Vermont Equipment Lease - General

Description

How to fill out Equipment Lease - General?

Are you presently in a circumstance where you need documents for either business or personal purposes virtually every day.

There are numerous legal document templates available online, but finding ones you can trust isn't straightforward.

US Legal Forms offers thousands of form templates, such as the Vermont Equipment Lease - General, which are created to meet state and federal requirements.

Once you find the correct form, click on Buy now.

Choose the pricing plan you prefer, complete the necessary details to process your payment, and complete the purchase with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Vermont Equipment Lease - General template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/state.

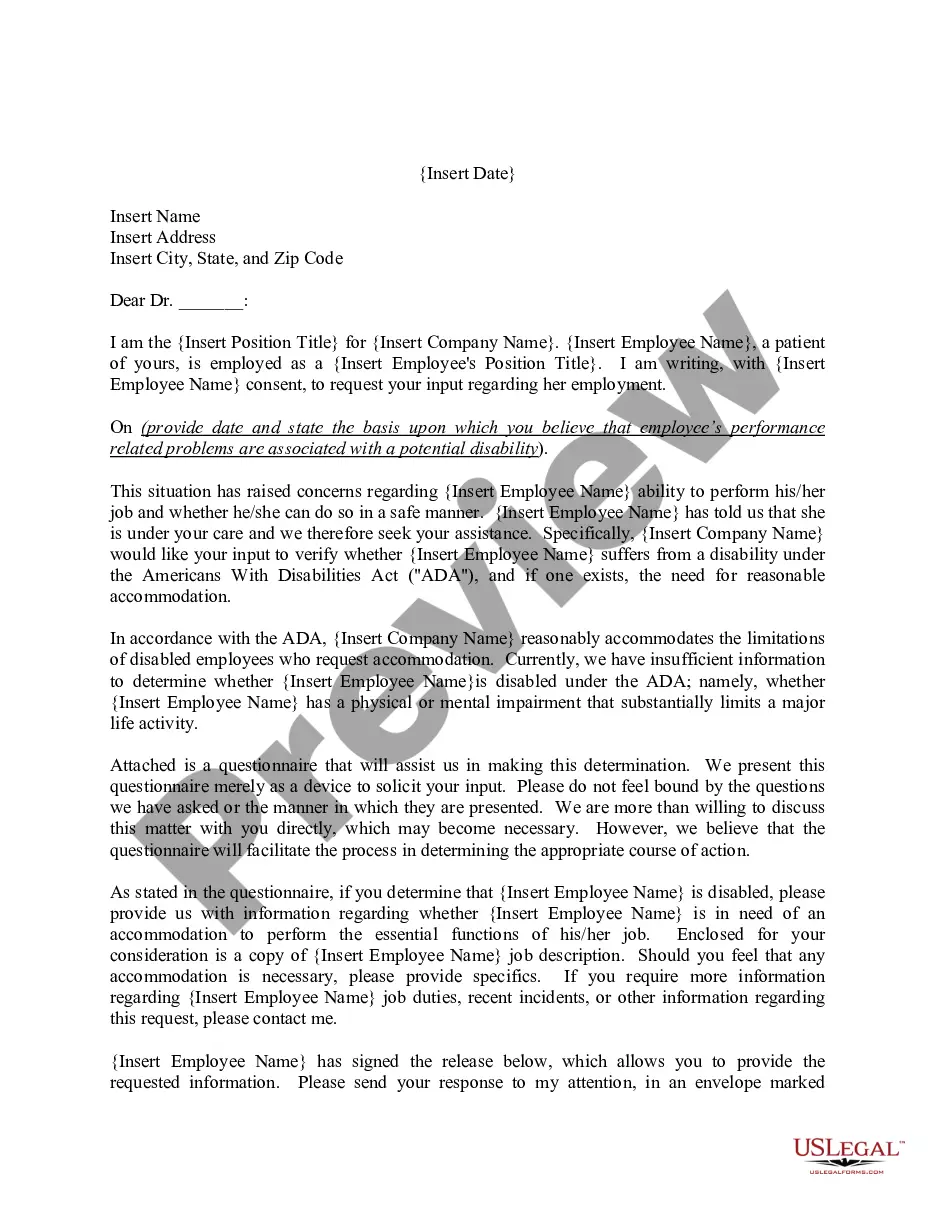

- Utilize the Review button to examine the form.

- Check the description to make sure you have selected the right form.

- If the form is not what you are searching for, use the Search section to find the template that suits your needs.

Form popularity

FAQ

To register for sales tax in Vermont, visit the Vermont Department of Taxes website. You can complete the registration online, which simplifies the process. Ensure you have your business details ready, including your Vermont Equipment Lease - General information. Registration typically allows you to collect sales tax for your transactions effectively, so it's crucial for compliance.

To get out of an equipment lease, first, review your lease agreement for any cancellation policies. Contact your lessor to discuss potential solutions, such as lease transfer or buyout options. You may also consider negotiating for a mutual termination if both parties agree. For personalized guidance, uslegalforms can offer templates and resources to facilitate this process.

Getting out of a commercial lease can vary based on the lease terms and your specific circumstances. A Vermont Equipment Lease - General may include clauses that allow for early termination under certain conditions. It's vital to assess the financial implications before making any decisions. Consulting uslegalforms can provide clarity and help you explore your options without difficulty.

If you default on a Vermont Equipment Lease - General, the lessor may take legal action to reclaim the equipment. You could face additional fees, and your credit could be negatively affected. Understanding the terms in your lease agreement can prepare you for these consequences. If you find yourself in this situation, uslegalforms offers resources to assist you in managing defaults effectively.

Exiting an equipment lease early is possible, but it often comes with penalties or fees. It is crucial to review your lease agreement for any early termination clauses that outline your options. You may also negotiate with the leasing company for a more favorable exit. Using a platform like uslegalforms can help you navigate this process and understand your rights.

Not all equipment leases qualify as operating leases. A Vermont Equipment Lease - General can be either an operating or a capital lease, depending on its specific terms. An operating lease generally allows for easier upgrades and lower monthly payments, making it a popular choice for businesses looking for flexibility without ownership burdens.

To set up a lease to own agreement, you first need to discuss your intentions with a vendor that specializes in Vermont Equipment Lease - General. Clearly outline the terms, including payment structure and the timeframe for ownership transfer, in the lease document. Ensure both parties understand their obligations before signing the agreement for a smooth process.

A good equipment lease rate typically depends on various factors such as the type of equipment and the lease duration. In general, rates for a Vermont Equipment Lease - General can vary widely, but many businesses find rates between 3% and 8% to be competitive. It's essential to compare offers from multiple providers to ensure you receive a favorable rate that meets your budget.

Setting up a Vermont Equipment Lease - General involves a few simple steps. First, identify the equipment you want to lease and gather necessary documentation, such as financial statements. After that, consult with a leasing company to choose the right lease type and terms that suit your needs. Finally, complete the lease agreement to formalize the arrangement.

The current sales tax rate in Vermont is 6.25%, which applies to the majority of sales. This rate can impact your overall costs, especially in business contracts. If you're looking into a Vermont Equipment Lease - General, it's wise to include this tax rate in your calculations to ensure accurate budgeting.