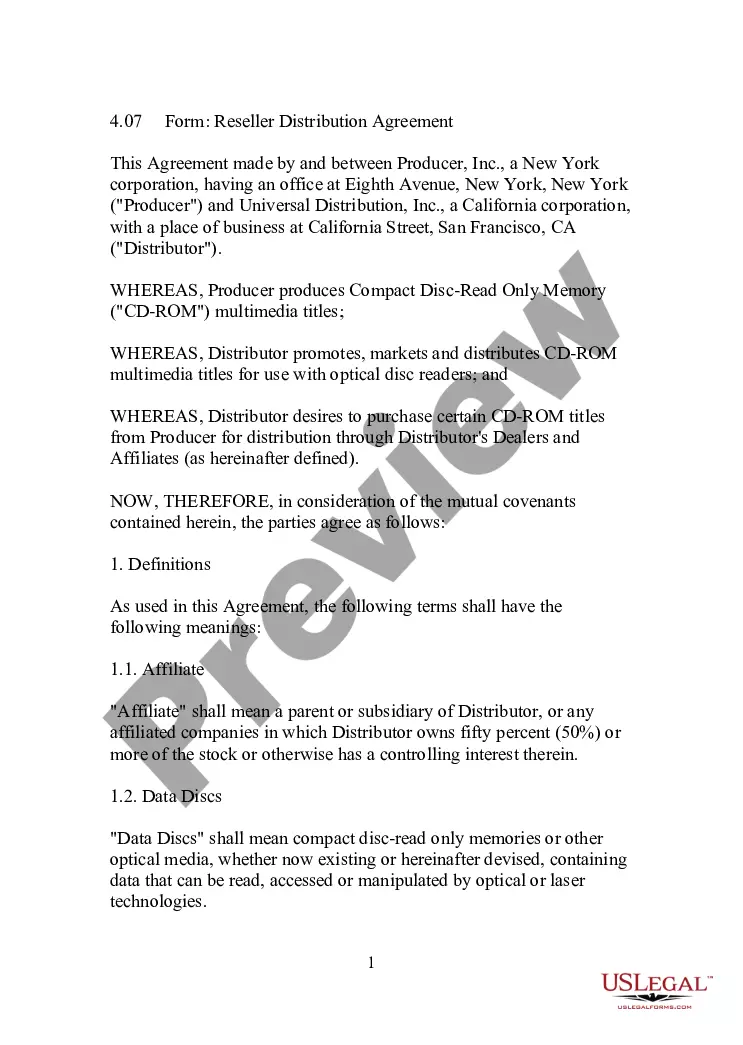

A Vermont Sale of Business — Promissory Not— - Asset Purchase Transaction refers to the legal agreement between a buyer and a seller in Vermont for the sale of a business, where a promissory note is used as a payment instrument for the transaction and only the assets of the business are being purchased. This type of transaction entails the transfer of ownership, rights, and liabilities of the business from the seller to the buyer in exchange for a promised payment to be made in the future. The promissory note used in the sale of a business transaction is a legally binding document that outlines the terms and conditions agreed upon by both parties. It serves as evidence of the buyer's promise to pay the seller a specified amount according to pre-established payment terms, which may include an upfront payment, installment payments, or a lump sum payment on a predetermined date. In Vermont, there may be different variations or types of Sale of Business — Promissory Not— - Asset Purchase Transactions that occur based on the specific agreement terms and the nature of the business being sold. Some examples of these types are: 1. Retail Business Purchase Transaction: This type of transaction involves the sale of a retail business, such as a store or franchise, where the buyer purchases the assets of the business, including inventory, equipment, and goodwill. The promissory note would outline the payment terms and conditions agreed upon by both parties. 2. Service-Based Business Purchase Transaction: In this type of transaction, a buyer acquires a service-based business, such as a consultancy firm, law practice, or accounting firm. The promissory note would detail the payment arrangements and sometimes include clauses specifying the retention or transfer of existing client contracts. 3. Manufacturing Business Purchase Transaction: This type of transaction involves the sale of a manufacturing business, where the buyer acquires the assets necessary for production, including machinery, equipment, intellectual property rights, and inventory. The promissory note would encompass the agreed-upon payment terms, addressing factors such as production timelines and the transfer of proprietary knowledge. 4. Franchise Purchase Transaction: When buying an existing franchise business in Vermont, the promissory note becomes crucial, dictating the payment method and terms between the franchisee (buyer) and franchisor (seller). This type of transaction may require additional documentation, such as franchise transfer agreements and consent from the franchisor. Regardless of the specific type of Vermont Sale of Business — Promissory Not— - Asset Purchase Transaction, it is crucial for both parties to seek legal counsel to ensure a thorough understanding of their rights and obligations. The promissory note serves as a critical component of the transaction, safeguarding the interests of both the buyer and the seller and providing a legally binding record of the agreed-upon terms.

Vermont Sale of Business - Promissory Note - Asset Purchase Transaction

Description

How to fill out Sale Of Business - Promissory Note - Asset Purchase Transaction?

Locating the appropriate valid document format can be challenging. Naturally, there are numerous templates accessible online, but how do you acquire the valid form you need? Access the US Legal Forms website. The service offers thousands of templates, including the Vermont Sale of Business - Promissory Note - Asset Purchase Transaction, that can be utilized for business and personal requirements. All the forms are reviewed by experts and comply with federal and state standards.

If you are already registered, Log In to your account and click on the Acquire button to obtain the Vermont Sale of Business - Promissory Note - Asset Purchase Transaction. Use your account to browse through the valid forms you have previously acquired. Visit the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions that you should follow: First, ensure you have chosen the correct form for your city/state. You can preview the form using the Preview option and examine the form description to ensure this is the right one for you. If the form does not satisfy your needs, utilize the Search area to find the appropriate form. Once you are confident that the form is suitable, click the Acquire now button to obtain the form. Choose the pricing plan you wish and input the required information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the valid document format to your device. Complete, edit, and print and sign the received Vermont Sale of Business - Promissory Note - Asset Purchase Transaction.

US Legal Forms is the largest repository of valid forms where you can find numerous document templates. Take advantage of the service to download professionally created documents that adhere to state requirements.

- Ensure proper document selection for your city/state.

- Utilize the Preview option for verification.

- Use the Search area if needed.

- Click Acquire now for purchase.

- Choose your payment plan and provide details.

- Download the format to your device.

Form popularity

FAQ

While buyer's counsel typically prepares the first draft of an asset purchase agreement, there may be circumstances (such as an auction) when seller's counsel prepares the first draft.

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

CLOSING. The closing of an acquisition transaction can be a simultaneous sign and close or a sign and then later close. In a sign and then later close, a buyer may continue its due diligence after signing, and there are usually pre-closing obligations the parties must meet in order to close.

Asset Sale ChecklistList of Assumed Contracts.List of Liabilities Assumed.Promissory Note.Security Agreement.Escrow Agreement.Disclosure of Claims, Liens, and Security Interests.List of Trademarks, Trade Names, Assumed Names, and Internet Domain Names.Disclosure of Licenses and Permits.More items...?

In an asset purchase or acquisition, the buyer only buys the specific assets and liabilities listed in the purchase agreement. So, it's possible for there to be a liability transfer from the seller to the buyer. Undocumented and contingent liabilities, however, are not included.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...

Interesting Questions

More info

I'm Housing Mortgage FAQ Mortgage Tips Buying Mortgage Tips Mortgage Searching Mortgage Rates Home Buyer's Guide Home Real Estate Investment Property Taxes Business Note Buyer Getting Most Cash Your Note Home Mortgage Norsemen Share This Page Tweet This Page Share 0 Comments.