Vermont Credit Cardholder's Report of Lost or Stolen Credit Card

Description

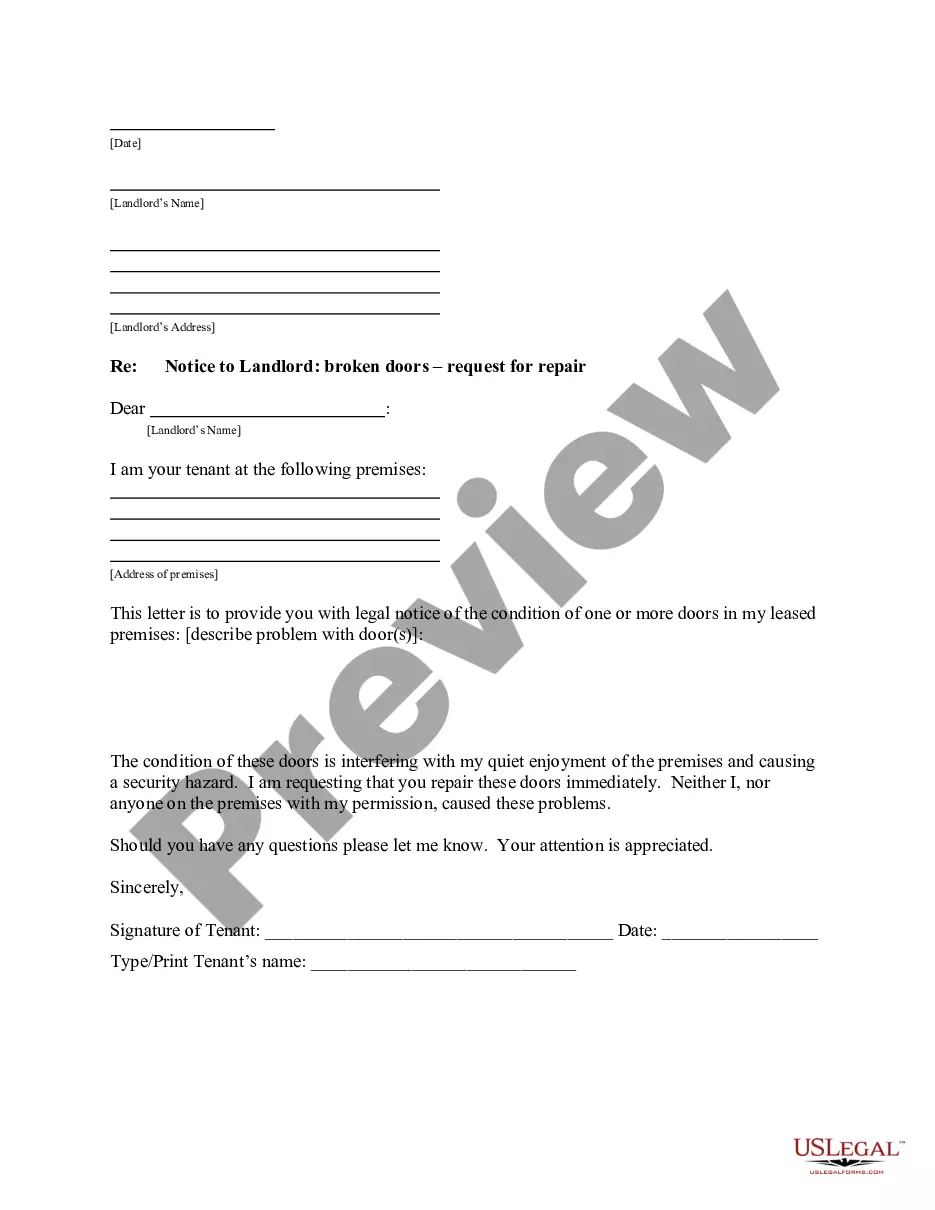

How to fill out Credit Cardholder's Report Of Lost Or Stolen Credit Card?

If you wish to full, download, or produce legal papers themes, use US Legal Forms, the most important assortment of legal types, that can be found on the web. Utilize the site`s simple and easy practical search to obtain the documents you need. A variety of themes for organization and person purposes are categorized by groups and claims, or search phrases. Use US Legal Forms to obtain the Vermont Credit Cardholder's Report of Lost or Stolen Credit Card within a handful of click throughs.

When you are previously a US Legal Forms customer, log in in your account and click on the Down load button to get the Vermont Credit Cardholder's Report of Lost or Stolen Credit Card. Also you can gain access to types you formerly saved from the My Forms tab of your account.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have chosen the shape to the correct metropolis/land.

- Step 2. Utilize the Preview method to examine the form`s content material. Do not forget to see the description.

- Step 3. When you are unhappy with all the kind, utilize the Lookup discipline at the top of the screen to find other types of your legal kind format.

- Step 4. Once you have found the shape you need, select the Acquire now button. Opt for the pricing program you choose and add your qualifications to sign up for the account.

- Step 5. Approach the financial transaction. You can use your charge card or PayPal account to perform the financial transaction.

- Step 6. Find the formatting of your legal kind and download it on your own device.

- Step 7. Complete, modify and produce or signal the Vermont Credit Cardholder's Report of Lost or Stolen Credit Card.

Every legal papers format you buy is yours forever. You may have acces to each and every kind you saved in your acccount. Click the My Forms area and pick a kind to produce or download yet again.

Be competitive and download, and produce the Vermont Credit Cardholder's Report of Lost or Stolen Credit Card with US Legal Forms. There are thousands of professional and state-specific types you can use for your personal organization or person requirements.

Form popularity

FAQ

There are several ways people steal credit card numbers, including through your mail, email, public Wi-Fi networks, and data breaches. Keep careful watch of your credit card statements, credit report, and personal information so you can act quickly if you see any suspicious activity.

Fraudsters might obtain your information through phishing or hacking, and some criminals sell card data online on the dark web. The thief doesn't need the physical card since online purchases only require that they know your name, account number and security code.

Contact your credit card issuer When you speak to a representative, tell them that your account was compromised and list the fraudulent transactions. The bank will cancel the card (this doesn't mean your account is closed) and mail you a new card with a new account number, expiration date and security code.

Call ? or get on the mobile app ? and report the loss or theft to the bank or credit union that issued the card as soon as possible. Federal law says you're not responsible to pay for charges or withdrawals made without your permission if they happen after you report the loss.

Credit cards can be stolen in a variety of ways: Through theft of a physical card, via data breaches, by card skimmers?the list goes on. Zero liability protections may prevent you from being financially responsible for fraud, but a credit card theft remains an inconvenience at best and a nightmare at worst.

Many phishing emails try to get you to click a button or link that takes you to a familiar-looking fraudulent site to enter your account information. Phishing emails may also prompt you to click a link or download a file containing spyware, which hackers can use to export your card details and other information.

5 steps to take if you're a victim of credit card fraud. ... Call your credit card company immediately. ... Check your credit card accounts and change your passwords. ... Notify the credit bureaus and call the police if necessary. ... Monitor your statements and credit reports. ... Check your online shopping accounts. ... Bottom line.

When you find out that your credit card has been lost or stolen, call your bank to report the loss. You can also block your card from your online banking app or via net banking. The bank will cancel the card and send you a new card with a new account number, expiration date, and security code.