A Vermont Balloon Secured Note refers to a type of financial instrument that is utilized for fundraising purposes, typically issued by a borrower in Vermont. This note is secured by collateral, which serves as a guarantee for the repayment of the loan. The term "balloon" in Vermont Balloon Secured Note signifies that the loan repayment is structured such that a large or "balloon" payment is due at the end of the loan term, commonly referred to as the maturity date. The Vermont Balloon Secured Note is often attractive to both borrowers and lenders due to its flexible terms and potentially lower interest rates. Borrowers often find this note beneficial as it allows for lower monthly payments over the loan term until the balloon payment is due. Lenders, on the other hand, may find it appealing since they receive regular interest payments prior to the final lump sum payment. There might be various types of Vermont Balloon Secured Notes based on the specific requirements of the borrower and the lender. These variations may include terms such as loan duration, interest rate, collateral type, and repayment structure. For instance, some types of Vermont Balloon Secured Notes could have a shorter loan term with a larger balloon payment compared to others. Alternatively, different notes may feature varying interest rates based on market conditions or other factors. In summary, a Vermont Balloon Secured Note is a financial instrument used in fundraising where the repayment of the loan is secured by collateral and includes a sizable balloon payment at the end of the loan term. It offers flexibility to borrowers through lower monthly payments, while also providing lenders with regular interest payments until the final lump sum payment is due.

Vermont Balloon Secured Note

Description

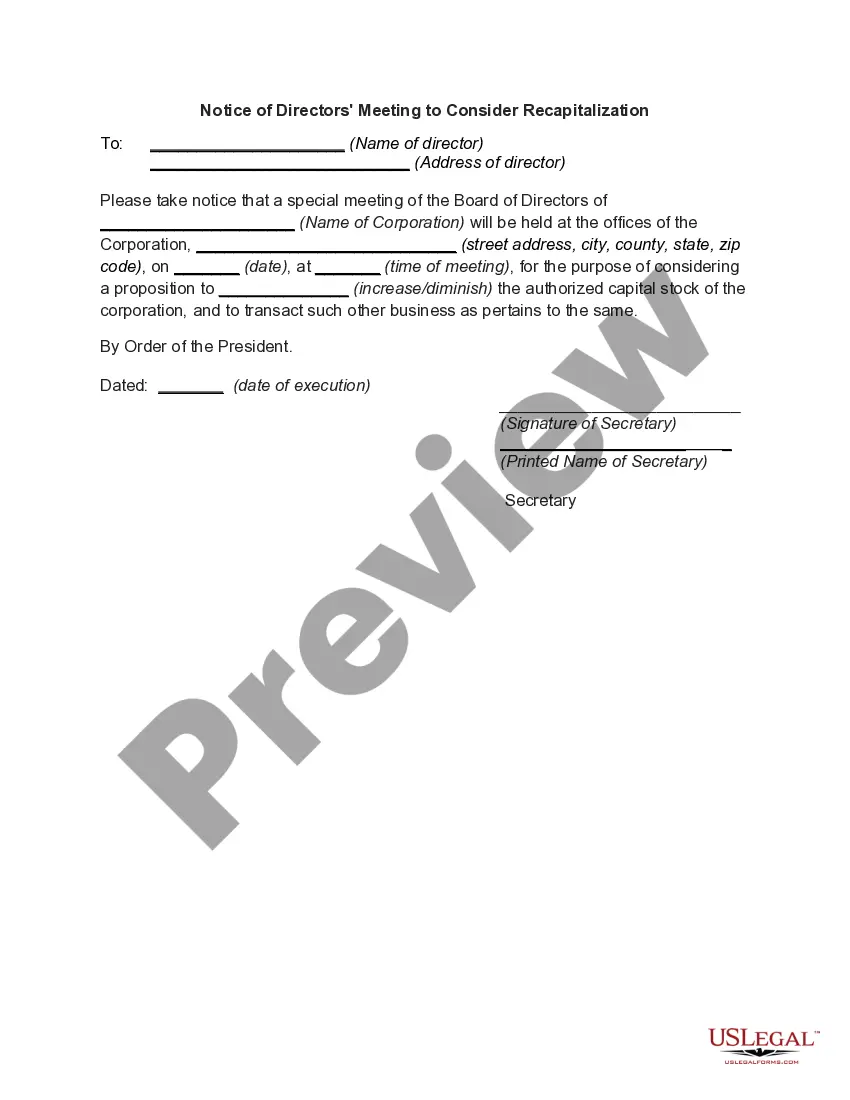

How to fill out Vermont Balloon Secured Note?

You are able to invest hours online attempting to find the legal record format that suits the federal and state requirements you want. US Legal Forms supplies a huge number of legal forms that happen to be examined by professionals. It is possible to download or printing the Vermont Balloon Secured Note from our services.

If you already have a US Legal Forms account, it is possible to log in and click on the Acquire switch. Following that, it is possible to total, modify, printing, or indication the Vermont Balloon Secured Note. Every single legal record format you get is the one you have forever. To obtain another backup of the acquired kind, go to the My Forms tab and click on the corresponding switch.

If you are using the US Legal Forms web site the first time, stick to the straightforward guidelines beneath:

- Very first, ensure that you have chosen the proper record format to the county/town that you pick. Look at the kind description to make sure you have selected the correct kind. If offered, utilize the Preview switch to search throughout the record format too.

- If you would like get another edition from the kind, utilize the Lookup area to get the format that suits you and requirements.

- After you have discovered the format you need, click on Purchase now to proceed.

- Choose the rates plan you need, enter your credentials, and register for a merchant account on US Legal Forms.

- Full the financial transaction. You can use your bank card or PayPal account to purchase the legal kind.

- Choose the structure from the record and download it in your system.

- Make alterations in your record if needed. You are able to total, modify and indication and printing Vermont Balloon Secured Note.

Acquire and printing a huge number of record templates making use of the US Legal Forms website, which provides the most important collection of legal forms. Use professional and condition-particular templates to tackle your small business or person needs.