Vermont Certificate of Trust for Successor Trustee

Description

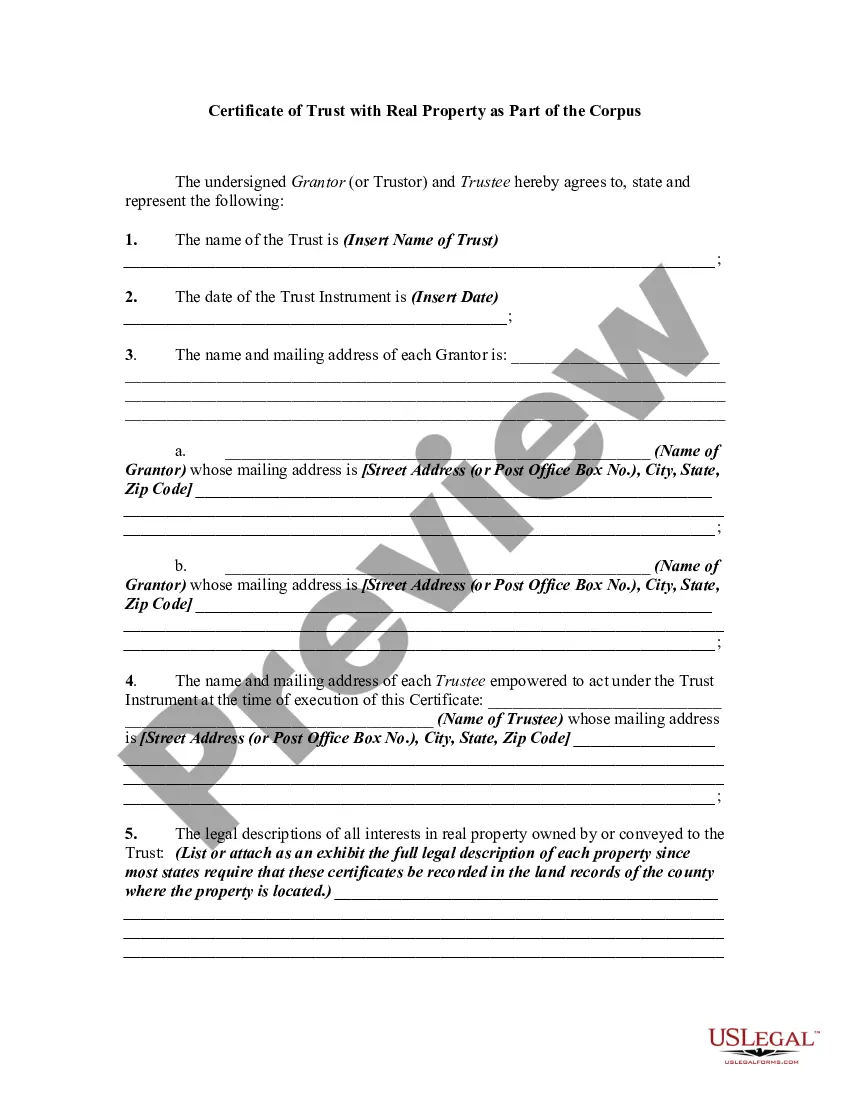

How to fill out Certificate Of Trust For Successor Trustee?

You can spend time on-line searching for the lawful record format that fits the state and federal demands you need. US Legal Forms gives 1000s of lawful forms which can be evaluated by experts. It is possible to obtain or print out the Vermont Certificate of Trust for Successor Trustee from my service.

If you already have a US Legal Forms bank account, you are able to log in and click on the Down load key. After that, you are able to comprehensive, edit, print out, or indicator the Vermont Certificate of Trust for Successor Trustee. Every single lawful record format you acquire is your own property for a long time. To have yet another copy of the obtained kind, go to the My Forms tab and click on the corresponding key.

If you work with the US Legal Forms internet site the very first time, adhere to the simple recommendations below:

- Initially, be sure that you have chosen the proper record format for that state/area of your choosing. Look at the kind information to ensure you have picked out the proper kind. If accessible, make use of the Review key to search from the record format also.

- If you wish to find yet another variation in the kind, make use of the Search area to get the format that fits your needs and demands.

- After you have found the format you would like, click on Buy now to carry on.

- Find the prices program you would like, key in your accreditations, and register for your account on US Legal Forms.

- Total the purchase. You can utilize your credit card or PayPal bank account to pay for the lawful kind.

- Find the structure in the record and obtain it in your system.

- Make alterations in your record if necessary. You can comprehensive, edit and indicator and print out Vermont Certificate of Trust for Successor Trustee.

Down load and print out 1000s of record templates utilizing the US Legal Forms website, which provides the biggest variety of lawful forms. Use skilled and condition-certain templates to deal with your organization or person requires.

Form popularity

FAQ

Here's a partial list of assets that may avoid the probate process: Property held in a trust3 Jointly held property (but not common property) Death benefits from insurance policies (unless payable to the estate)4 Property given away before you die. Assets in a pay-on-death account.

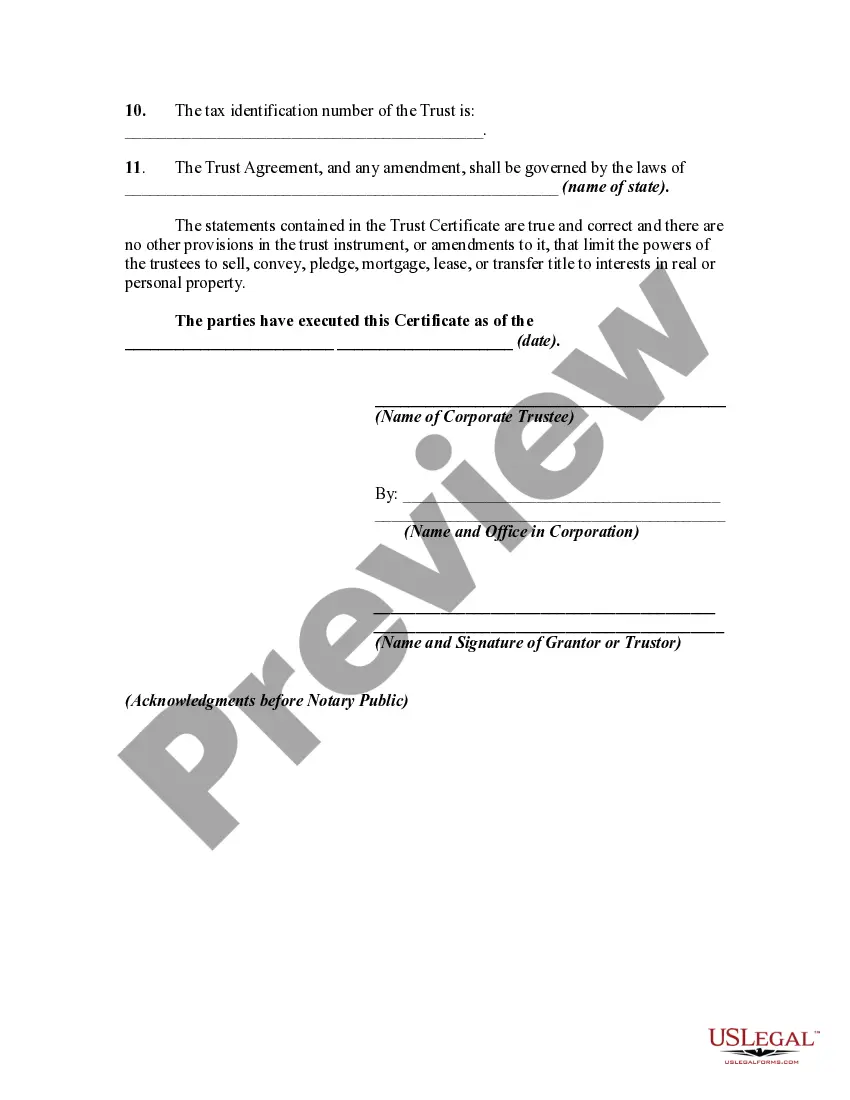

A Vermont living trust holds ownership of your assets during your life while you continue to use and control them. Assets are then passed to beneficiaries after your death. A revocable living trust (sometimes called an inter vivos trust) can offer a variety of benefits.

While most estates need to undergo the probate process, the best way to avoid probate in Vermont is by creating a living trust before dying. Assets will then transfer to your beneficiaries without the need to go to court.

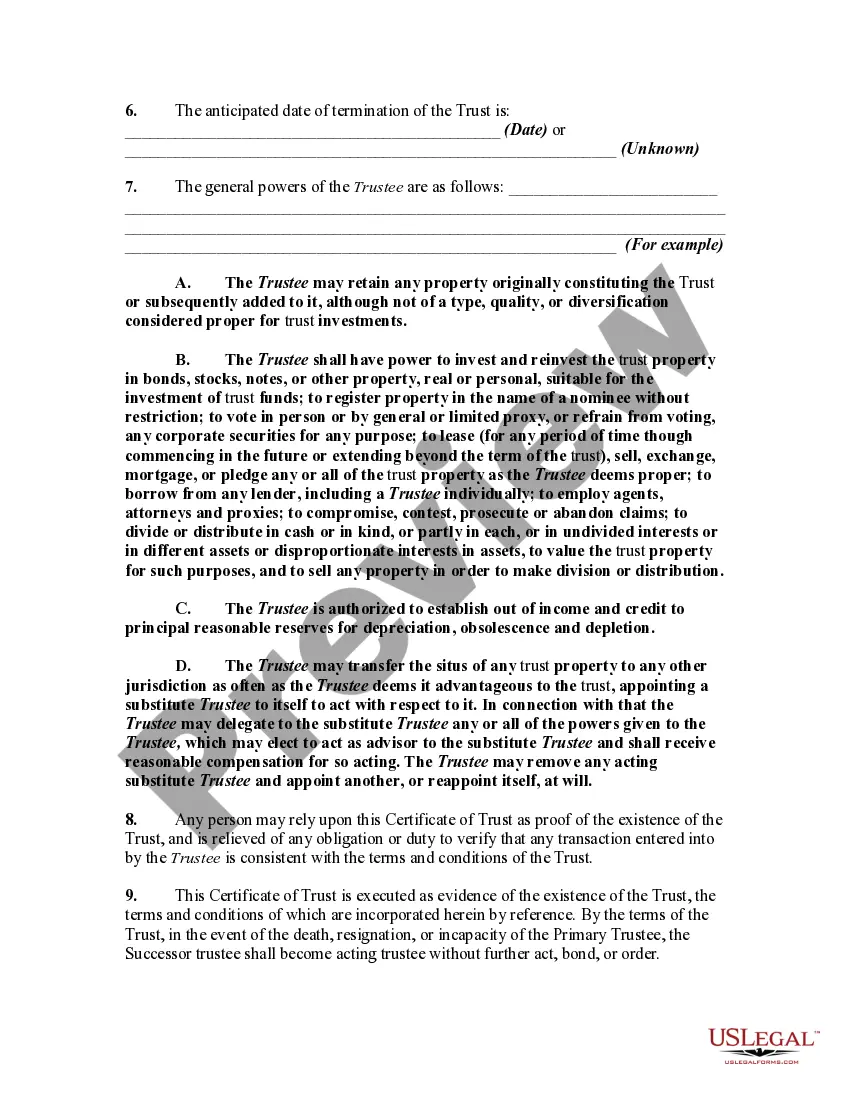

The successor trustee may be the primary beneficiary of the trust. However, the successor trustee can be anyone you trust. For example, the successor trustee can be a close friend, an adult child, your spouse, your lawyer, an accountant, or a corporate trustee.

Trustees generally do not have the power to change the beneficiary of a trust. The right to add and remove beneficiaries is a power reserved for the grantor of the trust; when the grantor dies, their trust will usually become irrevocable. In other words, their trust will not be able to be modified in any way.

Formal Probate If the person who died owned real estate or if the estate is worth more than $45,000.

To make a living trust in Vermont, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

And although a beneficiary generally has very little control over the trust's management, they are entitled to receive what the trust allocates to them. In general, a trustee has extensive powers when it comes to overseeing the trust.

Trustor: a person who establishes a trust, typically either an individual person or a married couple. A trustor may also be called a grantor or a settlor. Trustee: a person or persons designated by a trust document to hold and manage the property in the trust.

The Bottom Line There's a significant difference between being a beneficiary or trustee of a trust. If you're named as a beneficiary then you stand to benefit from the assets in the trust. On the other hand, if you're the trustee it's your job to manage those assets ing to the wishes of the trust creator.