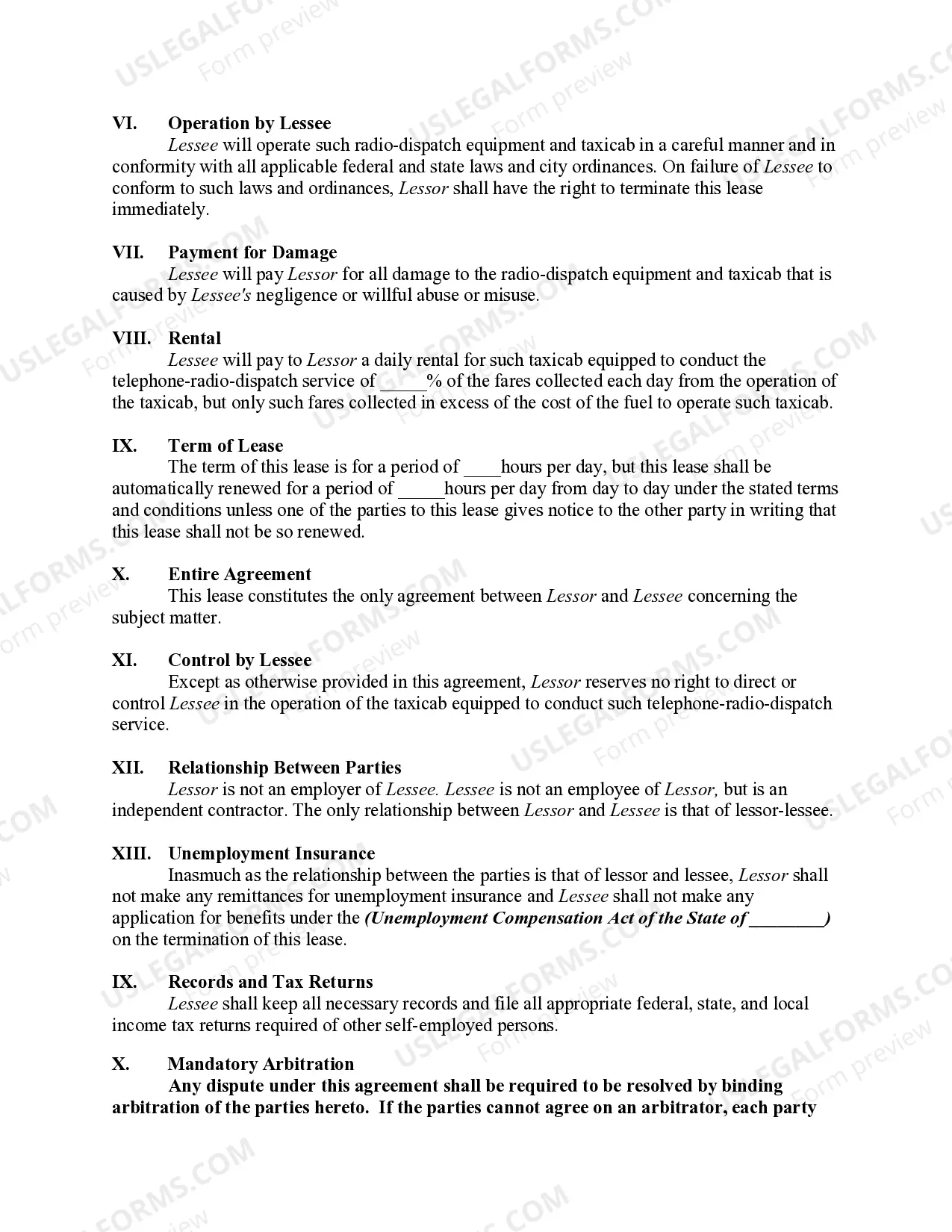

Vermont Lease of Taxicab: Detailed Description and Types A Vermont Lease of Taxicab refers to a legally binding agreement between a taxicab owner (lessor) and an individual or a business (lessee) for the purpose of renting a taxicab in the state of Vermont. This lease encompasses all terms and conditions related to the rental of a taxicab, ensuring a smooth and transparent transaction between the lessor and the lessee. This lease agreement outlines the specific details about the taxicab being leased, such as its make, model, year, license plate number, and identification marks. It may also require the lessor to provide the lessee with important documents, such as the vehicle registration, insurance information, and maintenance records, to ensure the lessee's safety and compliance with legal requirements. Additionally, the Vermont Lease of Taxicab describes the lease term, specifying whether it is a short-term or long-term agreement. It also mentions the agreed-upon payment terms, which may include the rental amount, mode of payment, and due dates. The lease may include clauses related to the use of the taxicab, such as any restrictions on mileage, geographical limitations, or permitted usage only for commercial purposes. It might also outline the lessee's responsibilities for maintaining the taxicab during the lease term, including regular servicing, cleanliness, and handling any potential damages or repairs. Furthermore, the lease agreement stipulates the lessee's obligations regarding liability insurance, ensuring that the taxicab is adequately insured against any accidents, theft, or damages. It may require the lessee to provide proof of insurance coverage and indemnify the lessor from any claims arising from the use of the leased taxicab. In Vermont, there can be various types of lease agreements for taxicabs, including: 1. Short-term Lease: This type of lease usually spans a few days to weeks. It is commonly used by individuals or tourists who require a taxicab for a limited period to explore Vermont or attend specific events. 2. Long-term Lease: This agreement typically extends for several months or even years. It is commonly utilized by taxicab drivers or businesses who need a taxicab for their daily operations. 3. Lease-to-Own: This type of lease offers an option for the lessee to purchase the taxicab at the end of the lease period. It allows individuals or businesses to test the taxicab's suitability before committing to its ownership. In conclusion, a Vermont Lease of Taxicab is a comprehensive agreement that outlines the terms, responsibilities, and obligations of both the lessor and the lessee when renting a taxicab in Vermont. It ensures a legally binding and transparent arrangement, providing clarity and protection to all parties involved in the lease transaction.

Vermont Lease of Taxicab

Description

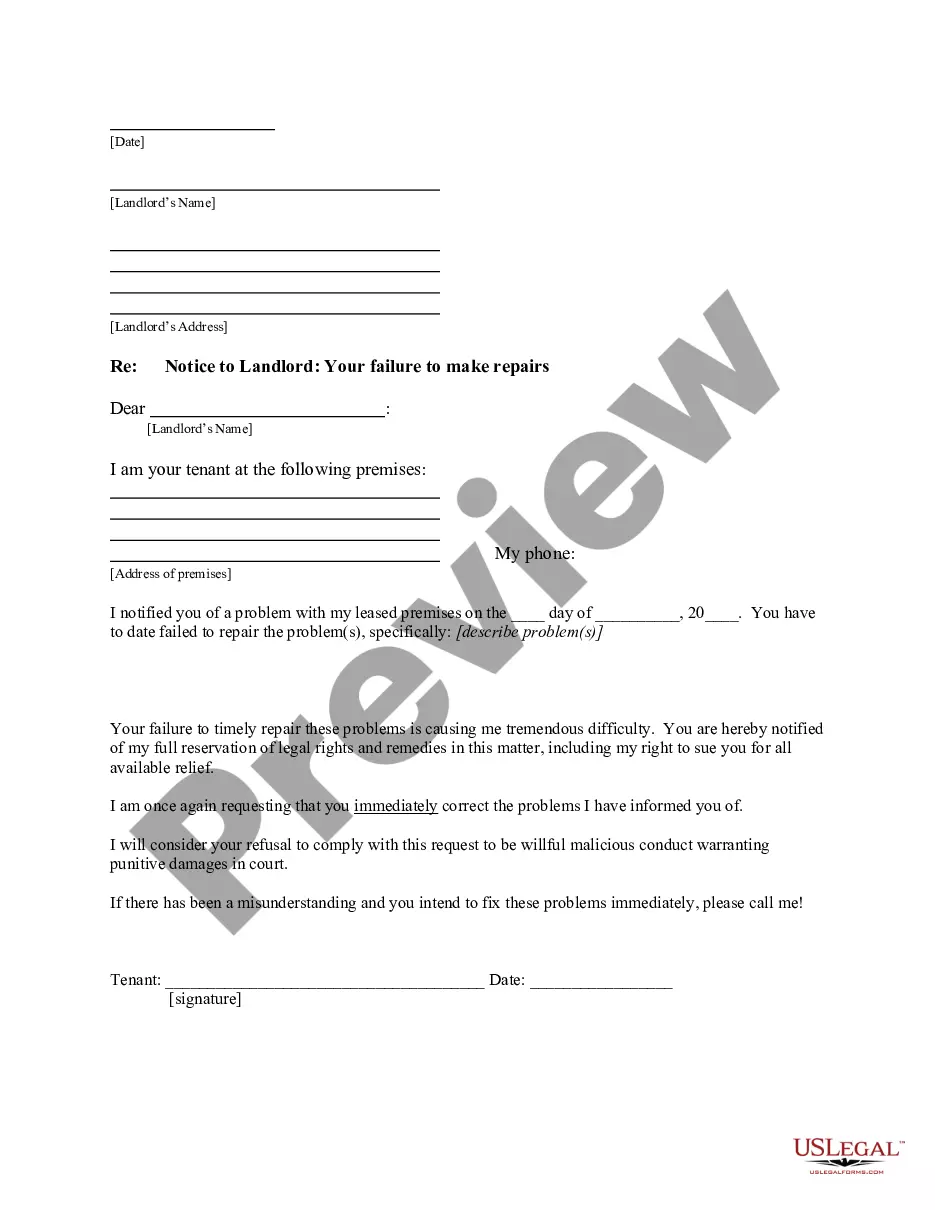

How to fill out Lease Of Taxicab?

Are you currently in a position where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of document templates, such as the Vermont Lease of Taxicab, that are designed to meet state and federal requirements.

Once you find the correct document, click Purchase now.

Select the pricing plan you prefer, provide the necessary information to set up your payment, and place the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Vermont Lease of Taxicab template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Get the document you need and ensure it is for the correct jurisdiction.

- Use the Preview button to check the form.

- Read the description to ensure you have selected the right document.

- If the document is not what you are looking for, use the Search box to find the template that suits your needs.

Form popularity

FAQ

The non-resident tax form for Vermont is typically the Vermont Non-Resident Personal Income Tax Return, also known as Form NR. This form is used by individuals who earn income in Vermont while residing in another state. If you're leasing a taxicab and earning income within Vermont, you will need to file this form accurately to reflect your tax obligations. Uslegalforms can assist you in completing and submitting this important document.

Yes, Vermont requires 1099 filing for reporting various types of income, including that from the leasing of taxicabs. Individuals and businesses must submit a 1099 form if they make payments to contractors or service providers that exceed the specified threshold. Staying compliant with tax forms is important for those engaged in the Vermont Lease of Taxicab. You can utilize Uslegalforms to ensure accurate and timely filing.

Non-resident property tax in Vermont applies to individuals who own property but do not reside in the state. This tax ensures that non-residents contribute to local services and infrastructure that support their properties. If you are leasing a taxicab in Vermont but live elsewhere, understanding this tax is essential for compliance. Consulting with Uslegalforms can provide clarity on non-resident tax obligations.

Abatement of property taxes in Vermont refers to the reduction or cancellation of taxes owed due to various reasons, such as financial hardship or administrative errors. Property owners may apply for abatement to alleviate their tax burden, especially in cases where property values have decreased. For those involved in the Vermont Lease of Taxicab, understanding property tax abatement can be crucial for financial planning. Uslegalforms can guide you through the abatement application process.

You need to submit the following documents obtained from the person who is giving you the vehicle (the previous owner):...Registering used vehicle received as a giftProperly assigned titleBill of Sale & Odometer Disclosure Statement (form #VT-005)Gift Tax Exemption (form #VT-013)

No. Anyone can register a vehicle in the state of Vermont.

How long will this work for? The Vermont DMV is still currently offering this for residents of all 50 states. They have indicated that in 2021 or 2022, they may restrict the process to Vermont residents only, so if you have a vehicle that qualifies, it is better to get it done sooner.

Vermont collects a 6% state sales tax rate on the purchase of all vehicles.

Complete the entire Vermont Motor Vehicle Registration, Tax and Title Application (form #VD-119). Be sure to enter the Plate number that you are transferring. You must complete Section 7 of the Vermont Registration Application, or incude your current Vermont Registration with the "Transfer Section" completed.

Purchased from an out-of-state dealer Complete a Vermont Registration, Tax, and Title application (VD-119) and submit it (together with the above documentation and the appropriate fees) to the Vermont Department of Motor Vehicles.