A contract is based upon an agreement. An agreement arises when one person, the offeror, makes an offer and the person to whom is made, the offeree, accepts. There must be both an offer and an acceptance. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

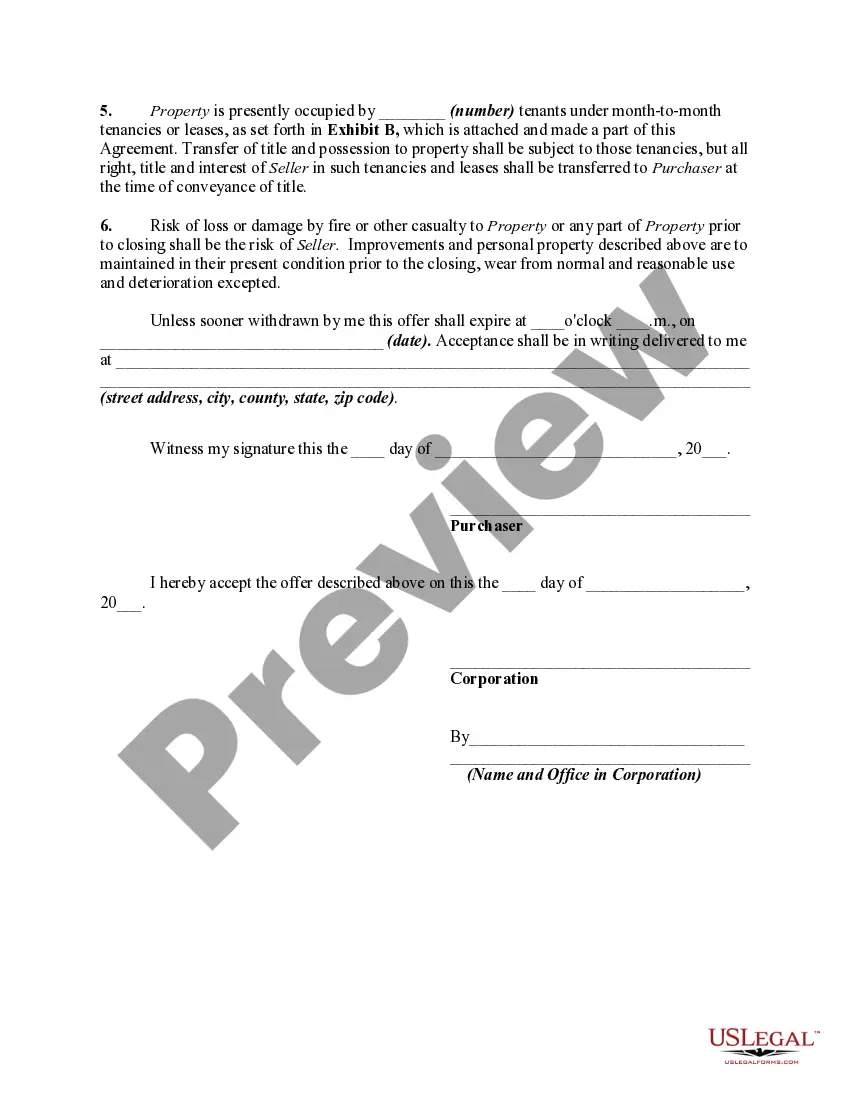

Vermont Offer to Purchase Commercial Property is a legal document used for buying or selling commercial properties in the state of Vermont. It outlines the terms and conditions of the purchase agreement between the buyer and seller, ensuring a smooth and legally binding transaction. This description will highlight the key aspects of a Vermont Offer to Purchase Commercial Property, including the different types available. 1. Vermont Offer to Purchase Commercial Property: The Vermont Offer to Purchase Commercial Property is a legal contract that provides a framework for the purchase and sale of commercial real estate in Vermont. It serves as a vital document that helps both parties establish a mutual understanding of the terms and conditions, protecting their interests. 2. Key Components of Vermont Offer to Purchase Commercial Property: a. Purchase Price: This section outlines the agreed price at which the property will be bought and sold. It takes into account factors such as market value, location, property condition, and any other relevant considerations. b. Due Diligence Period: This section provides a timeframe wherein the buyer can conduct inspections, investigations, and due diligence processes to ensure the property meets their expectations. It typically includes an inspection of the building structure, title searches, zoning compliance, environmental assessments, and any other necessary evaluations. c. Earnest Money Deposit: The Vermont Offer to Purchase Commercial Property may require the buyer to provide an earnest money deposit as a show of good faith and commitment to the purchase. This deposit is typically held in escrow until the closing of the transaction. d. Financing Contingencies: If the buyer intends to secure financing for the purchase, the offer may include specific provisions to protect their interests in case financing falls through. These contingencies ensure that if the buyer is unable to obtain financing within a specified period, the offer becomes null and the earnest money deposit is returned. e. Closing Timeline: This section establishes the timeline for the completion of the transaction, including the closing date. Both parties agree upon a mutually convenient date and outline the necessary steps to be taken leading up to the closing. 3. Types of Vermont Offer to Purchase Commercial Property: a. Standard Vermont Offer to Purchase Commercial Property: This is the most common type of offer and covers essential terms and conditions necessary for buying or selling commercial property in Vermont. b. As-Is Vermont Offer to Purchase Commercial Property: This type of offer specifies that the buyer is purchasing the property in its current condition, assuming any known or unknown faults or issues. It waives the seller's obligation to make any repairs or renovations before the closing. c. Planned Unit Development (PUD) Vermont Offer to Purchase Commercial Property: PUD offers are used when purchasing commercial properties located within planned unit developments. These developments typically have specific regulations and obligations that buyers must understand and comply with. d. Leaseback Vermont Offer to Purchase Commercial Property: In this type of offer, the seller becomes the tenant of the property after the closing, leasing it back from the buyer. This arrangement is often used when the seller needs to temporarily occupy the property for their business operations but does not want to remain as the owner. In conclusion, the Vermont Offer to Purchase Commercial Property is an essential legal document used in real estate transactions across the state. With different types available for varying circumstances, it ensures that both buyers and sellers are protected throughout the process.Vermont Offer to Purchase Commercial Property is a legal document used for buying or selling commercial properties in the state of Vermont. It outlines the terms and conditions of the purchase agreement between the buyer and seller, ensuring a smooth and legally binding transaction. This description will highlight the key aspects of a Vermont Offer to Purchase Commercial Property, including the different types available. 1. Vermont Offer to Purchase Commercial Property: The Vermont Offer to Purchase Commercial Property is a legal contract that provides a framework for the purchase and sale of commercial real estate in Vermont. It serves as a vital document that helps both parties establish a mutual understanding of the terms and conditions, protecting their interests. 2. Key Components of Vermont Offer to Purchase Commercial Property: a. Purchase Price: This section outlines the agreed price at which the property will be bought and sold. It takes into account factors such as market value, location, property condition, and any other relevant considerations. b. Due Diligence Period: This section provides a timeframe wherein the buyer can conduct inspections, investigations, and due diligence processes to ensure the property meets their expectations. It typically includes an inspection of the building structure, title searches, zoning compliance, environmental assessments, and any other necessary evaluations. c. Earnest Money Deposit: The Vermont Offer to Purchase Commercial Property may require the buyer to provide an earnest money deposit as a show of good faith and commitment to the purchase. This deposit is typically held in escrow until the closing of the transaction. d. Financing Contingencies: If the buyer intends to secure financing for the purchase, the offer may include specific provisions to protect their interests in case financing falls through. These contingencies ensure that if the buyer is unable to obtain financing within a specified period, the offer becomes null and the earnest money deposit is returned. e. Closing Timeline: This section establishes the timeline for the completion of the transaction, including the closing date. Both parties agree upon a mutually convenient date and outline the necessary steps to be taken leading up to the closing. 3. Types of Vermont Offer to Purchase Commercial Property: a. Standard Vermont Offer to Purchase Commercial Property: This is the most common type of offer and covers essential terms and conditions necessary for buying or selling commercial property in Vermont. b. As-Is Vermont Offer to Purchase Commercial Property: This type of offer specifies that the buyer is purchasing the property in its current condition, assuming any known or unknown faults or issues. It waives the seller's obligation to make any repairs or renovations before the closing. c. Planned Unit Development (PUD) Vermont Offer to Purchase Commercial Property: PUD offers are used when purchasing commercial properties located within planned unit developments. These developments typically have specific regulations and obligations that buyers must understand and comply with. d. Leaseback Vermont Offer to Purchase Commercial Property: In this type of offer, the seller becomes the tenant of the property after the closing, leasing it back from the buyer. This arrangement is often used when the seller needs to temporarily occupy the property for their business operations but does not want to remain as the owner. In conclusion, the Vermont Offer to Purchase Commercial Property is an essential legal document used in real estate transactions across the state. With different types available for varying circumstances, it ensures that both buyers and sellers are protected throughout the process.