An agreement that creates an interest in real property as security for an obligation, such as the payment of a note, and that is to cease upon the performance of the obligation, is called a mortgage. The person whose interest in the property is given as security is the mortgagor. The person who receives the security is the mortgagee (e.g., lender). A release, deed of reconveyance, deed of release, or authority to cancel is used by a mortgagee to renounce a claim upon a person's real property subject to the mortgage.

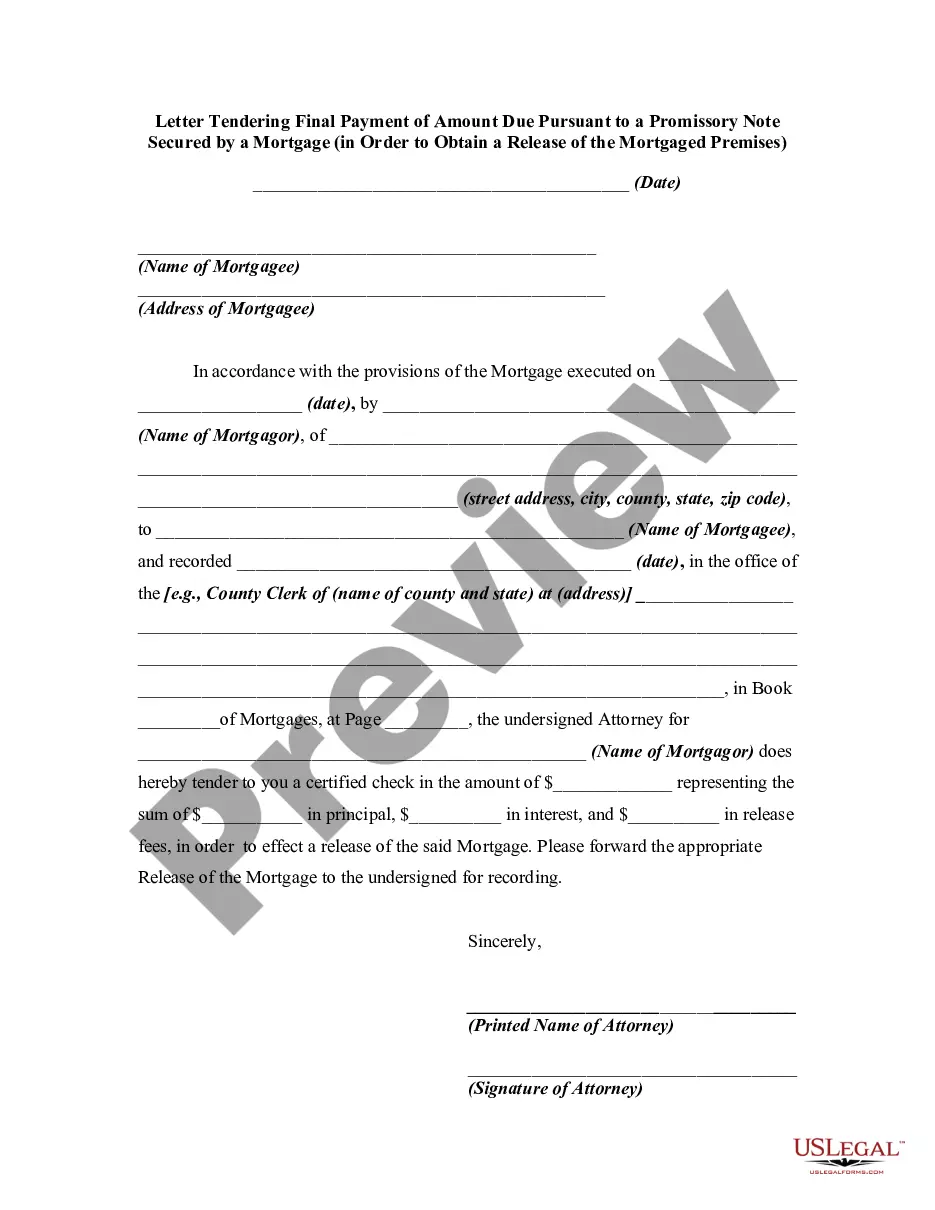

Vermont Letter Tendering Final Payment of Amount Due Pursuant to a Promissory Note Secured by a Mortgage in Order to Obtain a Release of the Mortgaged Premises

Description

How to fill out Letter Tendering Final Payment Of Amount Due Pursuant To A Promissory Note Secured By A Mortgage In Order To Obtain A Release Of The Mortgaged Premises?

If you wish to comprehensive, acquire, or print lawful papers layouts, use US Legal Forms, the largest assortment of lawful forms, that can be found online. Use the site`s easy and practical search to discover the papers you need. Numerous layouts for company and specific functions are categorized by categories and states, or keywords and phrases. Use US Legal Forms to discover the Vermont Letter Tendering Final Payment of Amount Due Pursuant to a Promissory Note Secured by a Mortgage in Order to Obtain a Release of the Mortgaged Premises in just a handful of click throughs.

In case you are already a US Legal Forms client, log in to your account and then click the Acquire key to have the Vermont Letter Tendering Final Payment of Amount Due Pursuant to a Promissory Note Secured by a Mortgage in Order to Obtain a Release of the Mortgaged Premises. You may also access forms you previously acquired within the My Forms tab of the account.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have chosen the shape for the proper city/country.

- Step 2. Take advantage of the Review choice to examine the form`s content. Don`t overlook to read through the information.

- Step 3. In case you are unsatisfied with all the develop, utilize the Lookup industry at the top of the display screen to get other versions of the lawful develop template.

- Step 4. After you have identified the shape you need, go through the Acquire now key. Pick the pricing strategy you favor and include your accreditations to register for the account.

- Step 5. Approach the purchase. You should use your Мisa or Ьastercard or PayPal account to complete the purchase.

- Step 6. Pick the format of the lawful develop and acquire it in your device.

- Step 7. Total, edit and print or indicator the Vermont Letter Tendering Final Payment of Amount Due Pursuant to a Promissory Note Secured by a Mortgage in Order to Obtain a Release of the Mortgaged Premises.

Every lawful papers template you get is your own for a long time. You have acces to every develop you acquired with your acccount. Go through the My Forms segment and decide on a develop to print or acquire again.

Be competitive and acquire, and print the Vermont Letter Tendering Final Payment of Amount Due Pursuant to a Promissory Note Secured by a Mortgage in Order to Obtain a Release of the Mortgaged Premises with US Legal Forms. There are thousands of specialist and state-specific forms you can use for your company or specific requirements.

Form popularity

FAQ

When a mortgage is used as a security instrument, who holds the mortgage and the promissory note? The lender holds the mortgage and the note. -The note and mortgage are the lender's leverage to foreclose in the event of default.

The deed of trust is what secures the promissory note. The promissory note includes the interest rate, the payment amounts and terms, and the buyer's promise to pay the lender the amount borrowed plus interest.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

A promissory note is a key piece of a home loan application and mortgage agreement. It ensures that a borrower agrees to be indebted to a lender for loan repayment. Ultimately, it serves as a necessary piece of the legal puzzle that helps guarantee that sums are repaid in full and in a timely fashion.

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.

There are three parties involved in a deed of trust: Trustor: This is the borrower. Trustee: This is the third party who will hold the legal title to the real property. Beneficiary: This is the lender.

The Note itself has virtually nothing to do with the property. If the borrower does not pay the agreed amount, the lender can sue ?under the Note? and obtain remedies for breaching the contract. The Deed of Trust is the document that grants the lender the rights to take the property if the loan is not repaid.