Vermont Unrestricted Charitable Contribution of Cash In the state of Vermont, individuals and businesses have the opportunity to make charitable contributions of cash to various organizations and causes. The Vermont Unrestricted Charitable Contribution of Cash program allows individuals and businesses to provide financial support to nonprofit organizations operating within the state. Unrestricted charitable contributions are donations made without restrictions or conditions on how the funds should be used by the receiving organization. This means that the nonprofit has the freedom to allocate the cash according to its most pressing needs, whether it be supporting programs, covering operational expenses, or funding specific projects. By participating in the Vermont Unrestricted Charitable Contribution of Cash program, individuals and businesses can contribute to the overall well-being of their local communities and the state as a whole. These charitable donations play a crucial role in helping organizations address pressing social issues, support vulnerable populations, and foster positive change in Vermont. Some key benefits of making unrestricted charitable contributions of cash include: 1. Supporting Diverse Causes: Vermont residents can choose from a wide range of organizations to donate to, allowing them to support causes that align with their values and passions. Whether its environmental conservation, education, healthcare, arts and culture, or social justice, there are numerous nonprofit entities to address a variety of needs. 2. State Tax Deductions: Vermont offers tax incentives to individuals and businesses who contribute to qualified charitable organizations. Contributions made to organizations eligible under the Vermont Unrestricted Charitable Contribution of Cash program may qualify for tax deductions, reducing the contributor's overall tax burden. 3. Strengthening Communities: Unrestricted cash donations enable nonprofits to provide critical services and support to individuals and families in need. By injecting funds into these organizations, contributions can help tackle issues like poverty, hunger, homelessness, and lack of access to education or healthcare, thereby strengthening local communities. In addition to unrestricted cash contributions, there may be other types of charitable contribution options in Vermont: 1. Restricted Charitable Contribution of Cash: Unlike unrestricted contributions, restricted charitable donations specify how the funds should be used by the receiving organization. Donors can designate a particular project or program to support, ensuring that their contribution directly impacts their chosen area of interest. 2. In-Kind Contributions: Instead of cash, individuals and businesses can also make in-kind contributions, where they donate goods or services needed by nonprofit organizations. Common examples include donating food, clothing, medical supplies, office equipment, or professional services such as legal or marketing assistance. In conclusion, the Vermont Unrestricted Charitable Contribution of Cash program provides an avenue for individuals and businesses to support nonprofit organizations in their efforts to improve the quality of life in Vermont. Whether through unrestricted or restricted cash contributions, these charitable donations play a pivotal role in addressing various social and economic challenges faced by communities in the state. By participating in this program, contributors can make a positive impact and help create a brighter future for Vermont residents in need.

Vermont Unrestricted Charitable Contribution of Cash

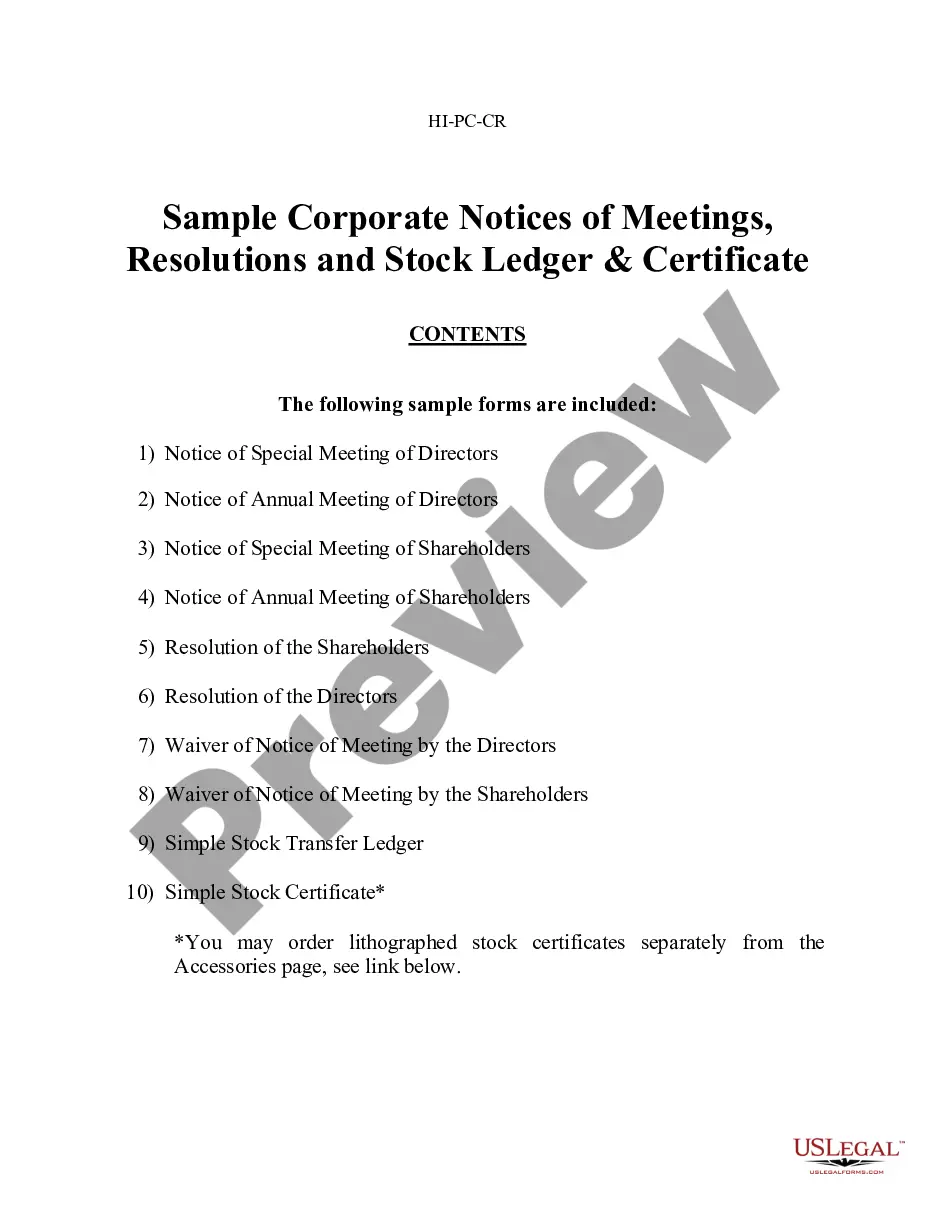

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

Are you inside a position in which you will need paperwork for both enterprise or individual uses nearly every day time? There are plenty of legitimate record templates available on the Internet, but locating kinds you can rely on is not simple. US Legal Forms delivers a large number of type templates, just like the Vermont Unrestricted Charitable Contribution of Cash, that are composed to satisfy state and federal demands.

When you are presently informed about US Legal Forms site and get your account, just log in. Afterward, it is possible to download the Vermont Unrestricted Charitable Contribution of Cash template.

If you do not offer an accounts and wish to begin to use US Legal Forms, follow these steps:

- Get the type you require and make sure it is for the proper town/region.

- Utilize the Preview switch to analyze the form.

- See the outline to actually have selected the right type.

- In case the type is not what you`re trying to find, utilize the Look for field to obtain the type that fits your needs and demands.

- Once you discover the proper type, just click Buy now.

- Choose the prices program you need, complete the required info to produce your money, and pay money for the transaction making use of your PayPal or Visa or Mastercard.

- Pick a handy data file structure and download your version.

Locate every one of the record templates you possess bought in the My Forms food list. You can aquire a further version of Vermont Unrestricted Charitable Contribution of Cash whenever, if possible. Just click on the needed type to download or print the record template.

Use US Legal Forms, the most considerable variety of legitimate kinds, in order to save time and avoid mistakes. The assistance delivers appropriately manufactured legitimate record templates that you can use for an array of uses. Produce your account on US Legal Forms and begin making your daily life easier.

Form popularity

FAQ

To be clear, you can claim work expenses up to $300 without receipts IN TOTAL (not each item), with basic substantiation. This means that if you have no receipts for work-related purchases, you can still claim up to $300 worth on your tax return.

Unlike specific individual charitable donations, deductions for noncash donations by a trust generally are limited to the asset's cost basis.

Vermont taxpayers may now deduct five percent of the first $20,000 in eligible charitable contributions made during the taxable year from their tax liability for that year. Vermont's tax forms will include easy to follow instructions regarding how Vermonters can claim this Tax Credit.

Cash or property donations worth more than $250: The IRS requires you to get a written letter of acknowledgment from the charity. It must include the amount of cash you donated, whether you received anything from the charity in exchange for your donation, and an estimate of the value of those goods and services.

The new threshold is 60 percent of AGI for cash contributions held for over a year, and 30 percent of AGI for non-cash assets. The good news is that the standard deduction is now higher to account for inflation, rising to $12,950 for people who file individually and $25,900 for married couples who file joint returns.

For contributions of non-cash assets held more than one year, the limit is 30% of your adjusted gross income (AGI). Your deduction limit will be 60% of your AGI for cash gifts.

Federal law limits cash contributions to 60 percent of your federal adjusted gross income (AGI). California limits cash contributions to 50 percent of your federal AGI.

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases.