An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

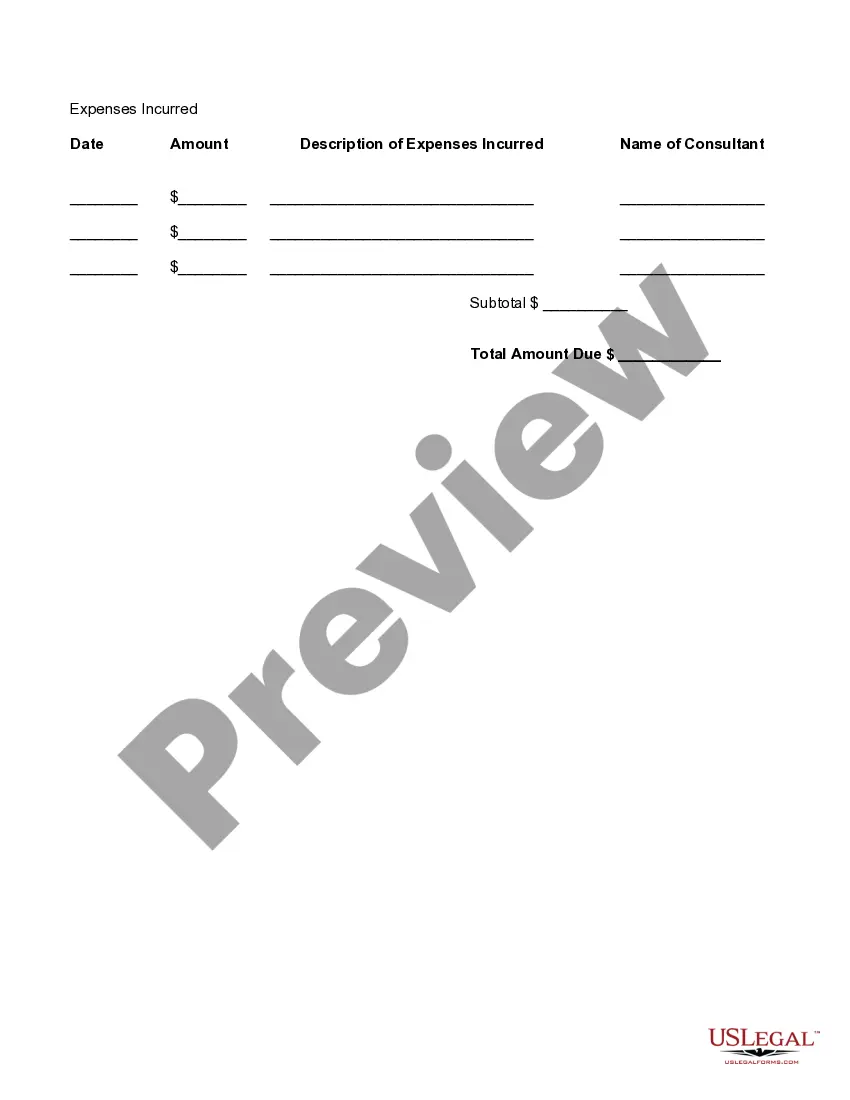

Vermont Detailed Consultant Invoice: A Comprehensive Overview of Vermont's Consulting Invoicing System Introduction: The Vermont Detailed Consultant Invoice is a crucial document used by consultants operating in the state of Vermont. This invoice serves as a transparent record of services rendered, expenses incurred, and payment terms for consulting engagements. It enables consultants to maintain accurate financial records while facilitating clear communication and transparency between clients and consultants. This detailed description will provide an in-depth analysis of the Vermont Detailed Consultant Invoice, its importance, essential components, and possible types. Importance of the Vermont Detailed Consultant Invoice: 1. Financial Transparency: The Vermont Detailed Consultant Invoice ensures transparency by outlining the cost breakdown of services provided, expenses, and applicable taxes. 2. Legal Compliance: This invoice adheres to Vermont's tax regulations and helps consultants fulfill their legal obligations by accurately documenting their earnings and complying with state tax laws. 3. Professionalism: By using a detailed invoice, consultants showcase their professionalism and commitment to organized financial practices, which also facilitates trust-building with clients. 4. Documentation: The detailed invoice serves as a vital financial record for consultants, helping them track their income, expenses, and client payments accurately. Components of the Vermont Detailed Consultant Invoice: 1. Consultant Information: The invoice typically begins with the consultant's name, contact details, and professional information. 2. Client Information: The client's name, address, and contact details should be included to identify who is responsible for payment. 3. Invoice Number and Date: Each invoice should have a unique identifier and clearly state the date of issuance. 4. Description of Services: A detailed breakdown of services provided, along with their respective charges, must be included to provide transparency and aid in client understanding. 5. Expenses: If applicable, the invoice should include a section dedicated to documenting any reimbursable expenses incurred during the consulting engagement. 6. Subtotal, Taxes, Discounts: The invoice should display the subtotal, itemize taxes, and consider any applicable discounts or promotions. 7. Total Due and Payment Terms: The invoice should specify the total amount due and provide clarity on payment methods, due dates, and any late payment penalties or interest charges. Possible Types of Vermont Detailed Consultant Invoice: 1. Time-Based Invoice: Consultants may charge clients based on the number of hours spent on a project, reflecting an hourly rate for their expertise. 2. Project-Based Invoice: This type of invoice considers a fixed fee for delivering a defined scope of work or completing a specific project. 3. Retainer Invoice: Consultants working under a retainer agreement can generate invoices periodically based on the pre-determined retainer amount and services provided during that period. 4. Milestone-based Invoice: For long-term projects, consultants often use milestone-based invoices, which bill clients upon achieving specific project milestones or predetermined deliverables. In conclusion, the Vermont Detailed Consultant Invoice is a critical administrative tool for consultants working in Vermont. This invoice showcases professionalism, ensures financial transparency, facilitates communication, and helps consultants maintain accurate financial records. With its various types available, consultants can choose the most suitable invoice format based on their unique consulting arrangements and ensure smooth financial operations.