Title: Understanding Vermont Sale of Business — Landlord's Consent to Assignment of Lease — Asset Purchase Transaction: A Detailed Guide Keywords: Vermont, sale of business, landlord's consent, assignment of lease, asset purchase transaction Introduction: In Vermont, the process of selling a business often involves the transfer of lease rights from the current tenant to the new buyer. This transaction requires the landlord's consent to assign the lease agreement to the buyer. This detailed guide explores the nuances of the Vermont Sale of Business — Landlord's Consent to Assignment of Lease — Asset Purchase Transaction, including different types and considerations to keep in mind. 1. Vermont Sale of Business — Landlord's Consent to Assignment of Lease — Asset Purchase Transaction: This transaction refers to the legal process involved in the transfer of a business, accompanied by an assignment of lease rights. The buyer acquires the assets of the business while assuming the lease obligations from the seller. This arrangement necessitates obtaining the landlord's consent for the assignment of the existing lease agreement. 2. Types of Vermont Sale of Business — Landlord's Consent to Assignment of Lease — Asset Purchase Transaction: a. Commercial Sale of Business: In commercial transactions, businesses in various industries, such as retail, restaurants, or offices, can be sold along with the assignment of the lease to the new buyer. b. Residential Sale of Business: In some cases, residential properties used for business purposes, such as bed and breakfasts or vacation rentals, can be sold with an assigned lease to the new buyer. 3. Landlord's Consent: The landlord's consent is a crucial element in the assignment of a lease agreement during a business sale. The landlord evaluates the credibility and financial stability of the potential new tenant to ensure they can meet the obligations outlined in the lease. Consent is generally needed to authorize the transfer of lease rights and to modify the existing lease agreement to accommodate the new tenant. 4. Process: a. Initial Negotiations: The buyer and seller discuss and finalize the terms of the business sale, including the assignment of the lease and the landlord's consent. b. Buyer's Application: The buyer submits an application to the landlord, providing relevant details about their financial standing, business experience, and any other references required by the landlord. c. Landlord's Evaluation: The landlord reviews the buyer's application to assess their suitability as a tenant, considering factors such as financial stability, business track record, and adherence to lease terms. d. Negotiating Amendments: If the landlord approves the assignment, negotiations may occur to amend the lease agreement to include any necessary changes or arrangements. e. Landlord's Consent: Once all parties reach an agreement regarding the terms, conditions, and potential amendments, the landlord's written consent is obtained. 5. Key Considerations: a. Compliance with Lease Terms: The buyer must thoroughly review the lease agreement to understand the existing terms and conditions. b. Financial Viability: The buyer's financial stability is a significant factor in securing the landlord's consent. c. Negotiating with Landlord: Open and transparent communication between the buyer, seller, and landlord is vital to successful negotiations. In conclusion, the Vermont Sale of Business — Landlord's Consent to Assignment of Lease — Asset Purchase Transaction involves obtaining the landlord's consent to transfer lease rights during the sale of a business. Successful completion of this transaction requires comprehensive understanding, careful negotiations, and adherence to lease obligations.

Vermont Sale of Business - Landlord's Consent to Assignment of Lease - Asset Purchase Transaction

Description

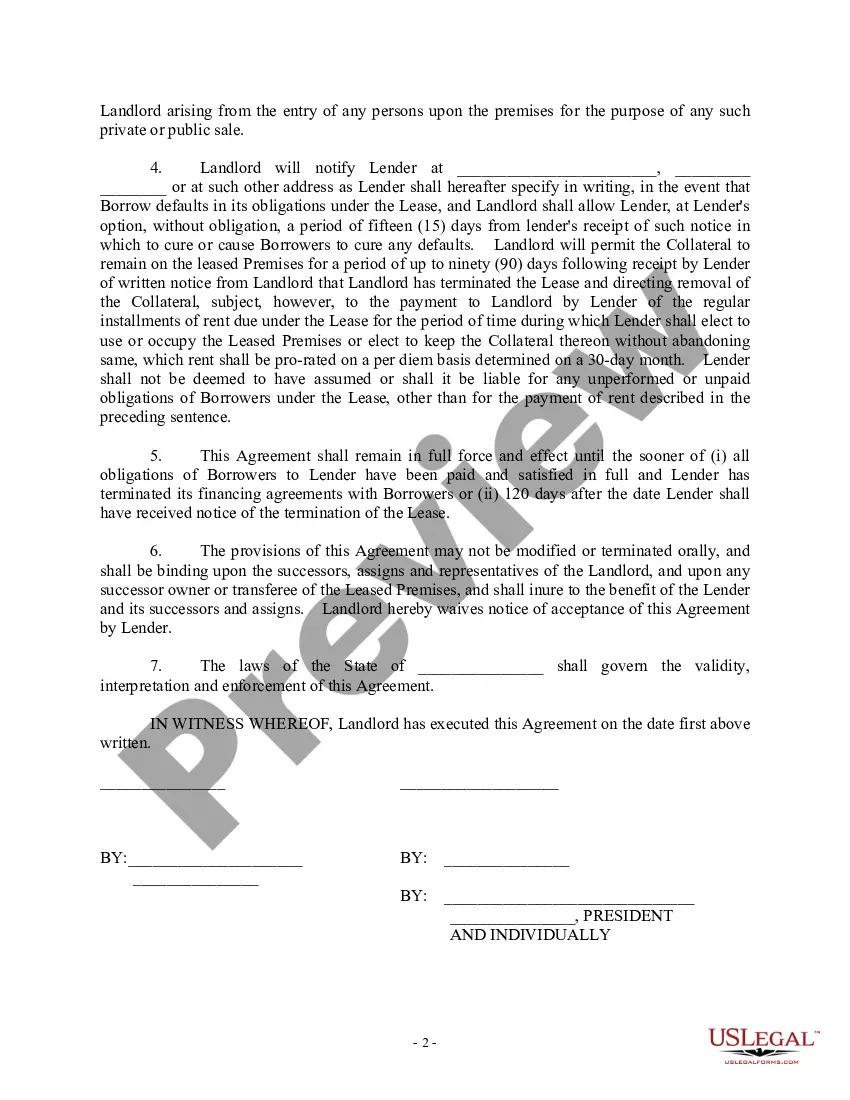

How to fill out Vermont Sale Of Business - Landlord's Consent To Assignment Of Lease - Asset Purchase Transaction?

If you have to total, download, or printing lawful record web templates, use US Legal Forms, the greatest variety of lawful varieties, that can be found on-line. Utilize the site`s basic and convenient lookup to discover the documents you require. Various web templates for organization and personal uses are sorted by categories and says, or keywords. Use US Legal Forms to discover the Vermont Sale of Business - Landlord's Consent to Assignment of Lease - Asset Purchase Transaction within a few clicks.

In case you are currently a US Legal Forms customer, log in for your bank account and click on the Download switch to get the Vermont Sale of Business - Landlord's Consent to Assignment of Lease - Asset Purchase Transaction. You may also access varieties you formerly saved inside the My Forms tab of your respective bank account.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have chosen the form for that correct town/region.

- Step 2. Take advantage of the Preview method to examine the form`s articles. Don`t forget about to see the description.

- Step 3. In case you are unsatisfied together with the develop, make use of the Research field towards the top of the display screen to get other versions from the lawful develop format.

- Step 4. Upon having identified the form you require, click on the Buy now switch. Select the pricing program you favor and add your accreditations to sign up for an bank account.

- Step 5. Approach the deal. You can utilize your charge card or PayPal bank account to finish the deal.

- Step 6. Find the formatting from the lawful develop and download it on your system.

- Step 7. Total, change and printing or sign the Vermont Sale of Business - Landlord's Consent to Assignment of Lease - Asset Purchase Transaction.

Each and every lawful record format you buy is your own eternally. You have acces to every develop you saved inside your acccount. Select the My Forms portion and choose a develop to printing or download once more.

Be competitive and download, and printing the Vermont Sale of Business - Landlord's Consent to Assignment of Lease - Asset Purchase Transaction with US Legal Forms. There are many expert and express-specific varieties you can utilize to your organization or personal requirements.