A claim may be presented to the personal representative (i.e., executor or administrator) at any time before the estate is closed if suit on the claim has not been barred by the general statute of limitations or a statutory notice to creditors. Claims may generally be filed against an estate on any debt or other monetary obligation that could have been brought against the decedent during his/her life.

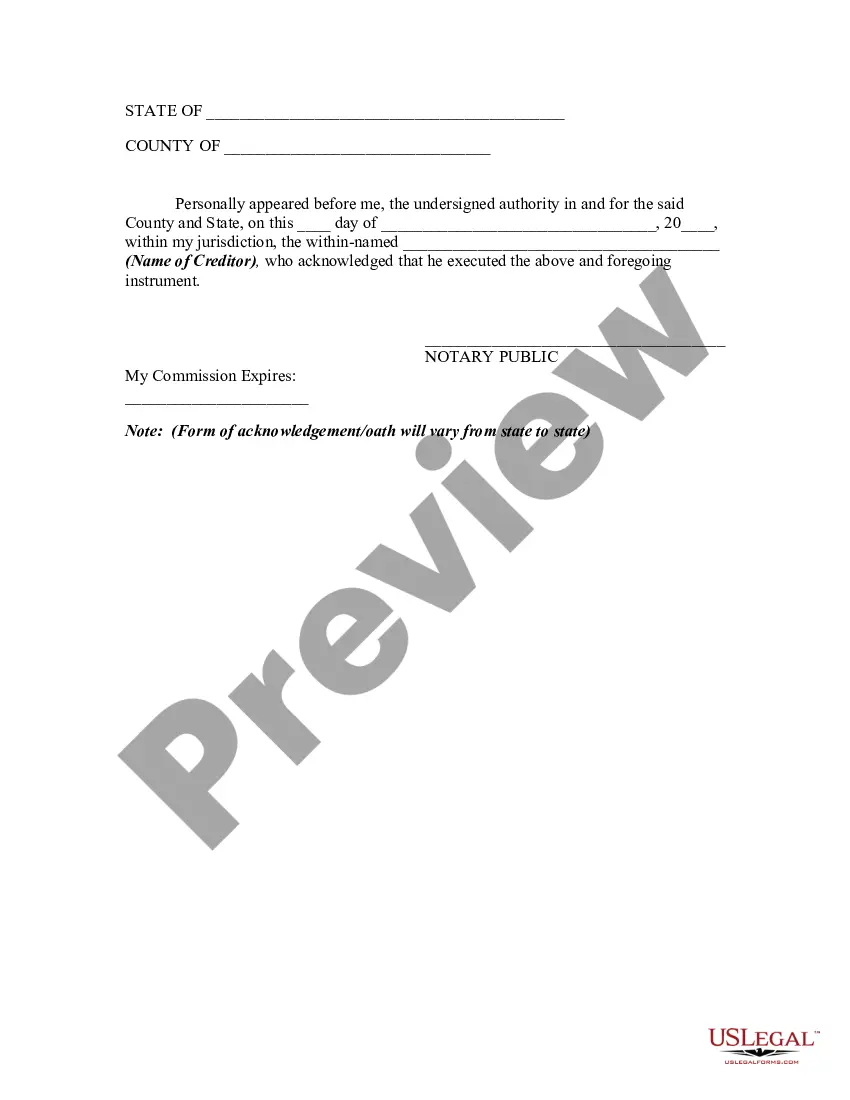

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Vermont Release of Claims Against an Estate by Creditor: Explained with Essential Details Introduction: Understanding the Vermont Release of Claims Against an Estate by Creditor is crucial for creditors seeking to collect debts owed by a deceased individual. This detailed description will clarify the purpose, requirements, and various types of releases associated with this legal document. I. Overview of the Vermont Release of Claims Against an Estate by Creditor: The Vermont Release of Claims Against an Estate by Creditor is a legal document that allows a creditor to relinquish their right to collect any debt owed to them by a deceased debtor from the debtor's estate. This release protects the executor and beneficiaries from future claims or lawsuits initiated by the creditor. II. Purpose and Benefits of the Release: 1. Debt Resolution: By signing the release, creditors acknowledge that payment cannot be obtained from the estate and agree not to pursue legal actions or claims against the assets or beneficiaries. 2. Executor Protection: The release grants protection to the executor by ensuring that all debts have been properly addressed and releases them from personal liability. 3. Estate Closure: A release eliminates potential obstacles that may delay the estate settling process, allowing for a smoother and quicker distribution of assets to beneficiaries. III. Key Elements and Requirements of a Vermont Release of Claims Against an Estate by Creditor: 1. Identification: The release must include accurate identification details of the creditor, debtor, and estate. 2. Debt Specification: Clearly outline the debt, including the amount owed, date of origination, and any supporting documentation. 3. Consideration: Specify any consideration exchanged for signing the release, which may include partial payment or other negotiated terms. 4. Intent Language: The release should contain explicit language indicating the creditor's intention to release the debtor's estate from further liability. 5. Legal Validity: The document must comply with Vermont state laws to be legally enforceable. IV. Types of Vermont Release of Claims Against an Estate by Creditor: 1. General Release: This release absolves the creditor's interests against the entire estate, including all assets and beneficiaries. 2. Limited Release: This type of release specifies certain exemptions or limitations, indicating that the creditor is waiving claims against specific assets or beneficiaries. 3. Conditional Release: A release that becomes effective only upon fulfillment of specific conditions agreed upon by both parties. 4. Full and Final Release: A comprehensive release that covers all debts, claims, or actions against the estate, providing a complete resolution. Conclusion: Understanding the Vermont Release of Claims Against an Estate by Creditor is essential for creditors navigating through the complex intersect of debt collection, estate settlement, and beneficiaries' rights. By adhering to the legal requirements and comprehending the different types of releases available, creditors can protect their interests while facilitating the efficient resolution of the estate.