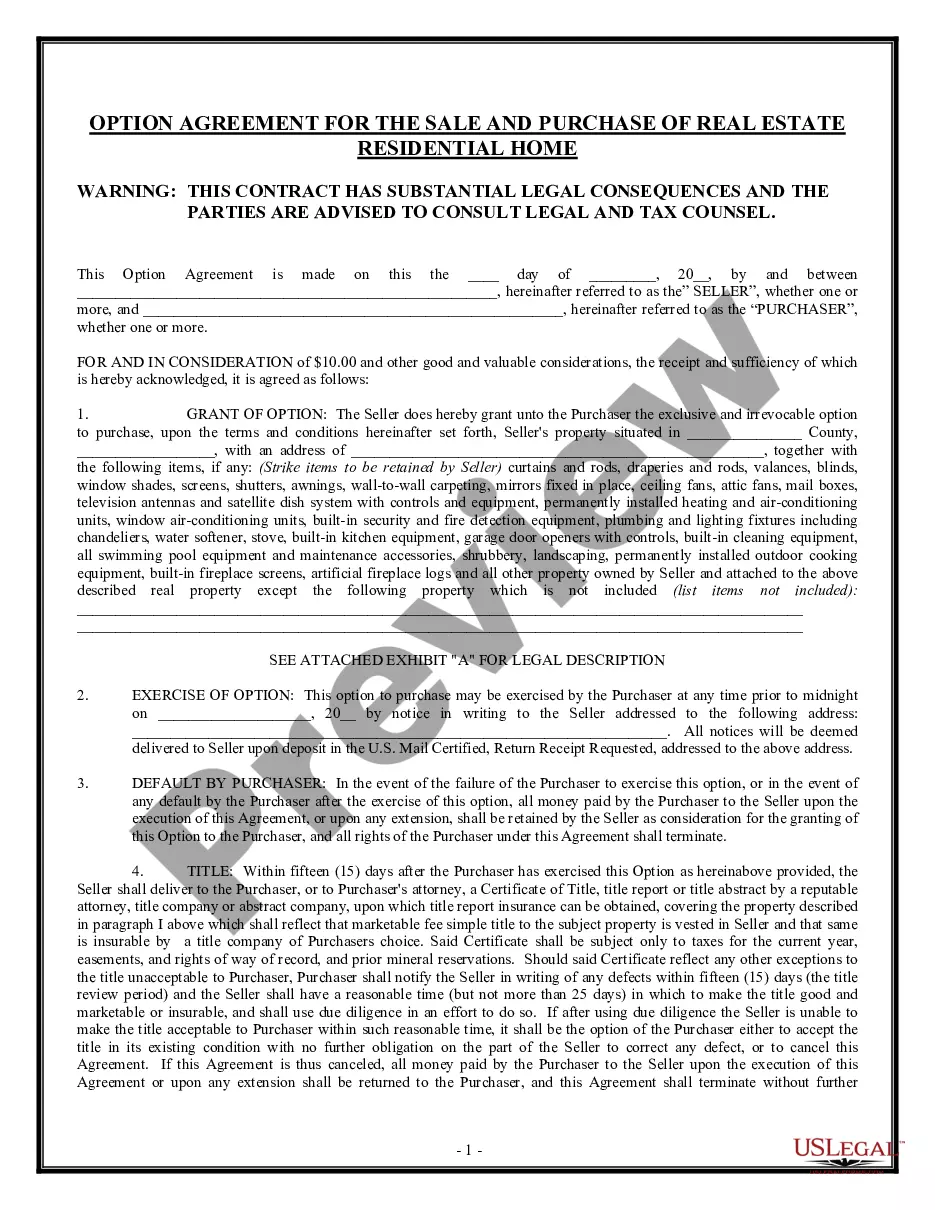

Vermont Option For the Sale and Purchase of Real Estate - Residential Home

Description

How to fill out Option For The Sale And Purchase Of Real Estate - Residential Home?

If you intend to complete, obtain, or produce legal document templates, utilize US Legal Forms, the foremost repository of legal forms, accessible online.

Take advantage of the website's straightforward and user-friendly search feature to locate the documents you require.

Various templates for business and personal purposes are organized by categories and suggestions, or keywords.

Each legal document template you acquire is permanently yours. You will have access to every document you have downloaded in your account.

Select the My documents section and choose a document to print or download again. Stay competitive and obtain and print the Vermont Option For the Sale and Purchase of Real Estate - Residential Home with US Legal Forms. There are millions of specialized and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to find the Vermont Option For the Sale and Purchase of Real Estate - Residential Home with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Vermont Option For the Sale and Purchase of Real Estate - Residential Home.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/region.

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Vermont Option For the Sale and Purchase of Real Estate - Residential Home.

Form popularity

FAQ

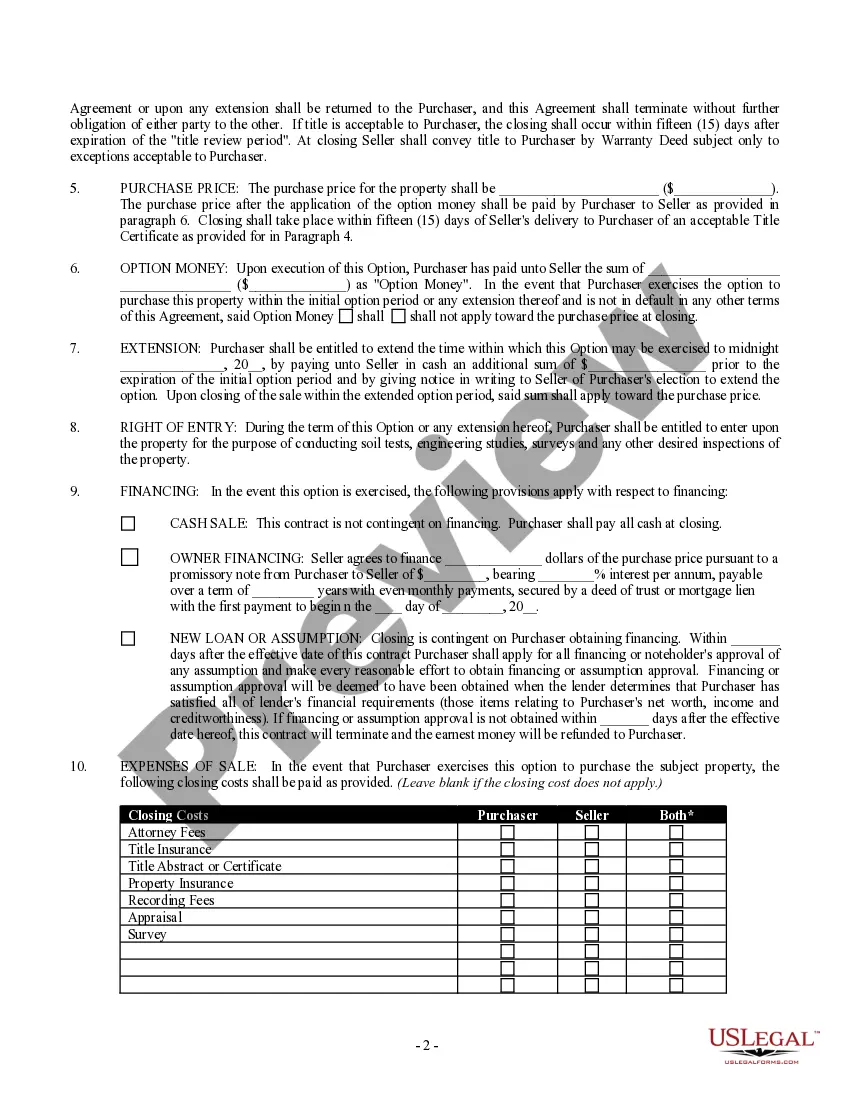

When a home purchase closes, the home buyer is required to pay, among other closing costs, the Vermont Property Transfer Tax. The buyer is taxed is at a rate of 0.5% of the first $100,000 of the home's value and 1.45% of the remaining portion of the value.

In general, average closing costs in Vermont will range from about 2% to 3% of the total loan/value of the house, although the percentage will be lower with higher priced homes since certain costs (ie, appraisals and credit reports) don't vary much in price regardless of the type of home you are buying.

If you've been trying to buy a home in Vermont recently, you may have already learned this the hard way: it's not an easy process during the pandemic.An analysis by financial literacy website HowMuch.net looked at housing affordability nationwide and, using median home prices, median income levels and mortgage rates,

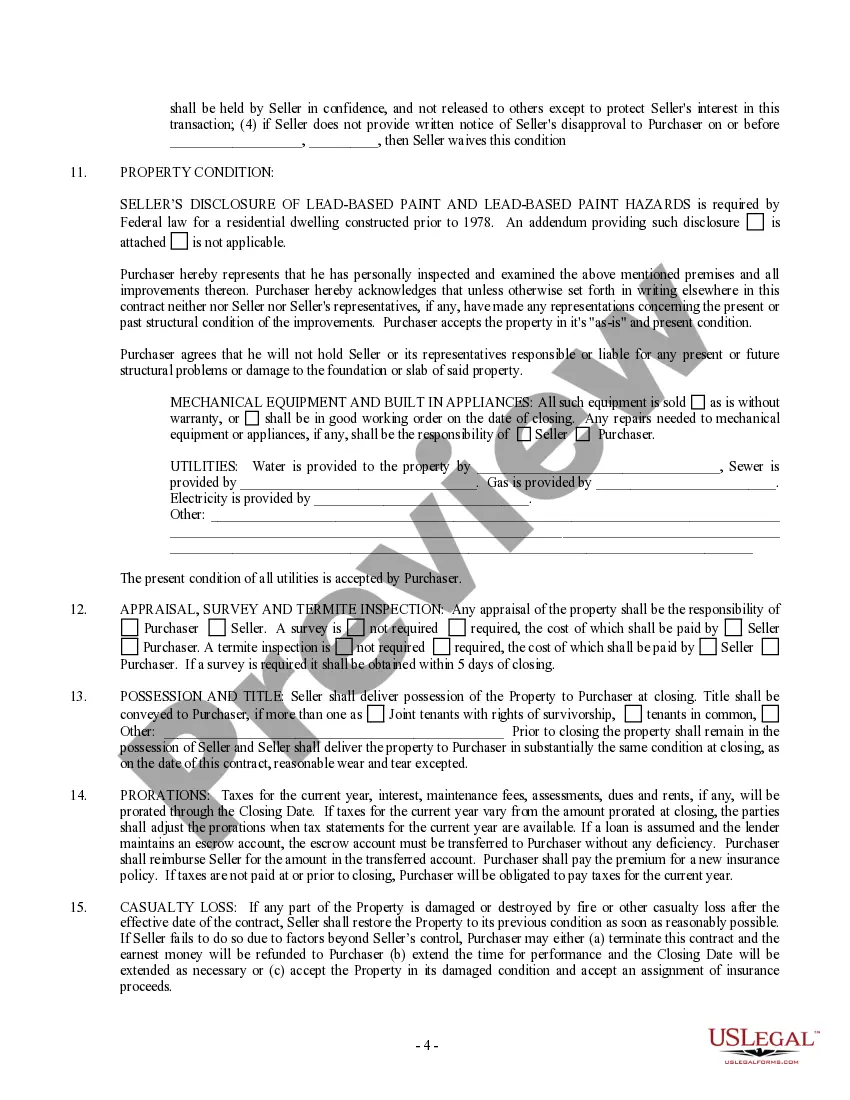

Even if you are simply buying a home in Vermont as-is, it is worthwhile to engage a real estate attorney to help ensure there are no clear nonconforming uses or permit issues that would require modifications upon a transfer of ownership.

Not directly, no. Transfer taxes aren't tax deductible, unless you're selling a rental or investment property, in which case they can be deducted as a standard business expense.

A real estate transfer tax, sometimes called a deed transfer tax, is a one-time tax or fee imposed by a state or local jurisdiction upon the transfer of real property. Usually, this is an ad valorem tax, meaning the cost is based on the price of the property transferred to the new owner.

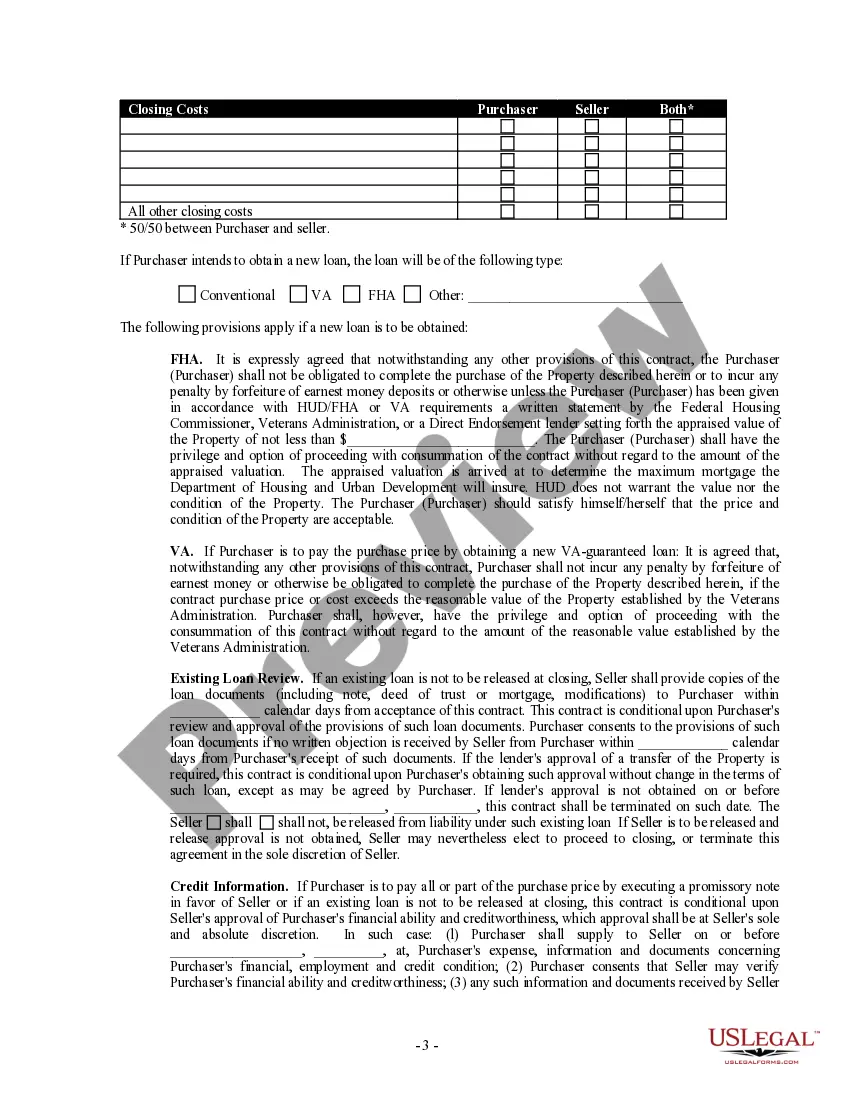

Typically, mortgage lenders in Vermont want you to contribute 20% of the purchase price as a down payment.

When real estate is sold in Vermont, state income tax is due on the gain from the sale, whether the seller is a resident, part-year resident, or nonresident. If the seller is a nonresident, the buyer is required to withhold 2.5% of the sale price and remit it to the Vermont Department of Taxes.

Vermont Capital Gains Tax Most capital gains in Vermont are subject to the personal income tax rates of 3.35% - 8.75%. This includes all short-term gains, but long term-gains may be eligible for an exclusion.

What are the steps to buying a house in Vermont?Save for down payment.Get pre-approved for a mortgage.Choose your preferred Vermont.Partner with the right real estate agent in Vermont.Go house hunting.Make a strong offer.Pass inspections and appraisal.Do a final walkthrough and close.