Vermont Credit Agreement

Description

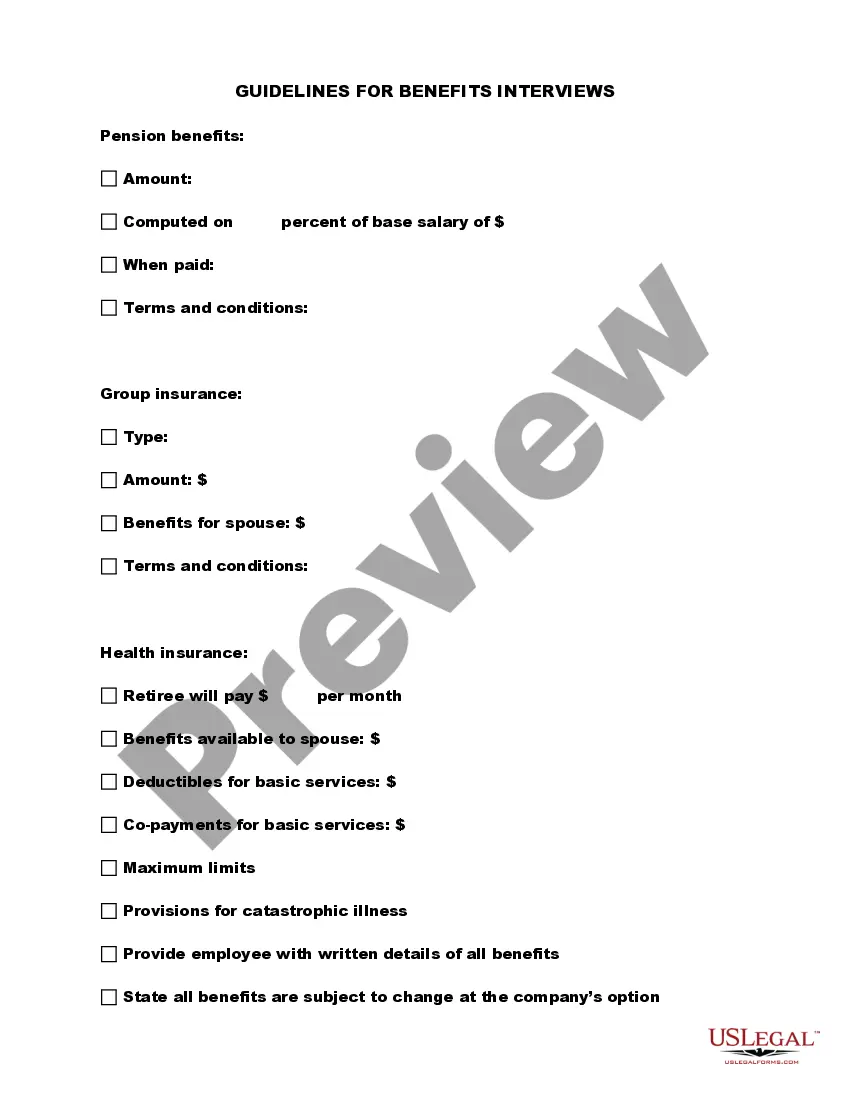

How to fill out Credit Agreement?

Selecting the finest legal document template can be somewhat challenging. Obviously, there are numerous templates accessible online, but how can you obtain the legal form you require? Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Vermont Credit Agreement, which can be utilized for both business and personal purposes. All of the forms are reviewed by professionals and comply with state and federal regulations.

If you are already signed up, Log In to your account and click the Download button to retrieve the Vermont Credit Agreement. Use your account to browse through the legal documents you have previously acquired. Navigate to the My documents tab in your account and obtain another copy of the document you need.

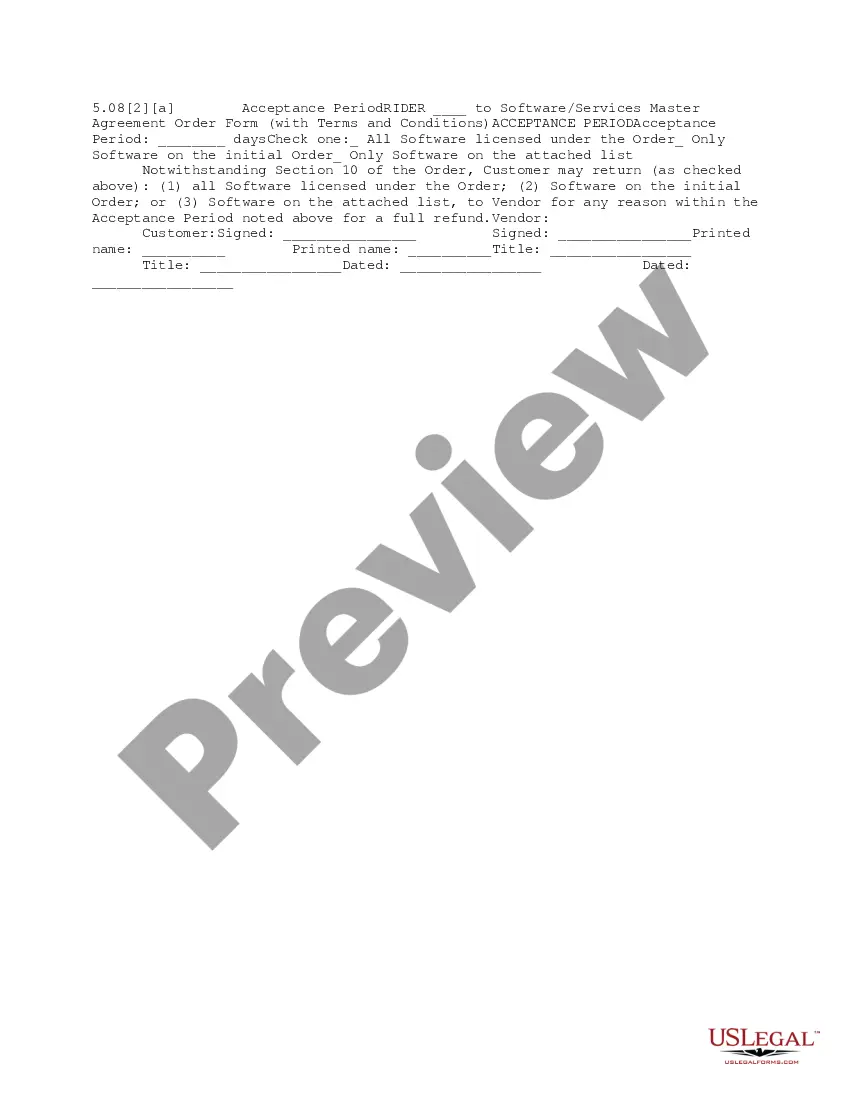

If you are a new user of US Legal Forms, here are simple guidelines for you to follow: First, ensure you have selected the correct form for your locality/county. You can review the form using the Review button and examine the form description to confirm it is suitable for you. If the form does not fulfill your requirements, use the Search section to find the appropriate form. Once you are confident the form is correct, click on the Get now button to obtain the form. Choose the pricing plan you desire and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Vermont Credit Agreement. US Legal Forms is the largest collection of legal documents where you can find various paper templates. Use the service to acquire properly crafted files that comply with state requirements.

Avoid modifying or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- Selecting the finest legal document template can be somewhat challenging.

- Numerous templates accessible online.

- Utilize the US Legal Forms website.

- The platform offers a vast array of templates.

- All of the forms are reviewed by professionals.

- Comply with state and federal regulations.

Form popularity

FAQ

Any of your Credit Agreements that have been shared with the Credit Reference Agencies, thereby appearing on your Credit Report, will directly influence your Credit Rating. Whether a Credit Agreement helps or hurts your Credit Report depends on how the account itself has been managed.

Vermont uses an annual budget. The legislature is not required to pass a balanced budget, the governor is not required to sign one, and deficits may be carried over into the following year. However, the state has budget rules that require lawmakers to balance revenues and expenditures.

You have the right to cancel a credit agreement if it's covered by the Consumer Credit Act 1974. You're allowed to cancel within 14 days - this is often called a 'cooling off' period. If it's longer than 14 days since you signed the credit agreement, find out how to pay off a credit agreement early.

In the fiscal year of 2021, the state of Vermont had state debt totaling 3.4 billion U.S. dollars. However, the local government debt was 1.1 billion U.S. dollars.

The term includes, without limitation, all amounts owed by the Borrower to the Lender at such date as a result of draws on letters of credit paid by the Lender for which the Borrower has not reimbursed the Lender, all principal, interest, fees, charges, expenses, attorneys' fees, and any other sum chargeable to any ...

The Vermont Department of Taxes collects a number of different tax types, such as personal income, corporate and business income, sales and use, meals and rooms, and property tax, to name just a few of the major taxes.

Vermont Interest Rate Laws When considering a personal loans in Vermont, the statutory interest rate for these types of unsecured, consumer loans is 12 percent. This is the maximum interest that can be charged on any personal, consumer loan in the State of Vermont.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

Vermont's Statute of Limitations on Debt The State of Vermont has a six-to-eight-year statute of limitations on written contracts, while oral contracts and collection of debt on accounts each have a six year statute of limitations. Judgements carry an eight-year statute of limitations.

California claims the top spot with a staggering $520 billion in debt. The state's large population, extensive infrastructure, and robust economy contribute to its high debt burden.