Vermont Receipt Template for Child Care

Description

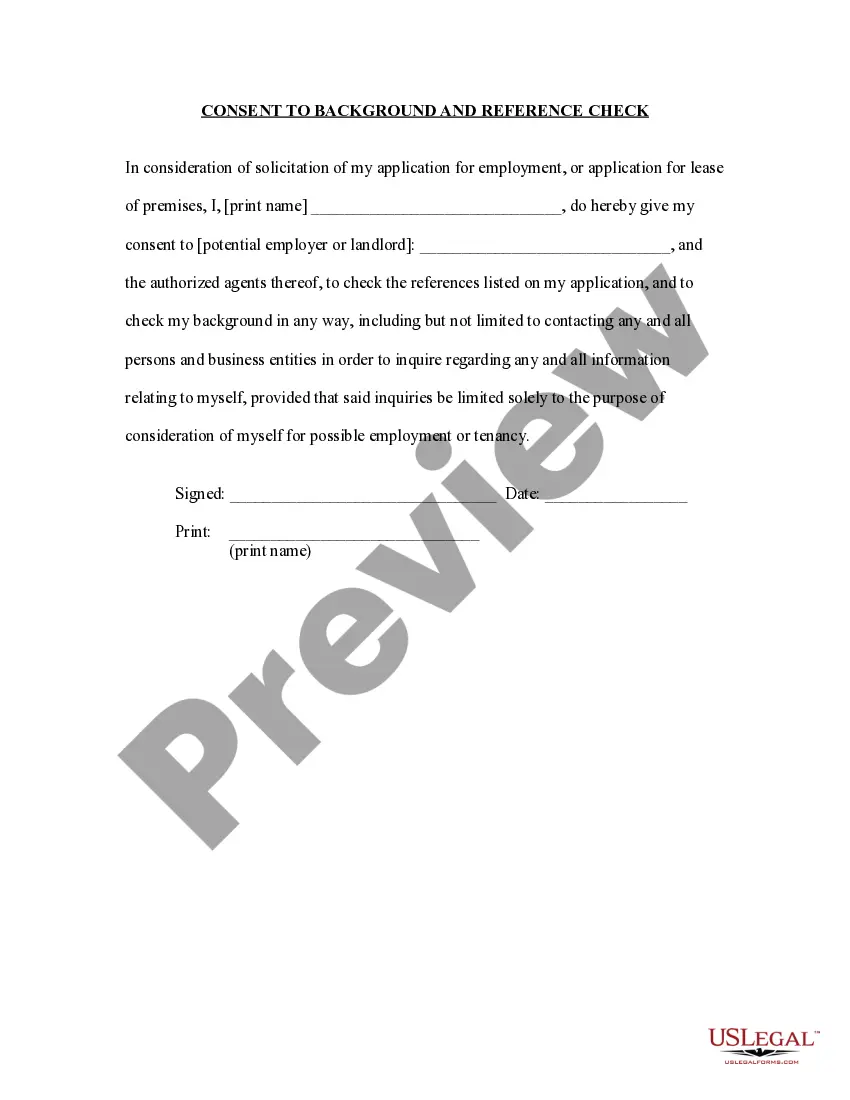

How to fill out Receipt Template For Child Care?

Are you presently within a position where you require documents for both business or personal reasons almost every day.

There are numerous legal document templates available online, but locating forms you can rely on is not easy.

US Legal Forms offers thousands of form templates, including the Vermont Receipt Template for Child Care, which can be customized to meet federal and state standards.

Once you obtain the correct form, click Buy now.

Choose the pricing plan you need, complete the necessary information to create your account, and finalize the purchase using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, just sign in.

- After that, you can download the Vermont Receipt Template for Child Care format.

- If you do not have an account and would like to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for the correct city/region.

- Use the Review button to verify the form.

- Read the description to ensure you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find the document that suits your needs.

Form popularity

FAQ

Yes, you need receipts to claim childcare expenses on your taxes. Specifically, a Vermont Receipt Template for Child Care can serve as essential documentation, demonstrating the costs associated with your childcare. Without these receipts, claiming the credit can become challenging, as tax authorities require proof of your expenditures. Keep your records organized to ensure a smooth tax filing experience.

Yes, if you use a dependent care FSA, you will typically receive Form 2441 when filing your taxes. This document provides important information about your contributions and eligible expenses. It's wise to keep a Vermont Receipt Template for Child Care handy, as it helps you track these expenses and ensure you're prepared for any reporting requirements.

To make a receipt for your dependent care FSA, start by including essential information such as the provider's name, address, and tax identification number, along with the service dates and total costs. Using a Vermont Receipt Template for Child Care makes this process easier, providing a structured format that ensures you don't miss any critical details.

Yes, the IRS requires receipts for FSA expenses to verify claims. This documentation helps confirm that the expenses fall within eligible categories, like child care costs. By utilizing a Vermont Receipt Template for Child Care, you can create organized and accurate records, making your FSA claims smoother and more efficient.

In general, you cannot receive reimbursement from your FSA without a valid receipt. The receipt serves as proof of your eligible expense, such as child care payments. Using a Vermont Receipt Template for Child Care can ensure you have the proper documentation, helping you avoid issues when submitting claims.

Filling out a child care receipt involves including specific details to ensure it's valid. Use the Vermont Receipt Template for Child Care, which makes the process straightforward. Input the caretaker's name, the services provided, the total amount charged, and the date. Always double-check for accuracy to ensure your receipt meets reimbursement requirements.

Unfortunately, you cannot claim child care expenses without providing receipts. The IRS mandates that you have documented proof of any expenses claimed. Using the Vermont Receipt Template for Child Care can simplify record-keeping and ensure you have the right documentation when filing. Always retain receipts as they provide the foundational evidence for your claims.

Yes, the IRS typically requires proof of child care expenses for dependent care credit claims. This proof should clearly document your expenses, which is where the Vermont Receipt Template for Child Care becomes invaluable. Having organized and accurate receipts ensures that you can substantiate your claims and avoid any audit issues. Keep these records for at least three years, as recommended.

Documentation required for dependent care FSA reimbursement includes your receipt and a completed claim form. Utilize the Vermont Receipt Template for Child Care to make your receipt clear and complete. You may also need to confirm your child’s eligibility and the suitability of your care expenses. Double-check the details in your submission to avoid delays.

Qualified expenses for dependent care generally include costs incurred for child care while you work or seek employment. This can involve daycare, preschool, or even the payment to a babysitter. It's crucial to ensure that any expenses you plan to claim on your Vermont Receipt Template for Child Care meet IRS criteria for eligibility. Care provided must serve children under the age of 13 or dependents who are physically or mentally incapable of self-care.