A Vermont Earnest Money Promissory Note is a legally binding document used in real estate transactions to establish the terms and conditions of the earnest money deposit. The earnest money deposit is a sum of money paid by the buyer to demonstrate their intention to purchase the property in good faith. The promissory note outlines the amount of the earnest money deposit, as well as the terms and conditions regarding its payment, refund, and forfeiture. It serves as evidence of the buyer's commitment to the transaction and provides assurance to the seller that the buyer is serious about completing the purchase. Different types of Vermont Earnest Money Promissory Notes may include: 1. Standard Earnest Money Promissory Note: This is the most common type and covers the basic terms and conditions of the earnest money deposit. It typically specifies the amount of the deposit, the timeframe for payment, and the conditions under which the deposit is refundable or forfeited. 2. Contingency-based Earnest Money Promissory Note: This type of promissory note includes additional provisions that stipulate certain contingencies or conditions that must be met for the earnest money deposit to be refundable. For example, if the buyer is unable to secure financing within a specified period, they may be entitled to a refund of the deposit. 3. Escrow Earnest Money Promissory Note: In some cases, the earnest money deposit may be held in an escrow account by a neutral third party until the completion of the transaction. An escrow Earnest Money Promissory Note specifies the role and responsibilities of the escrow agent, as well as the conditions for releasing the earnest money to the seller or returning it to the buyer. It is important to note that the specifics of the Vermont Earnest Money Promissory Note may vary depending on the agreement between the buyer and seller, as well as any applicable state laws and regulations. It is recommended to consult with a real estate attorney or professional to ensure that the promissory note accurately reflects the intentions of both parties and complies with all legal requirements.

Earnest Money Promissory Note

Description

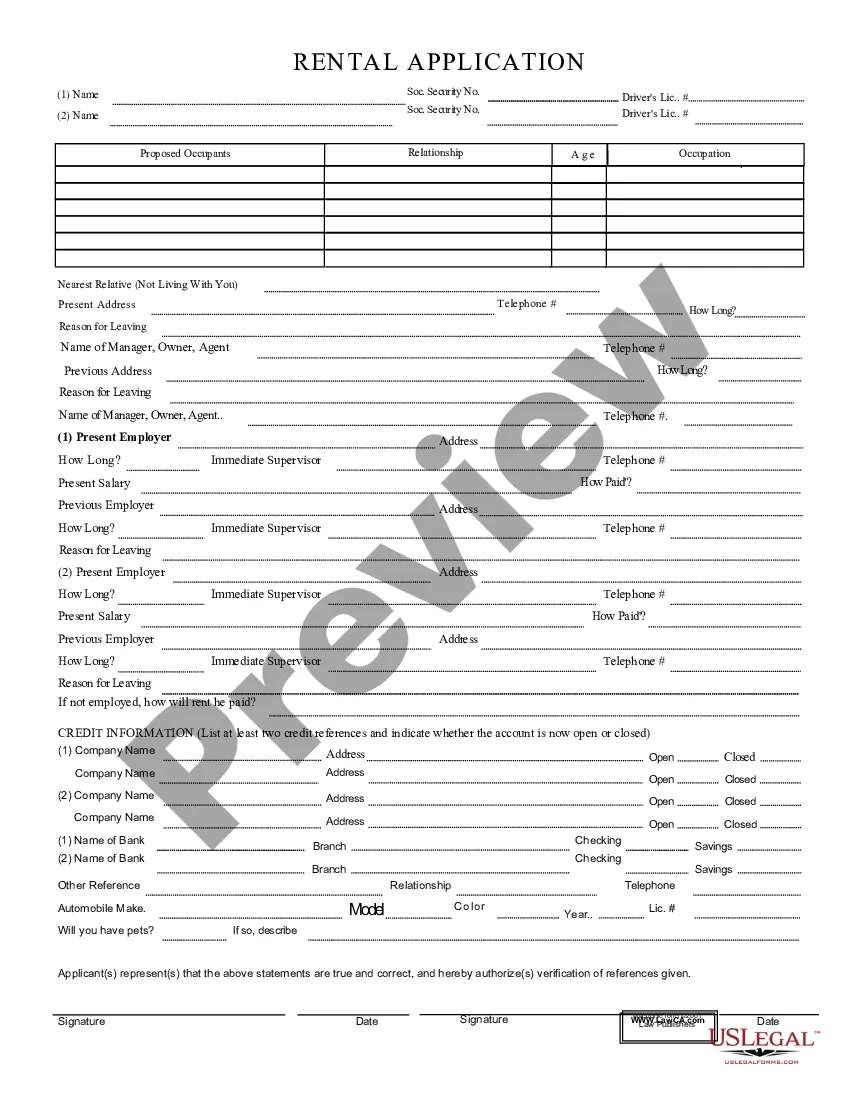

How to fill out Vermont Earnest Money Promissory Note?

You have the capability to spend time online searching for the valid document format that satisfies the federal and state stipulations you will require.

US Legal Forms offers a vast array of valid templates that can be assessed by experts.

It is easy to obtain or print the Vermont Earnest Money Promissory Note from my service.

If available, use the Preview button to look over the document format simultaneously.

- If you possess a US Legal Forms account, you may Log In and then click the Download button.

- After that, you may complete, edit, print, or sign the Vermont Earnest Money Promissory Note.

- Every valid document format you acquire is yours permanently.

- To get another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are utilizing the US Legal Forms website for the first time, follow the simple instructions below.

- Firstly, make sure you have selected the correct document format for the region/state of your choice.

- Review the form description to ensure you have chosen the right form.

Form popularity

FAQ

An earnest money deposit is money is put up by a potential buyer of real estate to show that it is seriously interested in making the purchase. The money is usually paid within 24-48 hours after the offer is accepted, and is held by a third party or escrow company until the deal is completed.

The parties should sign only one original note, and the seller or escrow agent should keep that document. If you are the buyer, you will want to keep the note in the hands of an escrow agent or company.

The owner must be aware that the earnest money deposit will be made in the form of a promissory note (i.e., not in cash) before it accepts the purchase offer. This fact must also be stated clearly in the purchase agreement itself.

Deposit Promissory Note means a debt instrument issued by the Bank; upon maturity the Bank is obliged to pay to the Client the Amount Payable. Concurrently the Bank ensures the custody of such promissory note.

Mortgage notes, or promissory notes, are financial instruments that define the terms of a loan used to purchase property. People who hold a mortgage note for a home, business or property can sell it for a cash lump sum to a buyer in the secondary mortgage note industry.

An earnest promissory note shows good faith commitment to purchase an asset and outlines the aspects of the purchase agreement between a buyer and seller.

The use of an earnest money promissory note usually contemplates the existence of a purchase agreement for real property. The enclosed document assumes that a purchase agreement will be created and signed by the parties, but that agreement is not provided as part of this form.

Paying earnest money deposit Typically, you pay earnest money to an escrow account or trust under a third-party like a legal firm, real estate broker or title company. Acceptable payment methods include personal check, certified check and wire transfer. The funds remain in the trust or escrow account until closing.

As promissory notes are legal and enforceable, banks will often accept them as they know they can get their money back if you fail to repay the loan. For your promissory note to be legal, you can print off a promissory note template online, fill in your details and sign it.