Vermont Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement

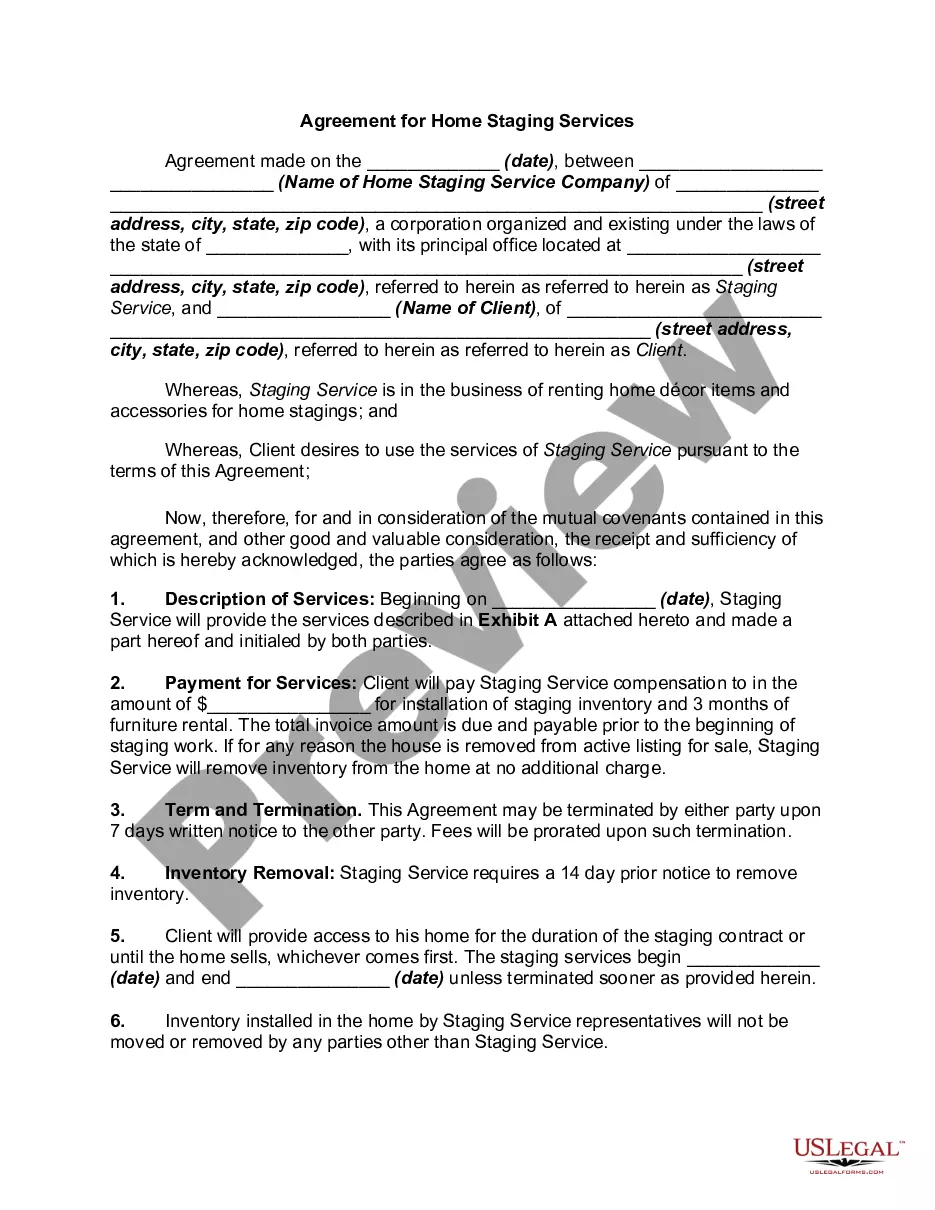

Description

How to fill out Balloon Secured Note Addendum And Rider To Mortgage, Deed Of Trust Or Security Agreement?

Are you currently in a situation where you require paperwork for either business or personal purposes on a regular basis.

There are numerous legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers a wide array of document templates, including the Vermont Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement, which are designed to comply with federal and state regulations.

Once you find the right template, click on Purchase now.

Choose the pricing plan you prefer, enter the required information to create your account, and complete the transaction using your PayPal or credit card. Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Vermont Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement at any time if needed. Simply select the desired template to download or print the document template. Use US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Vermont Balloon Secured Note Addendum and Rider to Mortgage, Deed of Trust or Security Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the template you need and ensure it is for your specific state/region.

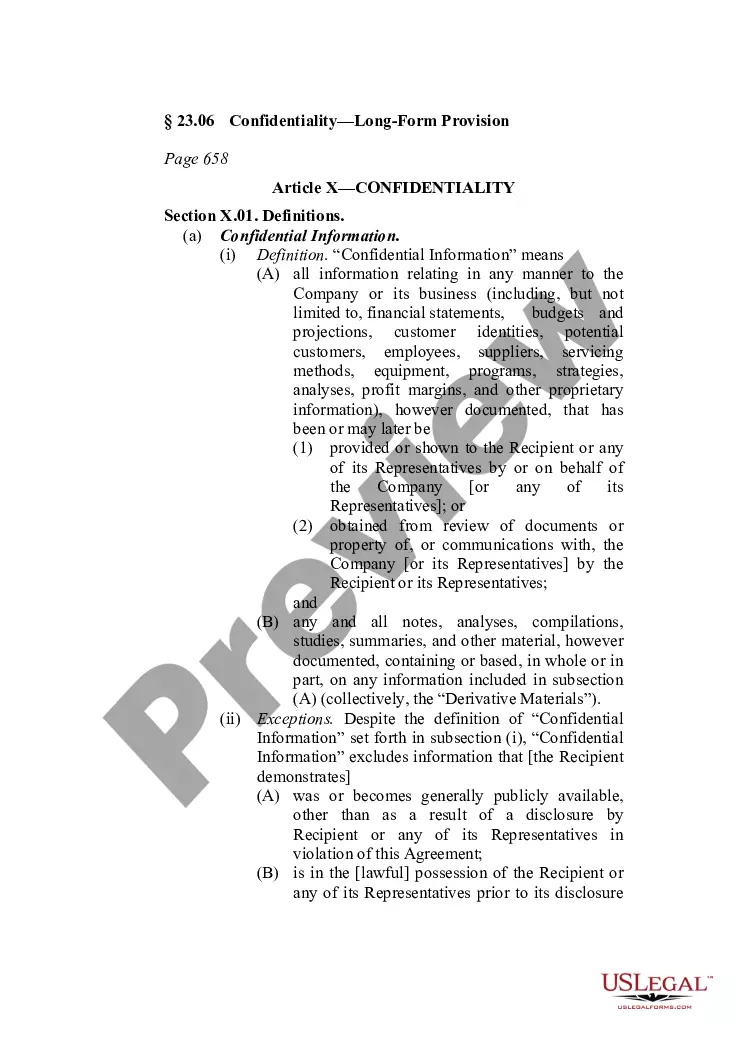

- Use the Preview button to review the document.

- Read the description to confirm you have selected the correct template.

- If the template is not what you are looking for, utilize the Search section to find the document that meets your needs and requirements.

Form popularity

FAQ

Cons of balloon payments Unsecured loans with balloon payments usually have a higher interest rate than conventional loans. Paying that large balloon payment at the end of the loan may be financially difficult for your business.

A balloon payment is a larger-than-usual one-time payment at the end of the loan term. If you have a mortgage with a balloon payment, your payments may be lower in the years before the balloon payment comes due, but you could owe a big amount at the end of the loan.

A secured promissory note is an agreement where the borrower puts something of value up as collateral to safeguard the value of the loan. In the event the borrower is unable to make payments and defaults on the loan, a secured promissory note empowers the lender to take possession of the collateral in lieu of payment.

Balloon loans can offer flexibility in the initial loan period by providing a low payment. Still, borrowers should have a plan to pay the remaining balance or refinance before the payment comes due. These loans do have their place?for those who only need to borrow for a short time, they can offer significant savings.

A balloon payment is a lump sum payment that is significantly larger than the monthly payments and paid at the end of a loan's term. Unlike loans that have a series of fixed payments to pay off the balance of the loan, a loan that includes a balloon payment is made up of lower fixed payments and a final larger payment.

Example of a Balloon Loan Let's say a person takes out a $200,000 mortgage with a seven-year term and a 4.5% interest rate. Their monthly payment for seven years is $1,013. At the end of the seven-year term, they owe a $175,066 balloon payment.

A Promissory Note with Balloon Payments is a loan contract that enables a lender set loan terms with one or more larger payments at the end. This lending document helps you to clarify the terms of a loan, define the payment schedule, and provide an amortization table, if the loan includes interest.

When the loan is interest-only, you only pay interest throughout the life of the loan. The final payment on the loan is called a balloon payment and equals the entire principal. This amount is due at the end of the loan period.