Vermont Acknowledgment by Charitable or Educational Institution of Receipt of Gift is an important legal process that charitable or educational organizations located in Vermont must adhere to when they receive gifts from donors. This acknowledgment serves as a vital documentation for both the institution and the donor, ensuring transparency, accountability, and compliance with state regulations. In Vermont, there are mainly two types of acknowledgments that charitable or educational institutions use when acknowledging the receipt of gifts, namely: the written acknowledgment and the contemporaneous written acknowledgment. 1. Written Acknowledgment: The written acknowledgment is typically used when the gift received by the institution does not exceed $250. According to Vermont laws, the charitable or educational organization must provide a written acknowledgment to the donor for any monetary or non-monetary contribution exceeding $75. This acknowledgment should include several key elements, such as: — Name of the organization: Clearly state the legal name of the charitable or educational institution, along with any other commonly recognized names. — Donation details: Describe the nature of the gift, whether it is a cash donation, in-kind contribution, securities, property, or any other valuable item. — Date of gift: Indicate the precise date when the gift was received by the institution. — Donor information: Include the full name and address of the donor, as well as their tax identification number if applicable. — Statement of no goods or services provided: If the donation is made without receiving any goods or services from the organization, explicitly state that the donor did not receive anything of value in return for their gift. — Tax-exempt status: Mention the organization's tax-exempt status under relevant sections of the Internal Revenue Code and provide its Employer Identification Number (EIN). — Statement regarding non-deductible benefits: If the donor received any goods or services with an estimated value, disclose this information and determine the deductible amount of their contribution. 2. Contemporaneous Written Acknowledgment: For any donations exceeding $250, Vermont law requires the charitable or educational institution to provide a contemporaneous written acknowledgment to the donor. This acknowledgment should contain all the elements mentioned above in the written acknowledgment, along with additional details such as: — Description of non-cash contributions: If the gift received is a non-cash contribution (property, securities, etc.), provide a detailed description of the item(s) received. — Evaluation statement: Include a statement stating whether the institution provided the donor with any goods or services or any intangible benefits in exchange for their contribution, along with an estimated value of such benefits. By following the Vermont Acknowledgment guidelines, charitable or educational institutions can maintain compliance and foster a positive relationship with their donors. This ensures transparency and supports the institution's reputation as a responsible and accountable recipient of charitable contributions.

Vermont Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

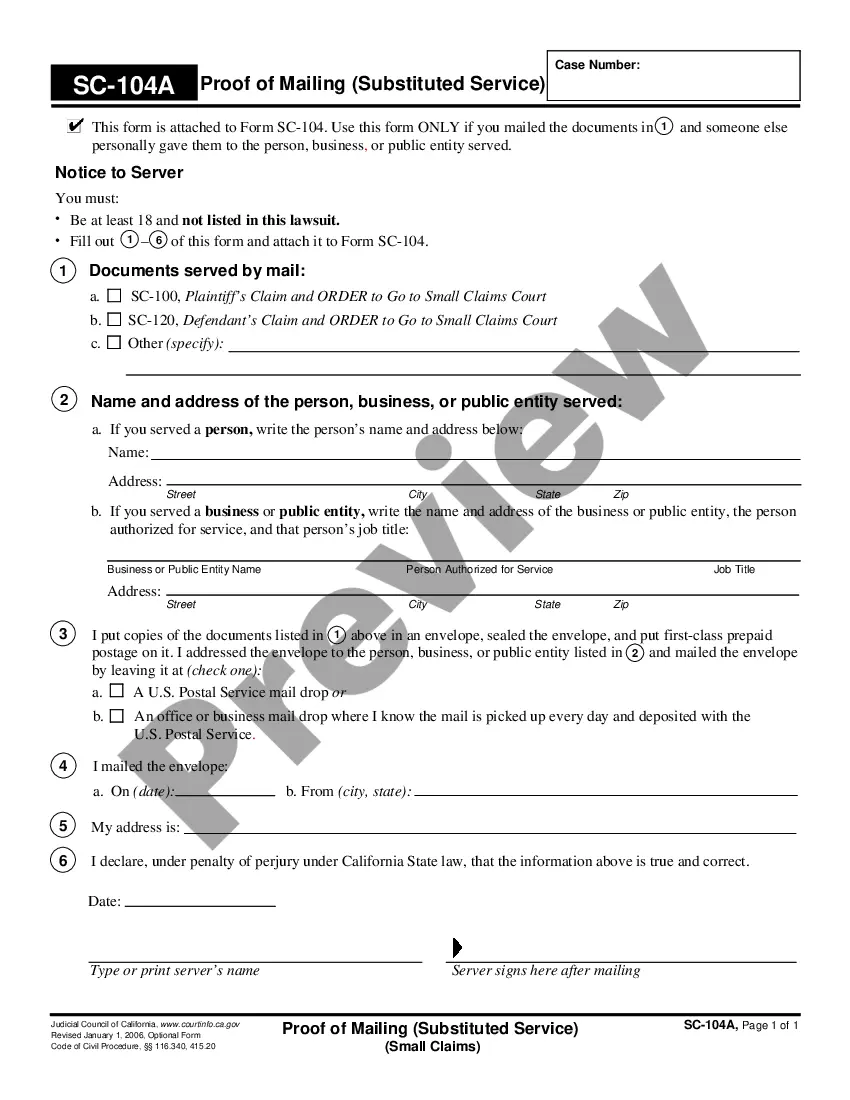

How to fill out Vermont Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

Finding the right authorized papers format can be a struggle. Naturally, there are plenty of themes accessible on the Internet, but how will you get the authorized kind you require? Utilize the US Legal Forms site. The support provides a huge number of themes, such as the Vermont Acknowledgment by Charitable or Educational Institution of Receipt of Gift, that can be used for enterprise and private demands. Each of the varieties are checked out by experts and satisfy state and federal requirements.

In case you are previously registered, log in in your accounts and click the Obtain switch to get the Vermont Acknowledgment by Charitable or Educational Institution of Receipt of Gift. Make use of your accounts to search from the authorized varieties you might have ordered formerly. Check out the My Forms tab of your own accounts and acquire yet another duplicate in the papers you require.

In case you are a new customer of US Legal Forms, here are basic recommendations that you can follow:

- Very first, make certain you have chosen the proper kind for your metropolis/region. You are able to examine the shape making use of the Preview switch and look at the shape explanation to guarantee it will be the best for you.

- In the event the kind fails to satisfy your needs, take advantage of the Seach discipline to get the appropriate kind.

- Once you are certain that the shape is acceptable, select the Acquire now switch to get the kind.

- Choose the prices program you want and enter in the required info. Create your accounts and pay for your order using your PayPal accounts or bank card.

- Pick the data file formatting and down load the authorized papers format in your system.

- Full, revise and produce and indication the attained Vermont Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

US Legal Forms will be the most significant local library of authorized varieties in which you will find various papers themes. Utilize the service to down load appropriately-produced documents that follow express requirements.

Form popularity

FAQ

A donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement. However, that's not always the case. All donors deserve to be thanked, no matter the size of their gift.

Gift acknowledgment letters are letters sent to donors that formally acknowledge their generous donation. These letters should express gratitude and appreciation while also providing the donor with a record of the donation.

IRS-Required Transaction Details Name of the organization; Amount of cash contribution; Description (but not value) of non-cash contribution; Statement that no goods or services were provided by the organization, if that is the case;

Tip #1: Although the IRS doesn't require acknowledgment letters to be sent for gifts under $250, it's a good rule of thumb to express thanks for every gift, regardless of its size.

A donation acknowledgment letter (sometimes called a donation receipt or thank-you letter) is an email or paper that recognizes a charitable contribution. At a bare minimum, it's a confirmation receipt to your donors acknowledging you've received their donation.

A donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement. However, that's not always the case. All donors deserve to be thanked, no matter the size of their gift.

Examples of acknowledge in a Sentence They acknowledged that the decision was a mistake. Do you acknowledge that you caused this mess? They readily acknowledged their mistake. She won't acknowledge responsibility for her actions.

Acknowledging each donation gives you an additional opportunity to show your gratitude to donors. It also serves as immediate confirmation. At the same time, the year-end acknowledgment letter is an excellent opportunity to summarize your donor's charitable giving and highlight what it helped accomplish.