Vermont Demand for Collateral by Creditor

Description

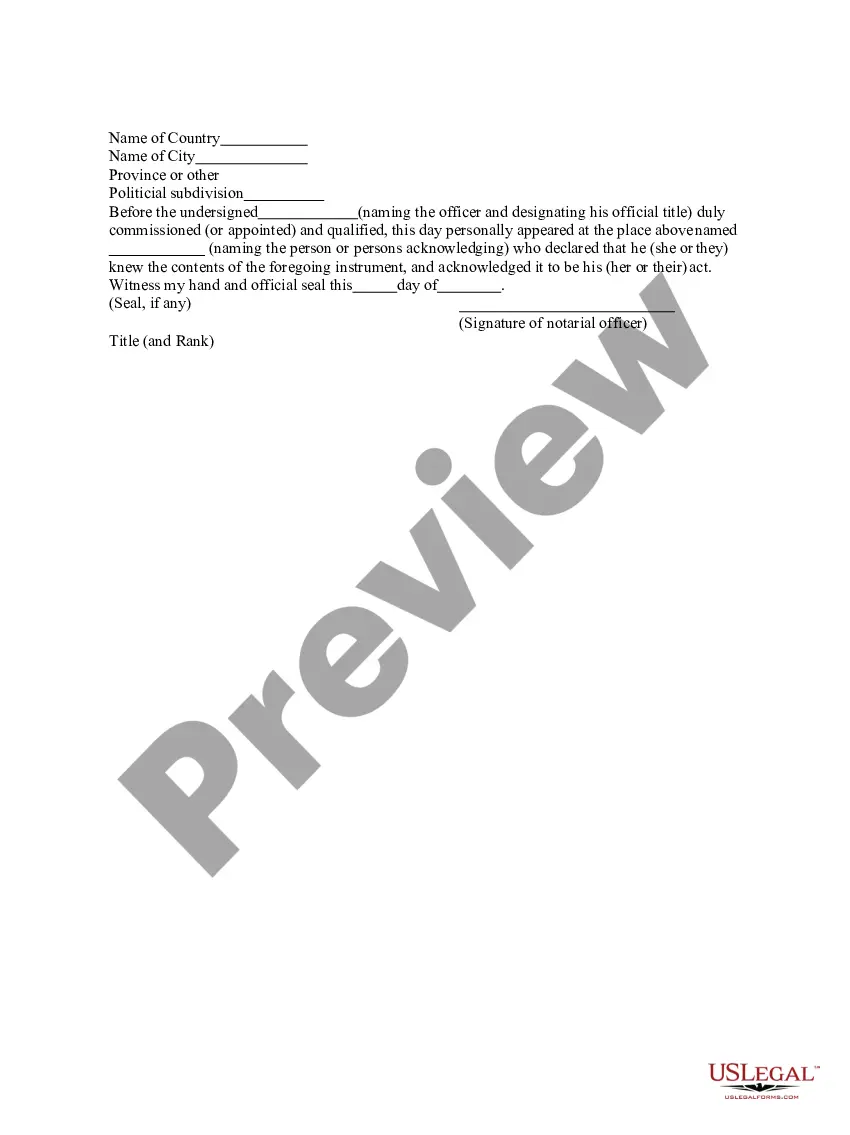

How to fill out Demand For Collateral By Creditor?

Selecting the appropriate legal document template can be a challenge.

Of course, there are numerous templates accessible online, but how can you find the legal form you require.

Utilize the US Legal Forms platform.

If you are a new user of US Legal Forms, here are essential steps to follow: First, ensure you have selected the correct form for your city/area. You can preview the form by using the Review button and read the form description to confirm it suits your needs. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are certain the form is suitable, choose the Buy now button to purchase the form. Select the pricing plan you want and enter the required information. Create your account and complete your order using your PayPal account or credit card. Choose the file format and download the legal document template to your system. Complete, modify, print, and sign the received Vermont Demand for Collateral by Creditor. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to obtain professionally crafted documents that meet state requirements.

- The service offers a wide array of templates, such as the Vermont Demand for Collateral by Creditor, suitable for both business and personal needs.

- All forms are verified by experts and adhere to federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to acquire the Vermont Demand for Collateral by Creditor.

- Use your account to browse the legal forms you have previously purchased.

- Navigate to the My documents section of your account to obtain an additional copy of the documents you require.

Form popularity

FAQ

Prejudgment interest in Vermont refers to the interest that may accrue on a legal claim from the date of damage until the court judgment. This interest compensates the prevailing party for the time they waited to receive what is rightfully owed. As a result, if you engage in a Vermont Demand for Collateral by Creditor, knowing about prejudgment interest can enhance your negotiation strategies and financial planning.

In Vermont, serious crimes such as murder do not have a statute of limitations, meaning they can be prosecuted at any time. This precedent underscores the significance of knowing your rights and seeking legal advice, especially in cases related to a Vermont Demand for Collateral by Creditor. Understanding these nuances can aid in effective decision-making and fortifying your legal stance.

It is important to note that while most states have statutes of limitations for certain actions, several states do not have a statute of limitations for specific crimes, such as murder. However, when it comes to Vermont, there are specific time frames that apply. If you are dealing with a Vermont Demand for Collateral by Creditor, understanding the state’s laws can provide clarity and help you navigate your situation.

The 7 year statute of limitations in Vermont refers to the time limit for creditors to collect on certain debts, including those associated with written agreements. Under this statute, if a creditor does not take action within seven years, they may lose the right to enforce the debt. Therefore, understanding your rights and obligations regarding a Vermont Demand for Collateral by Creditor is essential to ensure you are taking appropriate action.

The right granted to a creditor for the security of a debt is commonly known as a security interest. In the case of a Vermont Demand for Collateral by Creditor, a security interest gives the creditor a legal claim over the collateral provided by the borrower. This arrangement plays a key role in lending transactions, ensuring that creditors have at least some recourse in case of default. Utilizing platforms like uslegalforms can help you better understand and document these agreements.

The right of a creditor to use collateral to recover a debt is known as a lien. In the context of a Vermont Demand for Collateral by Creditor, a lien provides the legal authority to hold onto, or take possession of, the collateral in cases of default. This means that should a borrower fail to meet their obligations, the creditor can access these assets to offset unpaid debts. It is an important feature of secured lending that ensures accountability.

In the context of a Vermont Demand for Collateral by Creditor, a creditor with collateral is typically referred to as a secured creditor. This designation means that the creditor has a legal right to specific assets, which act as protection for the amount owed. Secured creditors enjoy a priority claim over these assets, allowing them to recover debts more effectively if the borrower defaults. Understanding this relationship is essential for navigating financial agreements.

Collateral rights refer to the legal entitlements a creditor has regarding the collateral pledged by a debtor. These rights allow creditors to take specific actions if a debtor fails to fulfill their financial obligations. Such actions can include repossessing the collateral or pursuing legal remedies for debt recovery. Familiarizing yourself with collateral rights is essential when addressing Vermont Demand for Collateral by Creditor.

The rights of a creditor debtor are defined by the terms of the security agreement and the law. Creditors typically have the right to take possession of collateral if the debtor defaults on payments. Additionally, creditors can pursue legal action to recover debts owed. Understanding these rights is fundamental when dealing with a Vermont Demand for Collateral by Creditor, as it helps both parties navigate their options effectively.

The right to redeem collateral allows a debtor to recover their pledged property by paying the total amount owed before the creditor takes possession. This right is crucial for debtors as it provides an opportunity to regain control over their assets. To exercise this right, it is essential to understand the specific terms outlined in the security agreement. In situations involving Vermont Demand for Collateral by Creditor, redemption can often prevent loss of property.