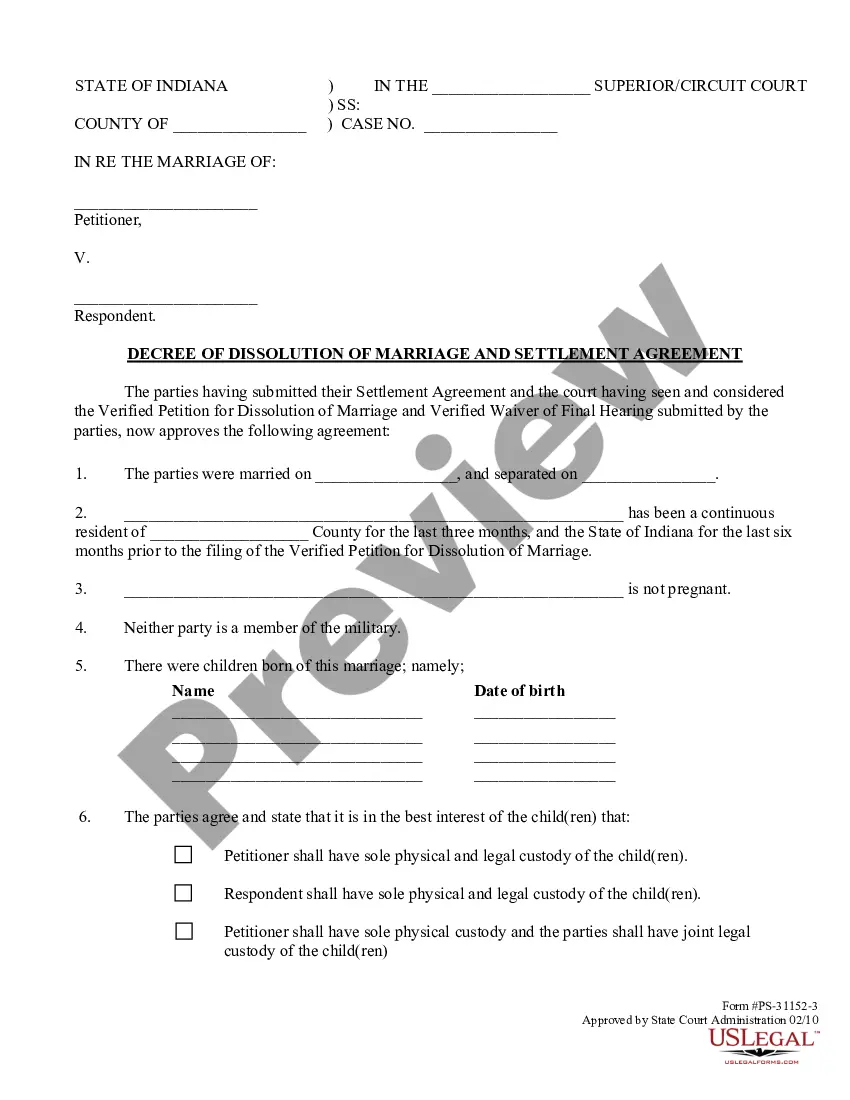

A Vermont Buy Sell or Stock Purchase Agreement is a legally binding contract that outlines the terms and conditions for the sale or purchase of common stock in closely held corporations. This agreement typically includes an option to fund the purchase through life insurance policies. In a closely held corporation, the number of shareholders is limited, and the stock is not publicly traded. This type of agreement is commonly used in small businesses and family-owned companies, where the stockholders want to establish a mechanism for selling or buying shares in the event of certain triggering events. The agreement covers various aspects such as the valuation of the common stock, the terms for purchasing the shares, and the funding options for the purchase. One of the funding options commonly included in a Vermont Buy Sell Agreement is utilizing life insurance policies. Life insurance funding provides a mechanism to secure the necessary funds for the purchase of common stock upon the occurrence of a triggering event, such as the death or disability of a shareholder. The agreement will specify the types and amounts of life insurance policies that each shareholder must maintain, and how the proceeds from these policies will be utilized for the purchase of the deceased or disabled shareholder's stock. There may be different variations of Vermont Buy Sell or Stock Purchase Agreements based on the specific needs and preferences of the parties involved. Some additional types of agreements may include: 1. Cross-Purchase Agreement: In this type of agreement, each shareholder agrees to purchase the shares of the other shareholders in the event of a triggering event. For example, if one shareholder passes away, the surviving shareholders will buy the deceased shareholder's stock in proportion to their ownership interest. 2. Entity-Purchase Agreement: In an entity-purchase agreement, the corporation itself is obligated to purchase the shares of a shareholder upon a triggering event. The corporation will then become the owner of the purchased shares, effectively reducing the number of outstanding shares and redistributing the ownership. 3. Wait-and-See Agreement: This type of agreement allows the remaining shareholders to observe the occurrence and effects of a triggering event before deciding whether to proceed with the purchase. It provides flexibility to assess the impact on the corporation and evaluate the best course of action. All variations of Vermont Buy Sell or Stock Purchase Agreements, whether utilizing life insurance or other funding methods, aim to ensure a smooth transfer of ownership in closely held corporations while maintaining the stability and continuity of the business. These agreements provide a clear framework for shareholders to plan for unforeseen events and protect the interests of all parties involved.

Vermont Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance

Description

How to fill out Vermont Buy Sell Or Stock Purchase Agreement Covering Common Stock In Closely Held Corporation With Option To Fund Purchase Through Life Insurance?

US Legal Forms - among the largest libraries of authorized kinds in the United States - gives a variety of authorized file templates you can acquire or print. Utilizing the internet site, you may get thousands of kinds for enterprise and specific uses, categorized by classes, suggests, or key phrases.You can get the latest models of kinds like the Vermont Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance in seconds.

If you have a registration, log in and acquire Vermont Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance through the US Legal Forms library. The Acquire button can look on each and every type you look at. You have accessibility to all earlier acquired kinds inside the My Forms tab of your profile.

If you wish to use US Legal Forms for the first time, here are simple directions to help you started off:

- Ensure you have selected the correct type for your city/area. Click the Preview button to analyze the form`s articles. Read the type outline to actually have selected the appropriate type.

- In case the type does not fit your needs, use the Look for field near the top of the screen to find the one which does.

- Should you be content with the form, affirm your selection by visiting the Get now button. Then, opt for the pricing prepare you favor and supply your references to register to have an profile.

- Method the purchase. Make use of your charge card or PayPal profile to perform the purchase.

- Find the file format and acquire the form in your system.

- Make changes. Fill up, modify and print and indicator the acquired Vermont Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance.

Each and every template you put into your account lacks an expiry particular date and is also your own property forever. So, if you want to acquire or print one more version, just check out the My Forms area and click on around the type you require.

Gain access to the Vermont Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance with US Legal Forms, the most extensive library of authorized file templates. Use thousands of skilled and state-particular templates that fulfill your small business or specific requires and needs.