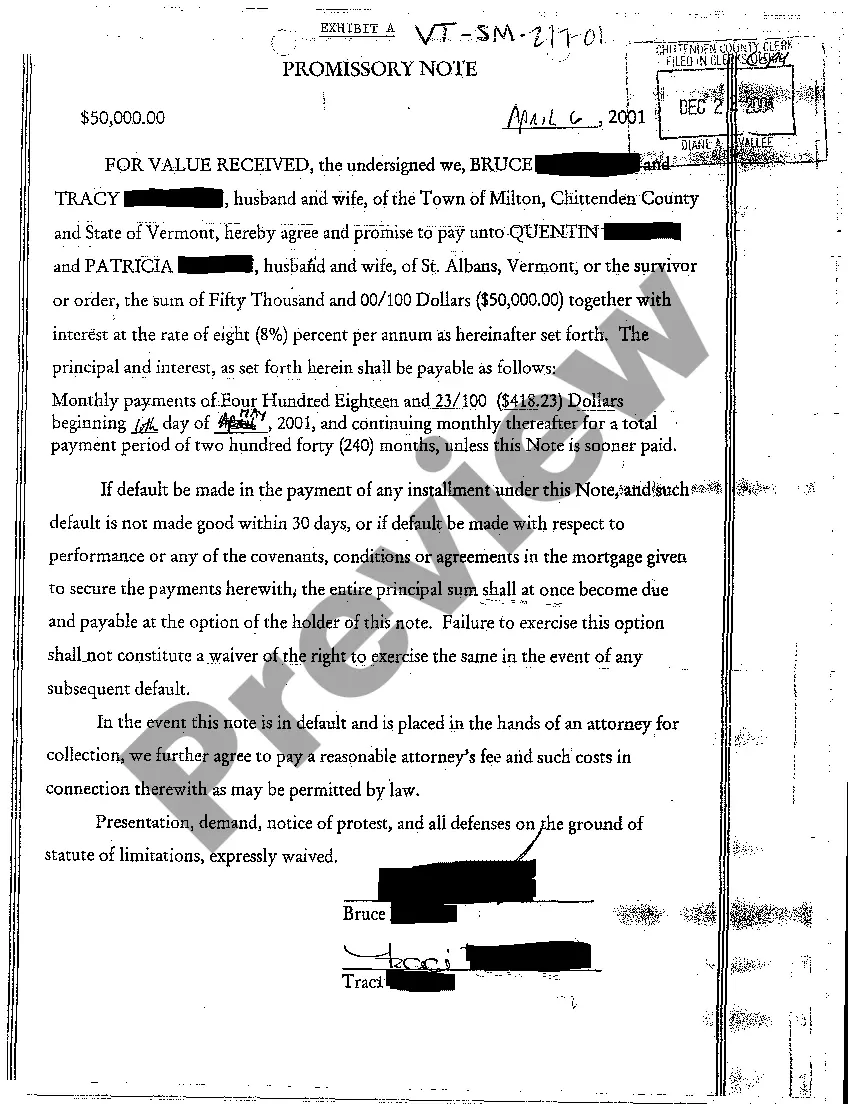

Vermont Promissory Note

Description

How to fill out Vermont Promissory Note?

Looking for a Vermont Promissory Note on the internet might be stressful. All too often, you see papers that you simply believe are ok to use, but discover later they are not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional attorneys according to state requirements. Have any form you are looking for within a few minutes, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll immediately be included in your My Forms section. In case you do not have an account, you must sign up and select a subscription plan first.

Follow the step-by-step recommendations listed below to download Vermont Promissory Note from the website:

- Read the document description and hit Preview (if available) to verify if the template suits your expectations or not.

- In case the document is not what you need, get others with the help of Search field or the provided recommendations.

- If it’s appropriate, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the document in a preferable format.

- After getting it, you are able to fill it out, sign and print it.

Obtain access to 85,000 legal forms from our US Legal Forms library. In addition to professionally drafted samples, users are also supported with step-by-step instructions regarding how to get, download, and fill out forms.

Form popularity

FAQ

Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money. Generally, they also state due dates for payment and an agreed-upon interest rate.

Promissory notes are one of the simplest ways to obtain financing for your company. They are often basic documents with few formalities.As such, a promissory note must contain the usual standard requirements for a contract, including consideration, meeting of the minds and capacity.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Borrower and Lender Details. A promissory note outlines information about both parties including the names, streets addresses, city, state and zip code of each party. Loan Information. Legal Language. Signatures. Warnings.

A simple promissory note is a legal document that evidences a loan. The individual or entity executing the note is promising to repay the debt to the lender. The terms of the promissory note include: Parties to the contract.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

A Promissory Note will only be enforceable if it includes all the elements which are necessary to make it a legal document. To make a Promissory Note enforceable, I must contain the following information.Date of Repayment - The note must clearly state the date on which the repayment for the loaned amount must be paid.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.