Vermont Accounts Receivable — Contract to Sale is a financial agreement that allows businesses in Vermont to sell their unpaid invoices or accounts receivable to a third-party company known as a factor. This method of financing helps businesses improve their cash flow and manage their working capital efficiently. In this contract to sale arrangement, the business (known as the seller) transfers the ownership of their accounts receivable to the factor in exchange for an upfront payment. The factor then assumes the responsibility of collecting the outstanding payments from the customers. These reliefs the seller of the burden of chasing down payments and reduces the associated administrative costs. There are several types of Vermont Accounts Receivable — Contract to Sale arrangements: 1. Recourse Factoring: In this type, the seller agrees to buy back any uncollectible invoices if the factor is unable to collect payment from the customers. This places some responsibility on the seller for the credit risk associated with their customers. 2. Non-Recourse Factoring: In contrast to recourse factoring, non-recourse factoring provides more protection to the seller. The factor assumes full responsibility for any uncollectible invoices, reducing the credit risk for the seller. 3. Spot Factoring: Spot factoring allows businesses to select specific invoices or accounts receivable to sell to the factor on a one-time basis. This provides flexibility to the seller, allowing them to choose which invoices they need immediate cash for, without committing to a long-term contract. 4. Whole Ledger Factoring: Whole ledger factoring involves selling the entire accounts receivable portfolio of a business to the factor. This type of contract to sale arrangement provides a holistic approach to managing cash flow, as it includes all outstanding invoices. By opting for a Vermont Accounts Receivable — Contract to Sale, businesses can access immediate funds by converting their unpaid invoices into cash. This helps them maintain a steady cash flow, meet their financial obligations, invest in growth opportunities, and maintain a healthy working capital position. In conclusion, Vermont Accounts Receivable — Contract to Sale enables businesses to alleviate the strain of late payments by selling their invoices to a factor. With different variations such as recourse factoring, non-recourse factoring, spot factoring, and whole ledger factoring, businesses have the flexibility to choose the most suitable option for their unique financial needs.

Vermont Accounts Receivable - Contract to Sale

Description

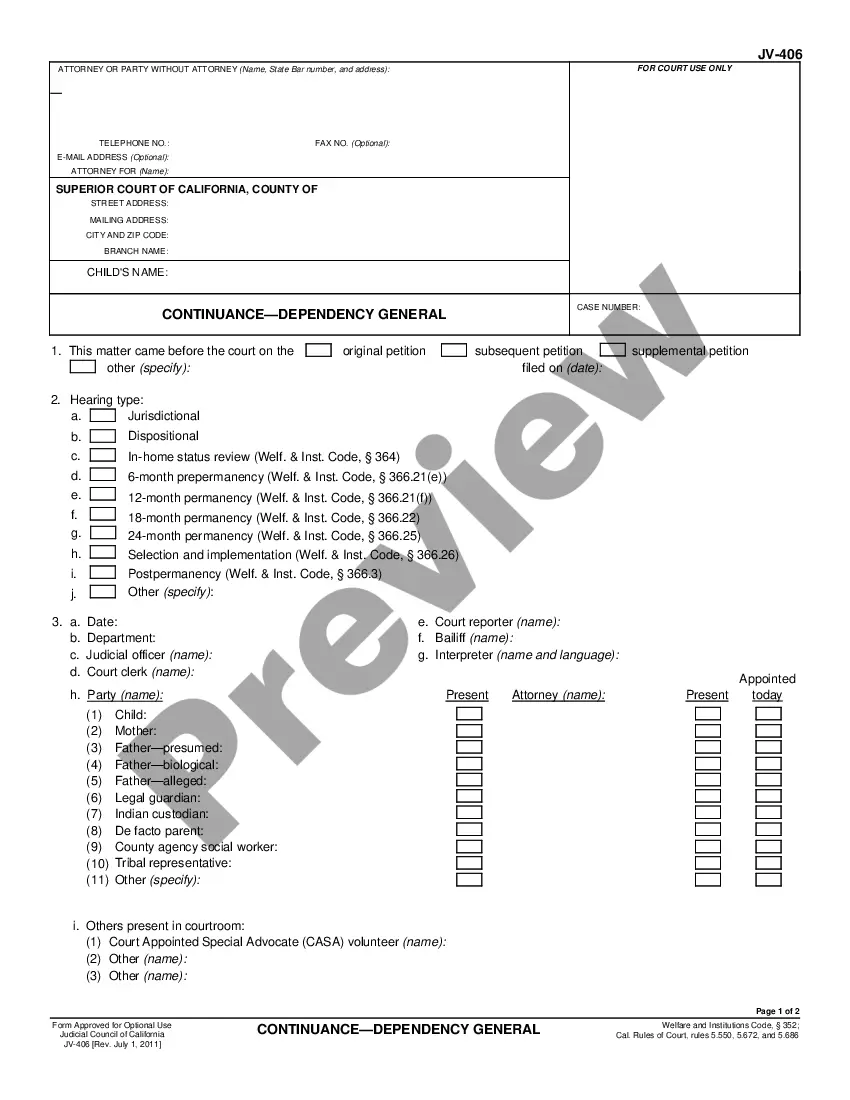

How to fill out Vermont Accounts Receivable - Contract To Sale?

Are you in the position the place you require files for both business or personal uses virtually every time? There are plenty of legal document web templates accessible on the Internet, but locating kinds you can rely on isn`t easy. US Legal Forms provides a large number of type web templates, much like the Vermont Accounts Receivable - Contract to Sale, which are composed to satisfy state and federal specifications.

In case you are already familiar with US Legal Forms internet site and get a merchant account, basically log in. Next, it is possible to down load the Vermont Accounts Receivable - Contract to Sale format.

If you do not provide an bank account and need to start using US Legal Forms, follow these steps:

- Find the type you require and ensure it is to the proper metropolis/county.

- Utilize the Review button to analyze the shape.

- Look at the description to actually have chosen the appropriate type.

- In the event the type isn`t what you`re searching for, utilize the Look for industry to discover the type that fits your needs and specifications.

- Whenever you find the proper type, click on Purchase now.

- Opt for the rates strategy you desire, fill in the necessary info to produce your account, and purchase the transaction making use of your PayPal or credit card.

- Select a practical data file structure and down load your duplicate.

Discover all of the document web templates you may have purchased in the My Forms menus. You can obtain a additional duplicate of Vermont Accounts Receivable - Contract to Sale whenever, if necessary. Just select the required type to down load or print out the document format.

Use US Legal Forms, probably the most comprehensive assortment of legal kinds, to conserve efforts and steer clear of faults. The services provides professionally produced legal document web templates which you can use for a selection of uses. Create a merchant account on US Legal Forms and begin making your way of life a little easier.

Form popularity

FAQ

An example of accounts receivable is a furniture manufacturer that has delivered furniture to a retail store. Once the manufacturer bills the store for the furniture, the payment owed is recorded under accounts receivable. The furniture manufacturer awaits payment from the store.

Contract Receivables means, during any period of determination, gross accounts receivable of Borrower and its Subsidiaries created from the sale to customers, on an installment payment basis, of membership contracts for the use of fitness or exercise centers, other than Receivables Program Receivables.

The key difference between Contract asset and Account receivable is its conditionality i.e. Contract Asset is recognized in the Financial Statements when the right to receive the payment is conditional upon something other than just passage of time (having conditional right to receive payment).

Receivables can be classified into accounts/trade receivable, notes receivable, and other receivables.

An accounts receivable purchase agreement is a contract between a buyer and seller. The seller sells receivables to get cash up front, and the buyer has the right to collect the receivables from the original customer.