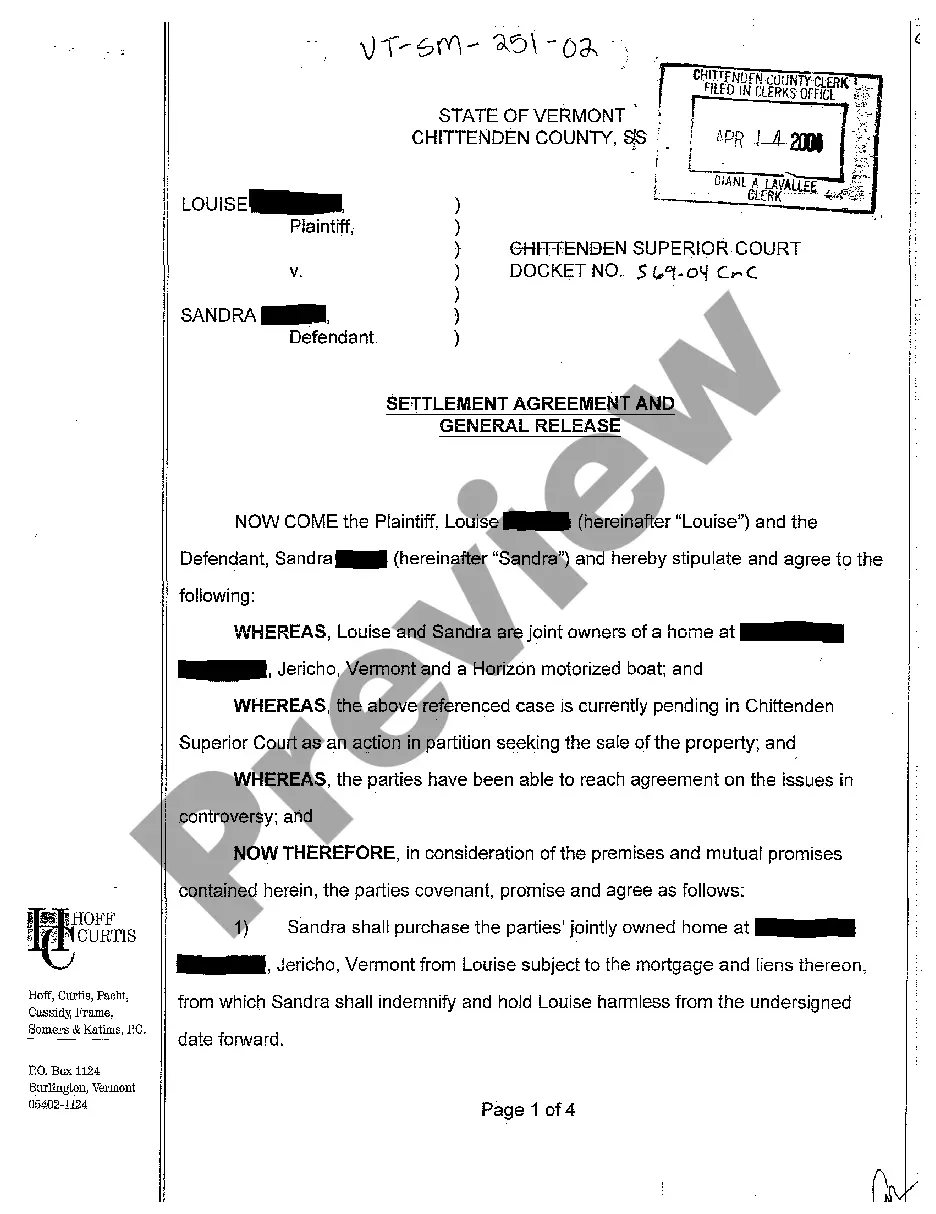

Lien Release Waiting Period The typical amount of time is 30 to 60 days. Some banks will send the lien release directly to the department of motor vehicles or the county recorder's office on behalf of the borrower, while others send the release to the borrower who then must file it.

The lender will also notify the Department of Motor Vehicles (DMV) that the loan has been paid in full. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied. This request can be made through the DMV or directly to the lender.

This release of mortgage is recorded or filed and gives notice to the world that the lien is no more. On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.When you call the lender, ask for the release of lien department.

The grantor is the owner, and the grantee is the buyer who is acquiring an equitable interest but not bare legal interest in a property. It's essential that a deed clearly states the grantee, grantor, and a description of the property involved in the transaction.

In the case of a mechanic's lien, the grantor is the home owner and the grantee is the contractor or builder. In mortgages and car leases, the grantor is the consumer and the grantee is the lender.

In most cases, the lien holder (the lender in this case) should send the release to be recorded within 30-90 days. If you aren't sure what the requirements are in your area, reach out to your real estate agent, title agent, or real estate attorney for guidance.

A grantee is the recipient of something, such as a college grant or real estate property. A grantor is a person or entity that transfers to another person or entity the interest or ownership rights to an asset. Legal documents, such as deeds, detail the transfer of assets between grantors and grantees.

A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property.