This form is a sample of an agreement to renew (extend) the term of a trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Vermont Agreement to Renew Trust Agreement

Description

How to fill out Agreement To Renew Trust Agreement?

Are you currently in a location where you require documents for either business or personal purposes almost all the time? There is a wide selection of legal document templates accessible online, but locating trustworthy ones can be challenging.

US Legal Forms provides thousands of document templates, such as the Vermont Agreement to Renew Trust Agreement, that are designed to meet federal and state requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Vermont Agreement to Renew Trust Agreement template.

- Choose the document you need and verify it is applicable to the correct city/region.

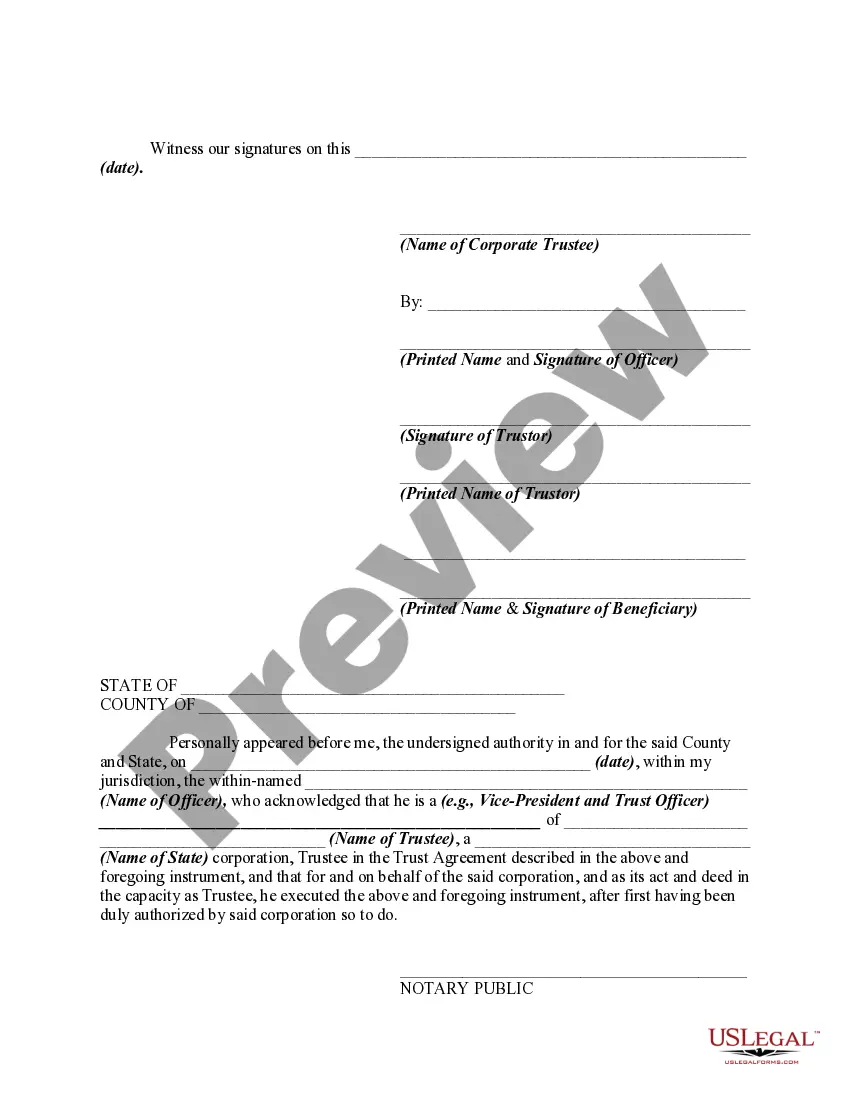

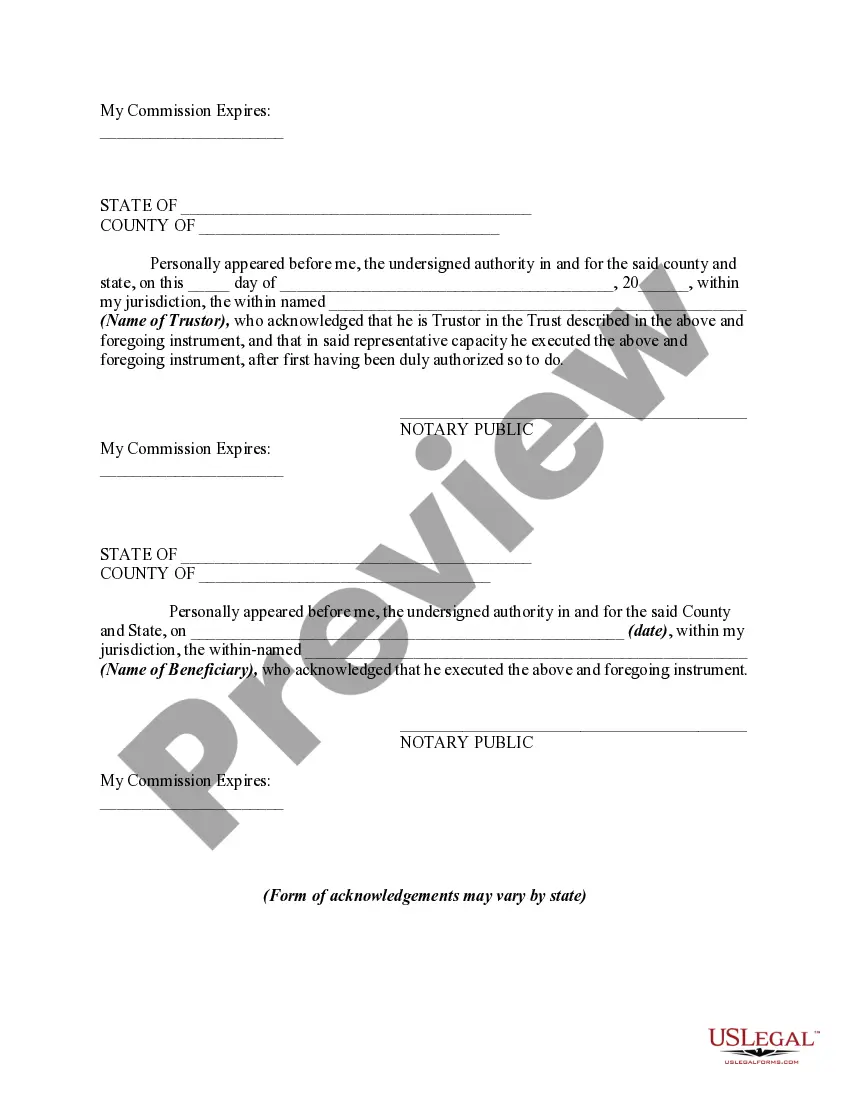

- Use the Review button to scrutinize the form.

- Check the summary to ensure you have selected the correct document.

- If the document isn’t what you seek, use the Lookup box to find the document that suits your needs and requirements.

- Upon finding the correct document, click Purchase now.

- Select the pricing plan you prefer, fill in the necessary details to create your account, and complete your order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

A fiduciary tax return accounts for income generated by a trust, while an estate tax return deals with the overall value of a deceased person's estate. If a Vermont Agreement to Renew Trust Agreement structures how income is distributed, it may also influence how you handle these returns. Understanding the distinctions can help you remain compliant with state tax laws and effectively execute your estate plan.

Yes, Vermont allows for tax extensions, enabling taxpayers some additional time to file their returns. However, it's important to understand that an extension to file does not exempt you from paying any taxes owed by the original deadline. If you are working with a Vermont Agreement to Renew Trust Agreement and need more time, filing an extension may be beneficial. Always check the requirements to avoid penalties.

A fiduciary tax return is filed by the estate or trust that earns income on behalf of its beneficiaries. This return reports income, deductions, and credits and is essential for tax compliance. If you manage a trust under a Vermont Agreement to Renew Trust Agreement, understanding this return’s requirements can help maintain transparency with tax authorities. Keep in touch with tax specialists to ensure accuracy.

When transferring real property in Vermont, a withholding tax return is often required. This return ensures that taxes on potential capital gains are appropriately withheld. If your estate or trust involves a Vermont Agreement to Renew Trust Agreement, it may simplify the process by clarifying the responsibilities associated with the property transfer. It is wise to consult a professional for detailed guidance.

A 1041 tax return is necessary for estates and trusts that generate income during the tax year. If your trust has a Vermont Agreement to Renew Trust Agreement and meets the income requirements, filing this return is essential. This process ensures compliance with Vermont tax laws and helps manage your fiduciary responsibilities effectively.

In Vermont, fiduciary tax returns are required if the trust produces income above a specific threshold set by the state. As tax laws can change, keeping up-to-date is important. If you have a Vermont Agreement to Renew Trust Agreement, it may guide the income reporting needed for your fiduciary return. Consulting an expert can provide peace of mind.

Yes, Vermont does impose a capital gains tax on real estate transactions. When selling property, individuals need to be aware of the tax implications. If you have an Agreement to Renew Trust Agreement, this documentation may help manage the proceeds from these sales. Always consult with a tax professional to understand your specific obligations.

Creating a living trust in Vermont involves several essential steps, including drafting the trust document, transferring assets, and designating a trustee. You should consider using a Vermont Agreement to Renew Trust Agreement to simplify renewing and managing your trust. Platforms like US Legal Forms provide valuable resources and templates to aid you in properly establishing your living trust, ensuring all legal requirements are met.

Yes, automatic renewal clauses are enforceable in Vermont provided they comply with state regulations. These clauses must be clearly stated in the contract, and parties must be informed about their rights regarding renewal. When drafting your Vermont Agreement to Renew Trust Agreement, it is wise to consult legal resources to ensure that these clauses are valid and compliant.

Auto-renewal contracts in Vermont must clearly outline the terms of renewal, including the duration and any necessary notifications. These rules ensure that all parties involved are aware and agree to the automatic extension of the contract. By adhering to these guidelines, you can maintain your Vermont Agreement to Renew Trust Agreement without any legal complications.