Vermont Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift

Category:

State:

Multi-State

Control #:

US-00577BG

Format:

Word;

Rich Text

Instant download

Description

This form is an acknowledgment by a charitable or educational nonprofit organization of a previously pledged gift.

How to fill out Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift?

Have you ever found yourself in a situation where you require documents for both business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding forms you can trust is not easy.

US Legal Forms provides thousands of form templates, such as the Vermont Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift, which are designed to meet federal and state requirements.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Vermont Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/region.

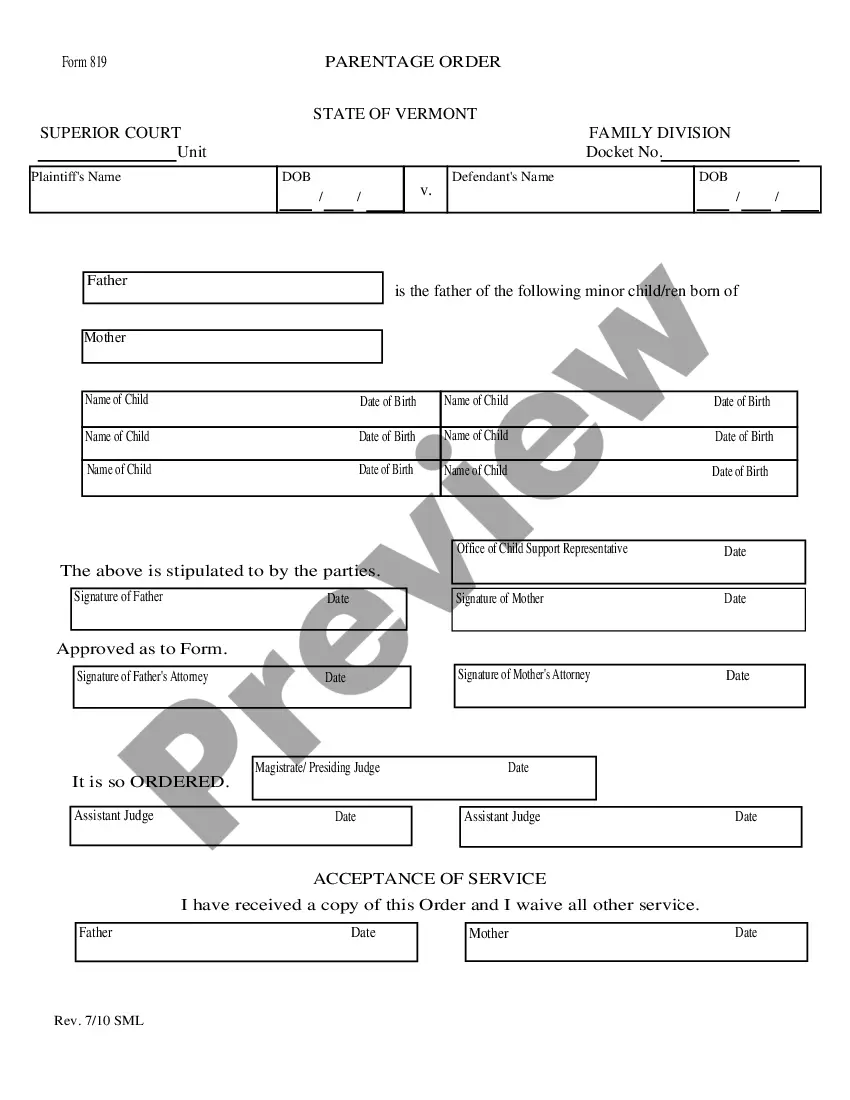

- Utilize the Review feature to inspect the form.

- Check the description to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search bar to find the form that meets your needs and criteria.

- Once you find the appropriate form, click on Acquire now.

- Choose the payment plan you prefer, enter the required information to set up your account, and finalize the transaction using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Vermont Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift at any time, if necessary. Just click on the desired form to download or print the document template.

- Utilize US Legal Forms, the largest collection of legal forms, to save time and prevent mistakes. The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.